News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Altcoin Market Sets Up for a Possible $1T Rotation — 5 Tokens Positioned for a 60% Breakout This Month

Cryptonewsland·2026/01/17 03:36

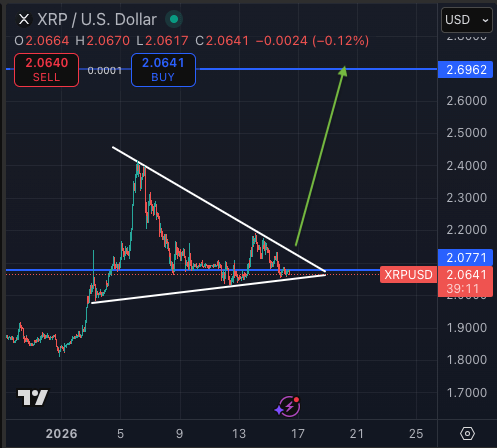

XRP Breakout Possible Before The Weekend, Expert Says

Newsbtc·2026/01/17 03:18

Crypto Market Review: Fake Bitcoin (BTC) Breakthrough; Shiba Inu (SHIB): Third Time's a Charm; XRP: 3 Price Waves

CryptoNewsNet·2026/01/17 03:12

PEPE Price Could Soar 3,000% If The Bottom Is In; Analyst Explains

Newsbtc·2026/01/17 02:06

Stop Chasing Cardano & XRP; Experts Say ZKP is Your Final $100M Backed 5000x Opportunity!

Coinomedia·2026/01/17 02:06

Soybeans End Friday with Gains

101 finance·2026/01/17 02:00

THORSwap Strengthens Liquidity with $BCH Cross-Chain Support

BlockchainReporter·2026/01/17 02:00

Cattle Sink into the Extended Weekend

101 finance·2026/01/17 02:00

Netflix, Warner Bros bonds among $100 million purchased by Trump

101 finance·2026/01/17 02:00

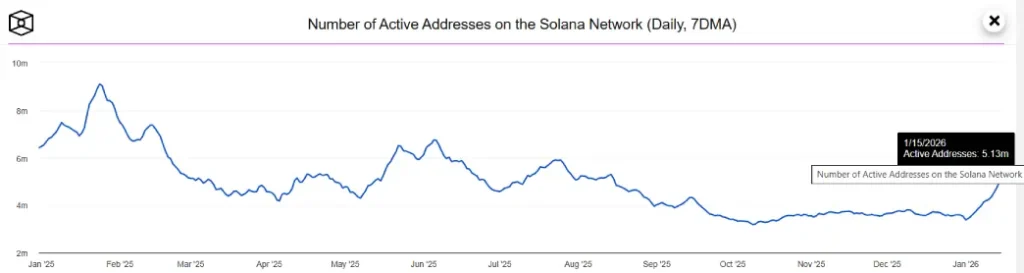

Solana Price Enters a Decisive Area With Trend Direction at Stake

CryptoNewsNet·2026/01/17 01:48

Flash

07:01

Whale address 0xf35 closed XMR long positions with a loss of $896,000On January 17, according to Onchain Lens monitoring, whale address 0xf35 has closed its high-leverage 2x long position in XMR, incurring a loss of $896,020.

06:58

A whale has liquidated their long position on XMR opened at a peak, losing $896,000BlockBeats News, January 17, according to Onchain Lens monitoring, the whale address "0xf35" has closed its highly leveraged XMR (2x leverage) long position in full, with a loss of $896,020.

06:48

Hong Kong-listed company Wincent International plans to launch a compliant digital asset exchange in the near futureAccording to ChainCatcher, as announced by the Hong Kong Stock Exchange, Hong Kong-listed company Winfull International has officially announced its strategic entry into the Web3.0 blockchain sector. Leveraging its existing software development experience, the company will provide comprehensive professional software development services for blockchain industry exchange projects. In addition, it is preparing to launch its own trading platform, planning to introduce a compliant digital asset exchange and develop wallet and public chain technologies in the near future, offering services such as digital asset trading, clearing, and custody.