News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Top DeFi Projects by Social Activity, Solana ($SOL) Dominates

BlockchainReporter·2026/01/17 08:00

How Labour might entice affluent individuals who are leaving Britain to return

101 finance·2026/01/17 07:42

Billionaire CEO Michael Novogratz Makes Statement on Cryptocurrency Market Bill

BitcoinSistemi·2026/01/17 07:27

XRP To Repeat Its 2017 Playbook? Analyst Points To 1,250% Rally

Newsbtc·2026/01/17 07:03

Bitmine Buys $65M in ETH Amid Market Momentum

Coinomedia·2026/01/17 07:00

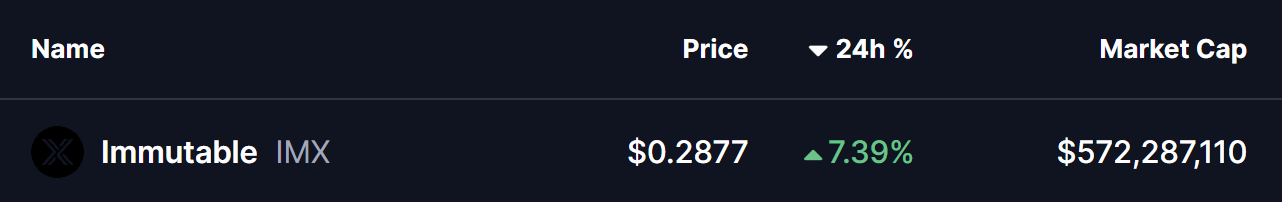

Immutable (IMX) To Rise Higher? This Emerging Bullish Pattern Hints at Upside Move!

Coinsprobe·2026/01/17 06:54

XRP Confirms First Golden Cross of 2026, and Bulls Are Already Targeting 13% Upside

CryptoNewsNet·2026/01/17 06:30

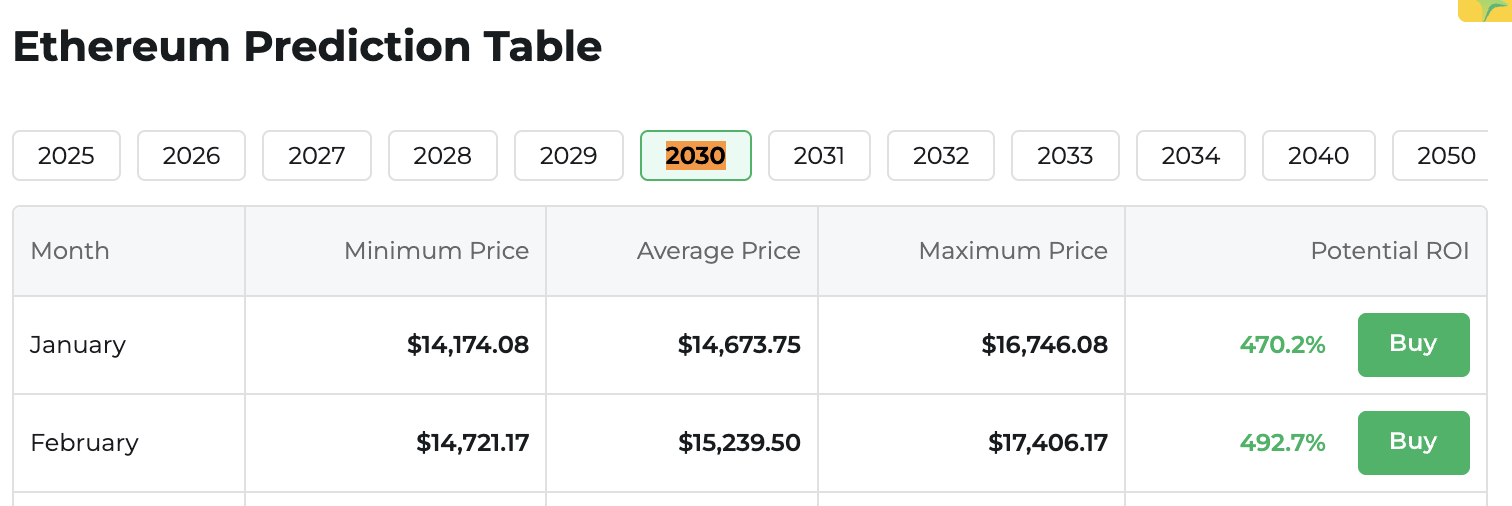

XRP vs Ethereum: Can XRP Catch Up by 2030?

