News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Bitmine Buys $65M in ETH Amid Market Momentum

Coinomedia·2026/01/17 07:00

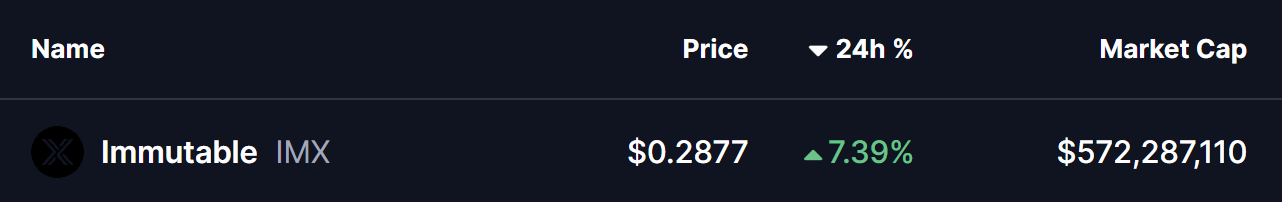

Immutable (IMX) To Rise Higher? This Emerging Bullish Pattern Hints at Upside Move!

Coinsprobe·2026/01/17 06:54

XRP Confirms First Golden Cross of 2026, and Bulls Are Already Targeting 13% Upside

CryptoNewsNet·2026/01/17 06:30

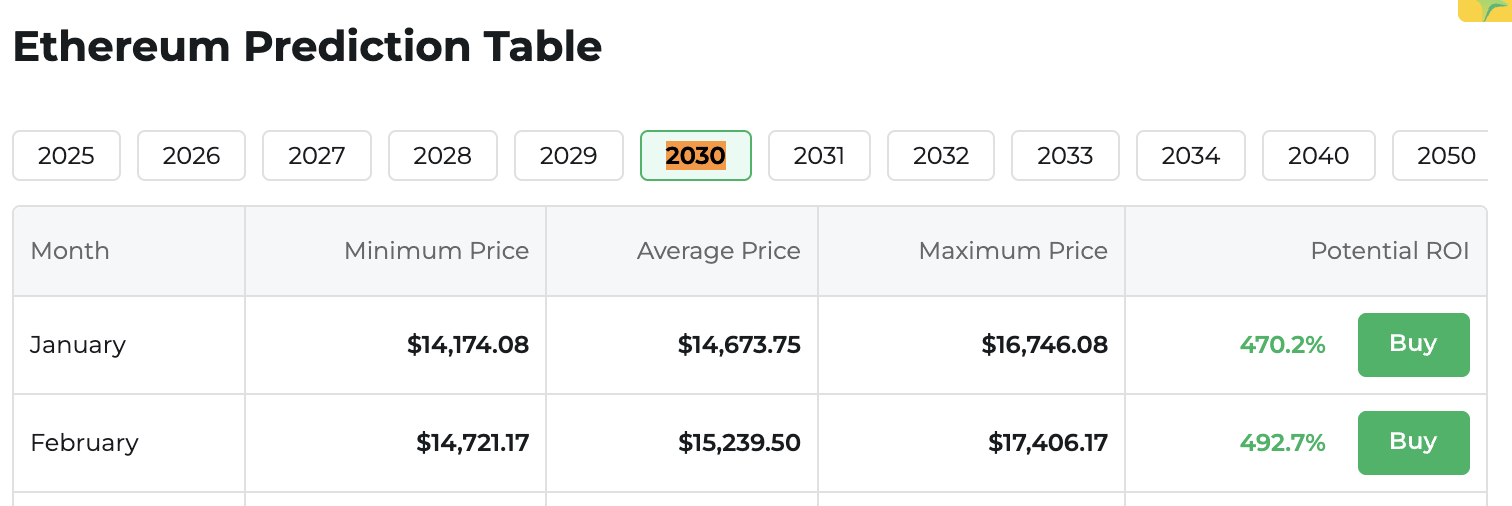

XRP vs Ethereum: Can XRP Catch Up by 2030?

