News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Index of Services, United Kingdom: November 2025

101 finance·2026/01/15 07:06

GDP monthly report, UK: November 2025

101 finance·2026/01/15 07:06

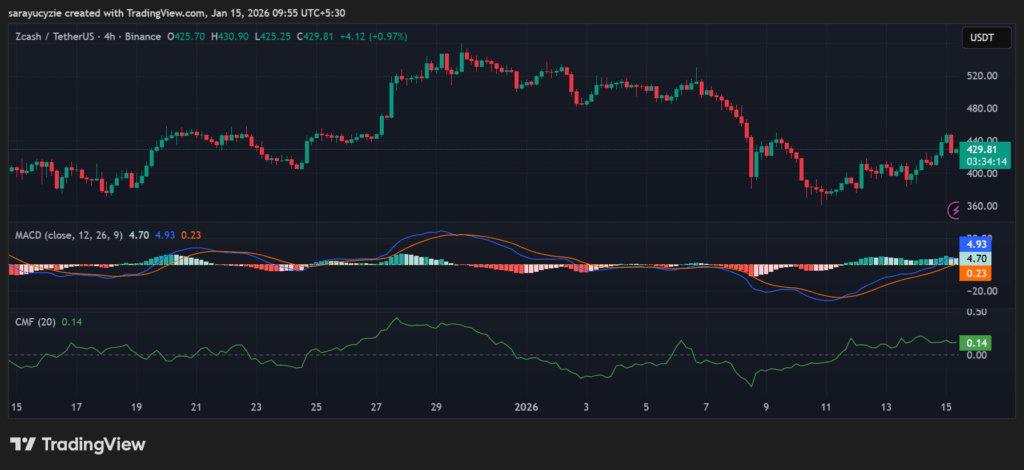

Zcash (ZEC) Bulls Take Charge: Can Momentum Sustain Gains Toward $450?

Newscrypto·2026/01/15 06:57

Upbit SUI Deposits Resume: Crucial Relief for South Korean Crypto Traders After Network Maintenance

Bitcoinworld·2026/01/15 06:51

Tokenization Breakthrough: GSN Pursues $200M Digital Transformation of Southeast Asian Water Infrastructure

Bitcoinworld·2026/01/15 06:51

Bitcoin Reclaims Higher Price Targets, Boosting Bull Market and Supercycle Expectations

Cryptonewsland·2026/01/15 06:42

Why Growing Bearish Social Sentiment Could Push Bitcoin Back Above $100K

Coinsprobe·2026/01/15 06:36

BOJ's Upcoming Rate Increase: The Reasons July Is in the Spotlight

101 finance·2026/01/15 06:30

Aster’s $1M Trading Battle: Humans vs. AI Returns!

Coinomedia·2026/01/15 06:27

Flash

09:23

Key Points from BitMine Shareholders' Meeting: This Year, the ETH/BTC Ratio May Surpass Previous Levels, and ETH Could Rise to $12,000Foresight News reported that BitMine Chairman Tom Lee released key points from the BitMine shareholders' meeting. These include that the ETH/BTC ratio may surpass previous levels this year, indicating significant upside potential for BMNR; ETH may rise to $12,000 this year; BitMine will generate considerable income from ETH staking rewards and $1 billion in cash reserves; a $200 million investment will be made in Beast Industries under MrBeast; and 5% of the balance sheet will be allocated to moonshots, with potential investments reaching $700 million.

09:15

AXS surpasses $1.7, with a 24-hour increase of 40.0%According to Jinse Finance, market data shows that AXS has surpassed $1.7, currently quoted at $1.68, with a 24-hour increase of 40.0%. The market is experiencing significant volatility, so please exercise proper risk control.

08:47

Stellar Community Fund announces upgrades and adjustments to optimize funding allocation methodsAccording to Odaily, Stellar has announced the upgrade of its community fund with the launch of Stellar Community Fund v7.0, aiming to accelerate ecosystem growth and help developers achieve scale more quickly. The fund has been in operation for six and a half years, and this upgrade follows the successful SCF Pilot vote through Soroban Governor, adapting to the network's maturity and developers' needs. SCF v7.0 will optimize and adjust the funding allocation method to encourage execution, speed, and delivery. Specifically, 10% of the funds will be paid at the time of the grant, 20% at the mid-development milestone stage, 30% at the advanced product readiness stage (testnet), and 40% upon mainnet launch verification and user experience readiness.