News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

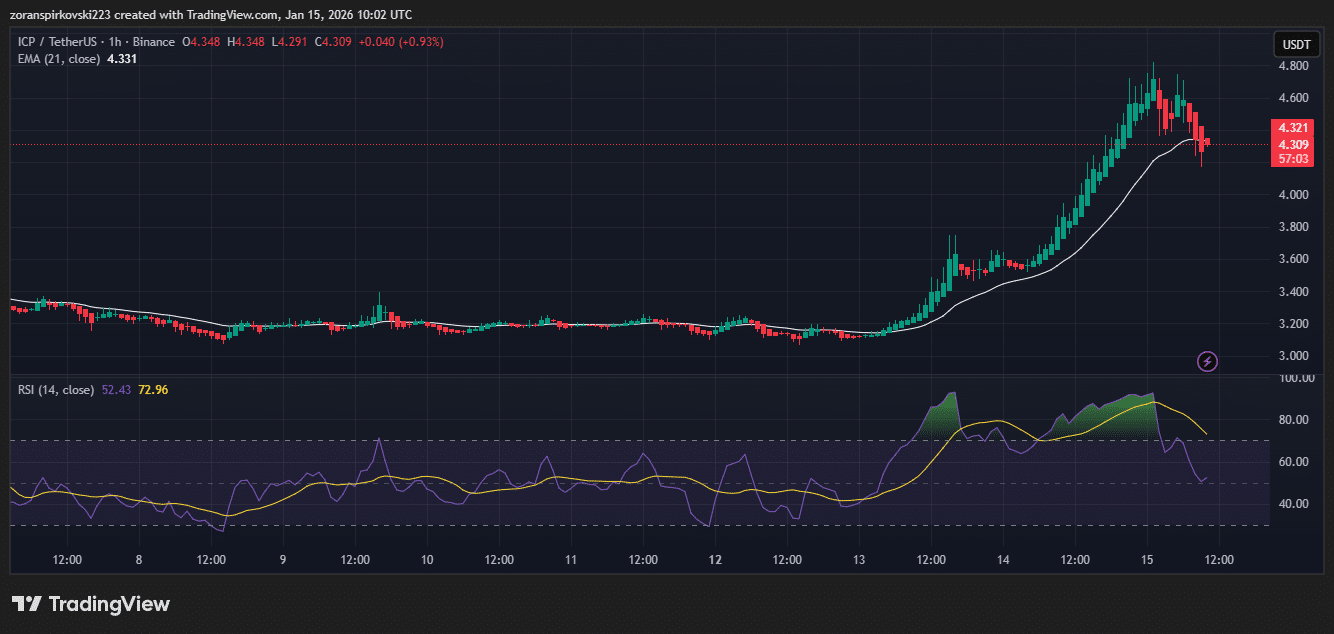

ICP Extends Rally to 35% as Mission 70 White Paper Targets 70% Inflation Cut

Coinspeaker·2026/01/15 12:21

Boston Scientific to buy Penumbra in $14.5 billion deal

101 finance·2026/01/15 12:18

Why Your Credit Scores May Differ and Which Score Is Actually Most Important for You

