News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

USDT Real Estate Transaction Shatters Records with $14M Miami Property Deal

Bitcoinworld·2026/01/15 14:51

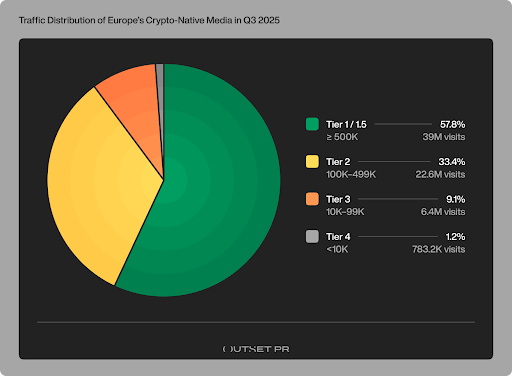

Europe’s crypto media relied almost entirely on search and direct traffic in Q3 2025

CryptoRo·2026/01/15 14:48

Litecoin slips below $76, lags broader crypto market amid bearish signals

CryptoNewsNet·2026/01/15 14:39

XRP Price Nightmare Scenario Over, Bollinger Bands Signal

CryptoNewsNet·2026/01/15 14:39

Dogecoin faces key test as traders sell into strength near $0.15

CryptoNewsNet·2026/01/15 14:39

Messari Report Explores the Emergence of the Universal Exchange (UEX) Model

CryptoRo·2026/01/15 14:33

Decred (DCR) price soars amid treasury spending cap approval

CryptoNewsNet·2026/01/15 14:27

Avalanche Pioneers Blockchain Integration in Traditional Finance

Cointurk·2026/01/15 14:24

Flash

16:00

Total Liquidations in the Last 24 Hours: $78.792 million, Largest Single LiquidationBlockBeats News, January 17th, according to Coinglass data, the total liquidation across the network in the past 24 hours was $78.792 million, with $30.397 million in long liquidations and $48.394 million in short liquidations.

In the past 24 hours, a total of 68,643 people were liquidated globally. The largest single liquidation occurred on Hyperliquid - xyz:AMZN-USD, amounting to $1.3055 million.

14:55

The market capitalization of euro-denominated assets reached $1.1 billion, a record high. according to Token Terminal, the market value of euro tokenized assets has reached a historic high of 1.1 billion USD, an increase of about 100% year-on-year.

14:47

The market value of tokenized euro assets has reached $1.1 billion, hitting a record high.According to Jinse Finance, data disclosed by Token Terminal shows that the market value of tokenized euro assets has reached a historic high of $1.1 billions, representing a year-on-year increase of approximately 100%.