CryptoNewsNet·2026/01/17 06:30

One Year of $TRUMP: The Meme Coin That Shook Crypto

Coinomedia·2026/01/17 06:27

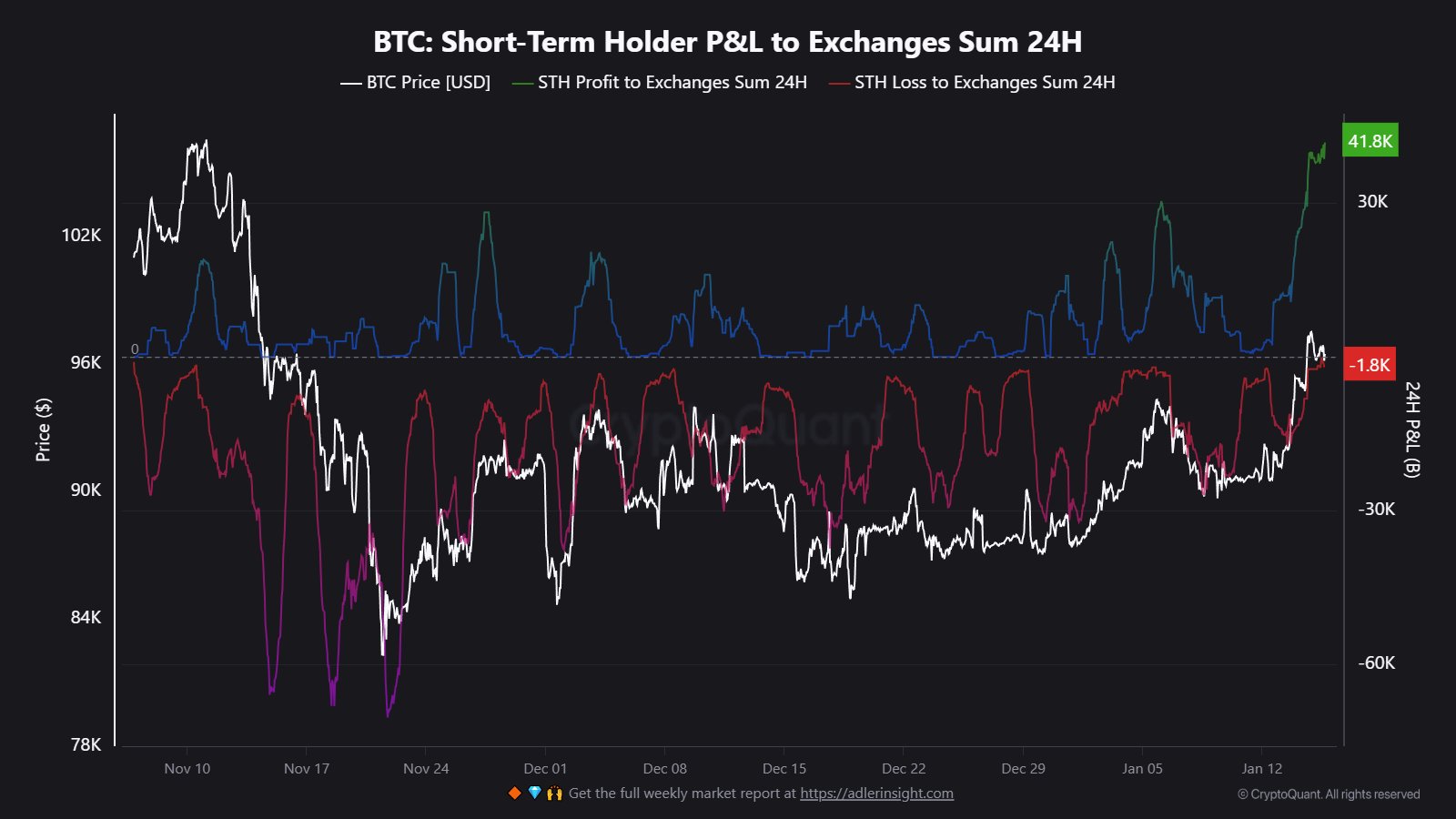

Bitcoin Short-Term Holders Take Profits: 41,800 BTC Sent To Exchanges

Newsbtc·2026/01/17 06:21

Flash

14:55

The market capitalization of euro-denominated assets reached $1.1 billion, a record high. according to Token Terminal, the market value of euro tokenized assets has reached a historic high of 1.1 billion USD, an increase of about 100% year-on-year.

14:47

The market value of tokenized euro assets has reached $1.1 billion, hitting a record high.According to Jinse Finance, data disclosed by Token Terminal shows that the market value of tokenized euro assets has reached a historic high of $1.1 billions, representing a year-on-year increase of approximately 100%.

14:19

dYdX releases annual ecosystem report: Cumulative transaction volume exceeds $1.55 trillion, buyback scale expands to 75% of net revenue. dYdX Foundation has released the 2025 dYdX ecosystem annual report. The report shows that its historical cumulative trading volume has surpassed $1.55 trillion. The trading volume in the fourth quarter of 2025 was $34.3 billion, the highest quarterly volume of the year, while the second quarter trading volume was about $16 billion. In terms of product expansion, dYdX has launched Solana native spot trading and, with governance approval, expanded the buyback scale to 75% of the protocol’s net revenue. In execution, distribution, and governance, dYdX’s focus remains on building a lasting foundation to support sustained participation and long-term development as on-chain derivatives continue to grow and mature.