News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Bond market calm supports bitcoin rally prospects toward six-figure prices

CryptoNewsNet·2026/01/15 10:54

Shiba Inu Analysis for Jan 15: Shiba Inu Must Hold Above This Bollinger Band Support: What’s Next?

CryptoNewsNet·2026/01/15 10:54

USD: Fed attack fuels de-dollarization debate – ING

101 finance·2026/01/15 10:54

XRP bulls face make-or-break test as BNB grabs fourth place

Crypto.News·2026/01/15 10:51

Iran Temporarily Avoids US Attacks by Promising Not to Carry Out Executions

101 finance·2026/01/15 10:48

India saw a 3.6% increase in coal production in December

101 finance·2026/01/15 10:45

Perp DEX traders pivot from airdrop hunting to CEX‑style execution quality

Crypto.News·2026/01/15 10:45

Bitcoin’s 2025 Decline Was a Liquidity Event, Not a Failure

CoinEdition·2026/01/15 10:45

“It’s Time to Send” Shiba Inu, Analyst Confirms Clean Breakout on SHIB Chart

CryptoNewsNet·2026/01/15 10:42

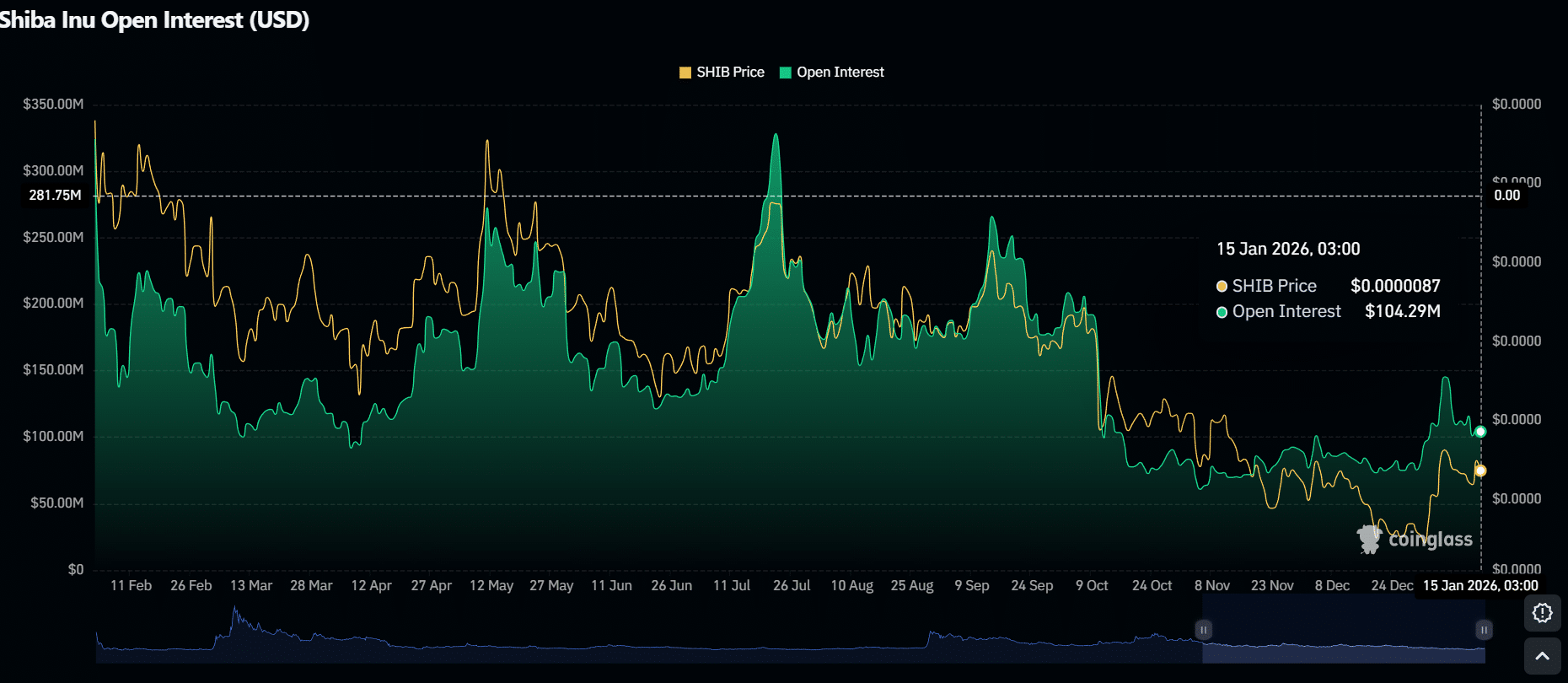

SHIB Eyes Liquidity Crunch Amid 910% Surge in Deflationary Metric

CryptoNewsNet·2026/01/15 10:42

Flash

2026/01/17 23:06

USDT0 Co-founder: Tokenized gold will become the collateral layer for on-chain finance, just as stablecoins have become the settlement layer.USDT0 co-founder Lorenzo R. stated: "As gold prices continue to reach new highs, the tokenized gold market is also heating up rapidly, and 2026 is expected to be a breakthrough year." He believes that tokenized gold will become the collateral layer for on-chain finance, just as stablecoins have become the settlement layer. He said: "The structural pressures driving the development of stablecoins—interest rate volatility, geopolitical fragmentation, and declining trust in sovereign debt—are now converging on gold-backed assets." He added: "It is becoming increasingly clear that programmable gold will evolve from a niche risk-weighted asset class to the default hard asset standard for on-chain finance."

2026/01/17 22:40

Cathie Wood: Bitcoin is a “good source of diversification” for investors seeking higher returnsAccording to Jinse Finance, Ark Invest CEO Cathie Wood believes that due to bitcoin’s low correlation with other major asset classes, it can serve as a valuable diversification tool in institutional investment portfolios. In a comprehensive report, Wood pointed out that bitcoin’s low correlation with other major asset classes—including gold, stocks, and bonds—is a reason asset allocators should take bitcoin seriously. She wrote: “For asset allocators seeking higher risk-adjusted returns, bitcoin should be an excellent source of diversification.”

2026/01/17 22:19

Superstate Founder: Long-standing Legal and Operational Barriers to Asset Tokenization Are Beginning to ShiftJinse Finance reported that Robert Leshner, founder of tokenization company Superstate, stated that long-standing legal and operational barriers are beginning to shift. In an email, he said, "With the emergence of credible, issuer-led on-chain equity structures, public equities are shifting from 'prohibited from trading' to 'tradable'." A series of trading platforms, including a certain exchange, have begun offering tokenized versions of the most popular stocks. Leshner added that the trend of moving from wrapped synthetic assets to direct token issuance is also accelerating.