CryptoNewsNet·2026/01/17 06:30

One Year of $TRUMP: The Meme Coin That Shook Crypto

Coinomedia·2026/01/17 06:27

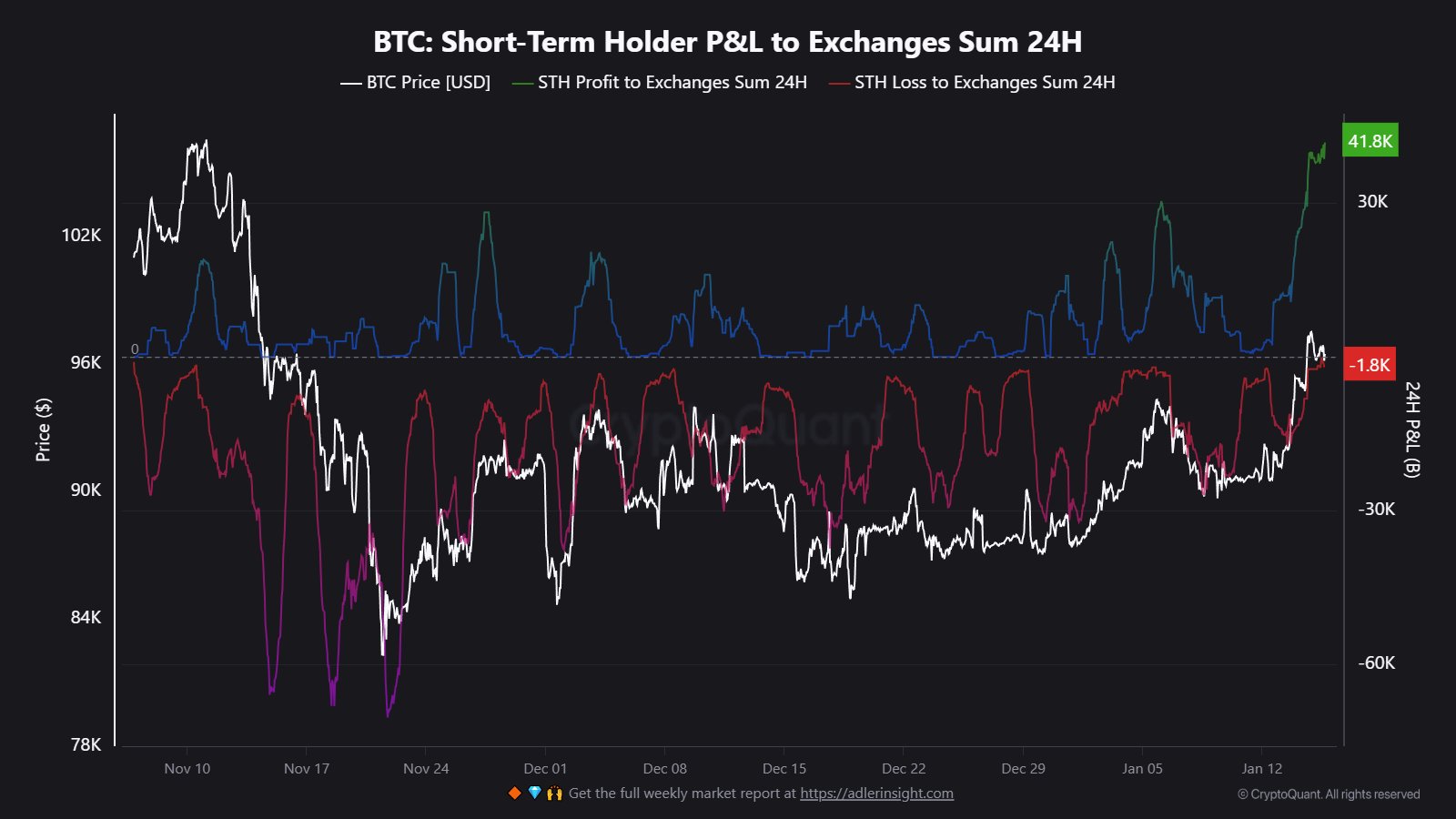

Bitcoin Short-Term Holders Take Profits: 41,800 BTC Sent To Exchanges

Newsbtc·2026/01/17 06:21

ZKP Shows Growing Momentum With 100x ROI Projections: Is It the Top Crypto to Buy in 2026?