101 finance·2026/01/15 12:15

Bitmine announces $200 million investment in Beast Industries, owned by MrBeast

BlockBeats·2026/01/15 12:10

AI video startup Higgsfield hits $1.3 billion valuation with latest funding

101 finance·2026/01/15 12:09

US lawmakers introduce bill to create $2.5 billion critical-minerals stockpile

101 finance·2026/01/15 12:09

10 Cities Where Millennials Are Finally Finding Alignment Between Employment, Salaries, and Housing

101 finance·2026/01/15 12:06

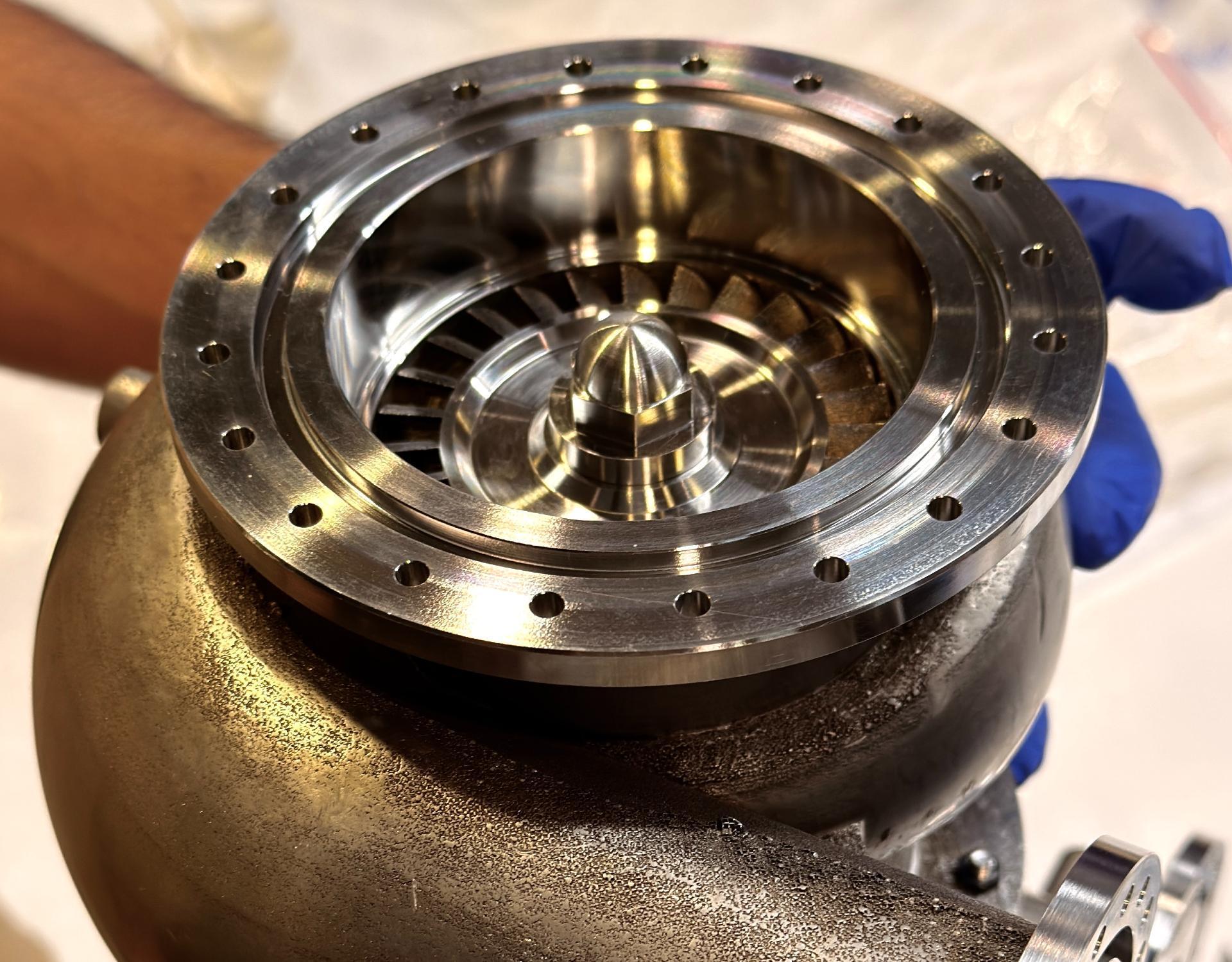

Indian SpaceX competitor EtherealX sees its valuation soar fivefold as it prepares for engine testing

101 finance·2026/01/15 12:06

First Horizon: Fourth Quarter Earnings Overview

101 finance·2026/01/15 12:03

India Leads Global Countries in Crypto Ownership Worldwide

Cryptotale·2026/01/15 12:00

Flash

16:00

Total Liquidations in the Last 24 Hours: $78.792 million, Largest Single LiquidationBlockBeats News, January 17th, according to Coinglass data, the total liquidation across the network in the past 24 hours was $78.792 million, with $30.397 million in long liquidations and $48.394 million in short liquidations.

In the past 24 hours, a total of 68,643 people were liquidated globally. The largest single liquidation occurred on Hyperliquid - xyz:AMZN-USD, amounting to $1.3055 million.

14:55

The market capitalization of euro-denominated assets reached $1.1 billion, a record high. according to Token Terminal, the market value of euro tokenized assets has reached a historic high of 1.1 billion USD, an increase of about 100% year-on-year.

14:47

The market value of tokenized euro assets has reached $1.1 billion, hitting a record high.According to Jinse Finance, data disclosed by Token Terminal shows that the market value of tokenized euro assets has reached a historic high of $1.1 billions, representing a year-on-year increase of approximately 100%.