News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 21) | U.S. September Nonfarm Payrolls Unexpectedly Increase by 119,000; BTC Falls Below $86,000, Crypto Market Sees $834M in Liquidations; OpenAI Launches ChatGPT Group Chat Feature Globally2Bitcoin slump to $86K brings BTC closer to ‘max pain’ but great ‘discount’ zone3Bitcoin, stocks crumble after Nvidia earnings and Fed uncertainty over next rate cut

Here is Cardano Price if Elon Musk Promotes ADA on X

CryptoNewsNet·2025/10/25 18:39

Bitcoin Treasury Firms Now Valued at Less Than Their BTC Holdings Amid Crumbled Sentiment

CryptoNewsNet·2025/10/25 18:39

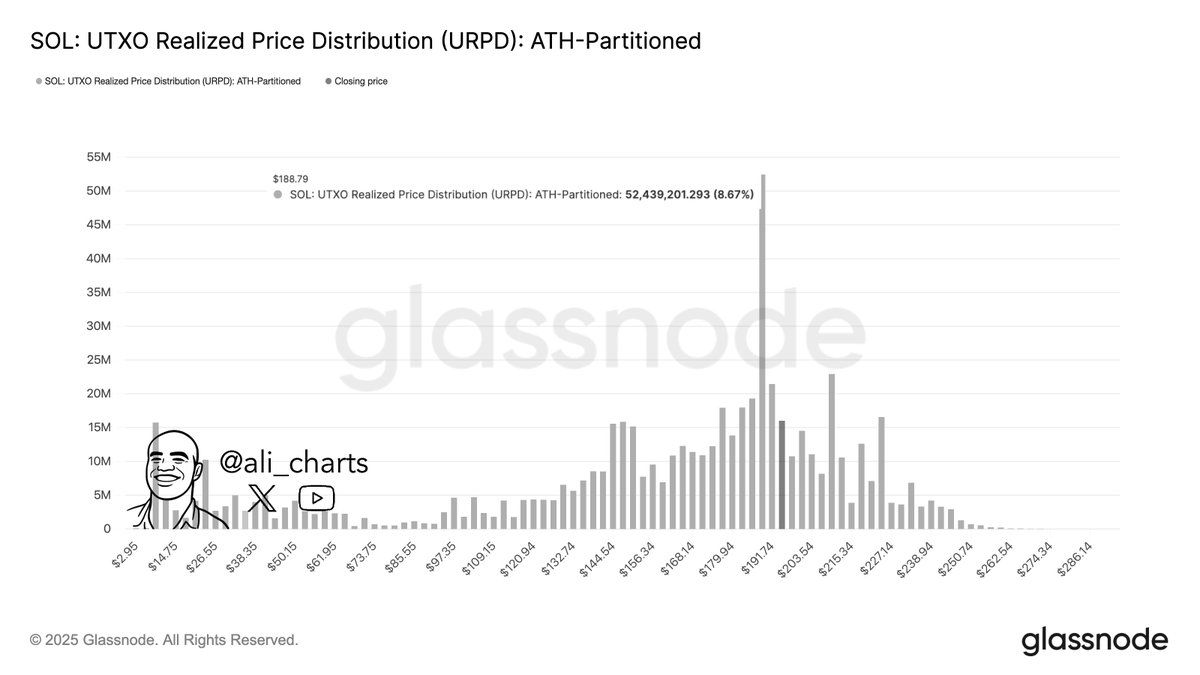

SOL Now on Fidelity’s Retail Platform as Price Tests $195 While $188 Support Draws Focus

CryptoNewsNet·2025/10/25 18:39

Fetch.ai and Ocean Protocol Near Settlement in $120M FET Token Dispute

Cointribune·2025/10/25 18:33

Banks Embrace Crypto: JPMorgan to Accept Bitcoin and Ethereum as Loan Collateral

Cointribune·2025/10/25 18:33

Pudgy Penguins (PENGU) Bounces Off Key Support — Could This Pattern Trigger an Upside Breakout?

CoinsProbe·2025/10/25 18:33

XRP To Surge Higher? Key Harmonic Pattern Hints at Potential Upside Move

CoinsProbe·2025/10/25 18:33

WSPN Launches Stablecoin Checkout Solution to Power Global E-Commerce Payments

DeFi Planet·2025/10/25 18:33

Donald Trump Picks Michael Selig to Lead the CFTC

Cryptoticker·2025/10/25 18:12

Zelle Embraces Stablecoin for Global Expansion

Coinlineup·2025/10/25 17:39

Flash

- 19:26Crypto lawyer Khurram Dara: New York State's Bitcoin license BitLicense is an illegal regulationJinse Finance reported that, according to crypto journalist Eleanor Terrett, crypto lawyer Khurram Dara stated in his first interview after announcing his candidacy for New York State Attorney General that the New York State Bitcoin license (BitLicense) is an illegal regulation that infringes upon the economic rights of crypto companies intending to conduct business in the state.

- 18:44Exchange Policy Head: Full Reserve Support Makes Stablecoins Safer Than the Banking SystemJinse Finance reported that central banks in various countries have warned that market volatility triggered by tariffs could lead to stablecoin runs, which in turn may trigger a concentrated sell-off of U.S. Treasury bonds. The rapid expansion of stablecoins has already constituted a systemic risk, and large-scale redemption activities could impact global financial stability. Faryar Shirzad, a policy executive at an exchange, stated, "The fully reserved collateral mechanism makes stablecoins safer than the banking industry," and "their broader adoption would actually enhance stability." He further explained, "Banks issue long-term and often high-risk loans to individuals and businesses, exposing themselves to both credit risk and liquidity risk. In contrast, stablecoin issuers typically hold short-term government bonds, which are virtually risk-free and highly liquid."

- 18:44Data: If BTC falls below $82,648, the cumulative long liquidation intensity on major CEXs will reach $1.59 billions.According to ChainCatcher, citing Coinglass data, if BTC falls below $82,648, the cumulative long liquidation intensity on major CEXs will reach $1.59 billions. Conversely, if BTC breaks above $90,925, the cumulative short liquidation intensity on major CEXs will reach $964 millions.