Coinomedia·2026/01/17 06:15

Weekly Crypto Gainers – Dash Up 129%, Monero and ICP Post Double-Digit Rallies

BlockchainReporter·2026/01/17 06:00

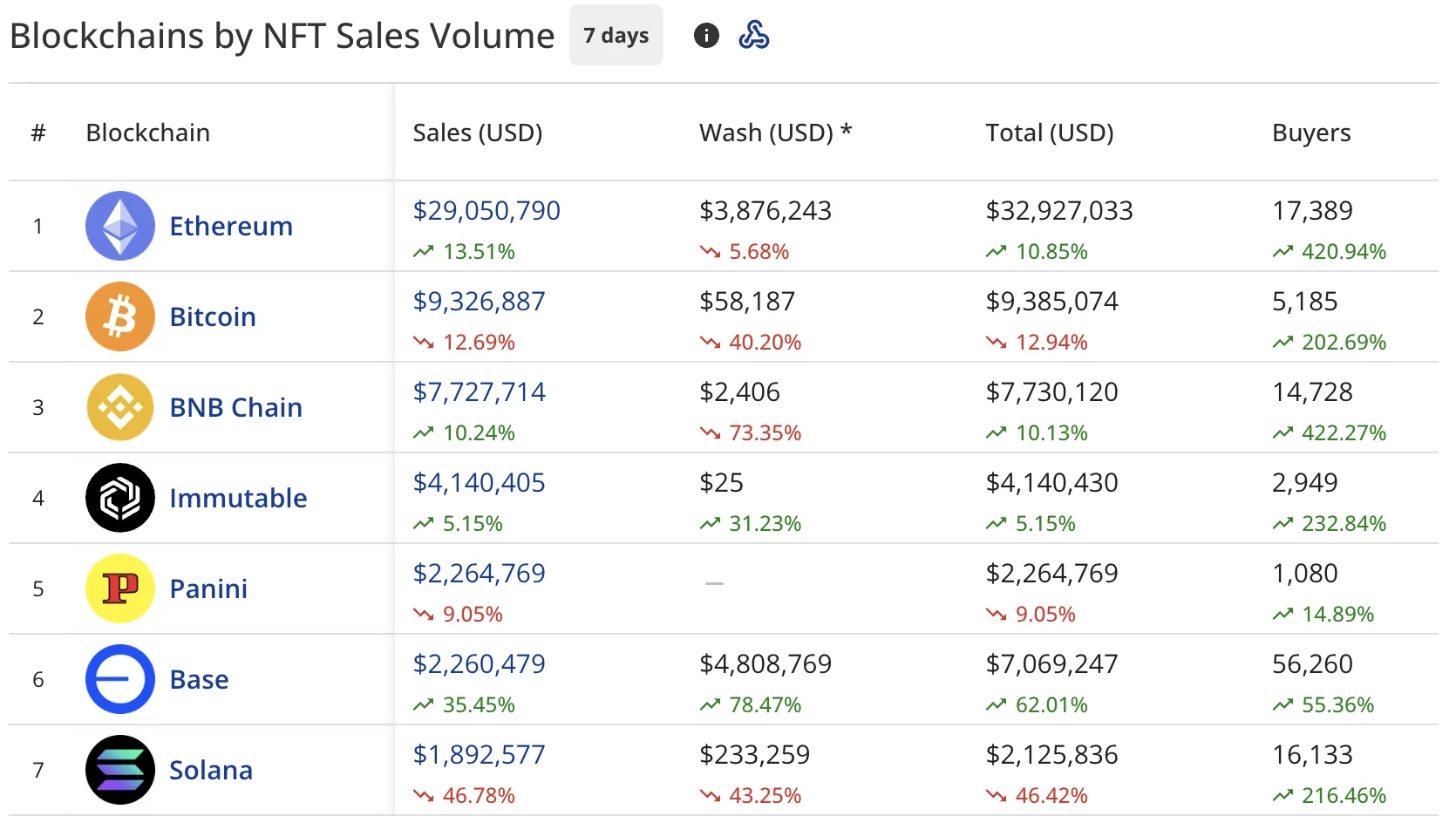

NFT buyers rise 120% despite sales staying flat at $61.5 million

Crypto.News·2026/01/17 05:51

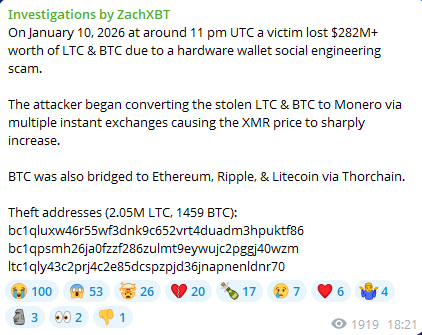

Was Monero’s (XMR) Surge Fueled by a $282M Theft Swap? Chart Says No!

Coinsprobe·2026/01/17 05:39

Flash

10:55

Eugene: Most shitcoin longs have exited, core Bitcoin longs still holdingBlockBeats News, January 17th, trader Eugene Ng Ah Sio posted in his personal channel, stating, "Most of the altcoin long positions have exited — although it did not reach the excess return I expected, I will take the available return for now. The core Bitcoin long position is still held, but is currently largely in cash again, waiting for the next opportunity to deploy."

10:45

Trader Eugene: Has mostly exited altcoin long positions as related investments underperformed expectationsAccording to Odaily, trader "Dove" Eugene stated on his personal channel that he has basically exited his long positions in altcoins, as the market performance of the related investment targets did not meet expectations. Therefore, he chose to take profits at this stage. However, he is still holding his core long position in bitcoin and has significantly increased his cash position to wait for the next round of trading opportunities.

10:34

VanEck denies bearish strategy, has recently increased its stock holdingsMatthew Sigel, Head of Digital Asset Research at VanEck, clarified on the X platform regarding The New York Times report, stating that the media outlet quoted out of context and misunderstood the remarks made by VanEck CEO Jan van Eck. Sigel explained that Jan van Eck only mentioned that they would not temporarily adopt the DAT strategy, and did not express a bearish view on Strategy company or its stock price. Currently, VanEck holds 284,000 shares of Strategy company on behalf of clients, ranking firmly within the top 75, and has increased its holdings in recent weeks.