News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The role of cryptocurrency in Argentina has fundamentally changed: it has shifted from a novelty that aroused curiosity and experimentation among the public, including Milei himself, to a financial tool for people to protect their savings.

The US payment system is preparing to integrate the assets and infrastructure you are already trading.

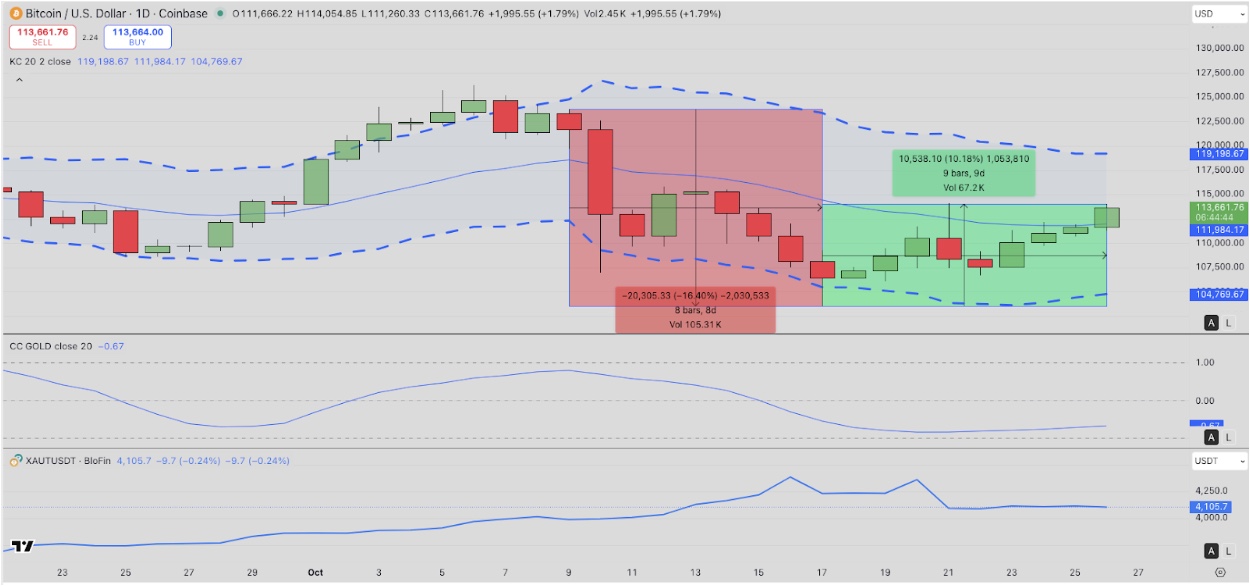

Bitcoin price rebounded to $113,800 on Sunday, gaining 10% as investors shifted capital from Gold to DeFi-based BTC exposure.

Quick Take BIP-444 calls on Bitcoin developers to restrict the amount of arbitrary data that can be attached to transactions on the network. Supporters are concerned that illegal content could be added to Bitcoin following the recent v30 Core update, which uncapped OP_RETURN data limits; detractors say the proposal amounts to protocol-level censorship. The change would require a soft fork of the blockchain, and would last about a year, during which time developers could evaluate longer-term solutions.

Quick Take About 62,000 BTC, worth $7 billion at current prices, has moved out of long-term holder wallets since mid-October, according to Glassnode data. More liquid supply makes it harder for Bitcoin’s price to rally without strong external demand.

Quick Take Bitcoin rose above $115,000 as traders assess easing macroeconomic concerns. As prices recovered, nearly $350 million worth of short positions were liquidated in the past day. Analysts expect the year-end ‘Santa Rally’ to take place again this year.

- 20:35USDe supply surpasses 7.4 billions, reaching a new all-time highAccording to Jinse Finance, data from the DeFilama platform shows that as of November 24, the supply of USDe has surpassed 7.4 billion, reaching 7.416 billion, setting a new all-time high.

- 19:26Crypto lawyer Khurram Dara: New York State's Bitcoin license BitLicense is an illegal regulationJinse Finance reported that, according to crypto journalist Eleanor Terrett, crypto lawyer Khurram Dara stated in his first interview after announcing his candidacy for New York State Attorney General that the New York State Bitcoin license (BitLicense) is an illegal regulation that infringes upon the economic rights of crypto companies intending to conduct business in the state.

- 18:44Exchange Policy Head: Full Reserve Support Makes Stablecoins Safer Than the Banking SystemJinse Finance reported that central banks in various countries have warned that market volatility triggered by tariffs could lead to stablecoin runs, which in turn may trigger a concentrated sell-off of U.S. Treasury bonds. The rapid expansion of stablecoins has already constituted a systemic risk, and large-scale redemption activities could impact global financial stability. Faryar Shirzad, a policy executive at an exchange, stated, "The fully reserved collateral mechanism makes stablecoins safer than the banking industry," and "their broader adoption would actually enhance stability." He further explained, "Banks issue long-term and often high-risk loans to individuals and businesses, exposing themselves to both credit risk and liquidity risk. In contrast, stablecoin issuers typically hold short-term government bonds, which are virtually risk-free and highly liquid."