News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.16)|CME to Launch ADA, LINK and XLM Futures on Feb 9; Bitmine Purchases 24,068 ETH; Polygon Lays Off 30% to Pivot Toward Stablecoin Payments2Atomic Wallet raises red flags in viral $479k Monero loss claim3Bitcoin Sheds 30% of Open Interest: Is a Rebound Imminent?

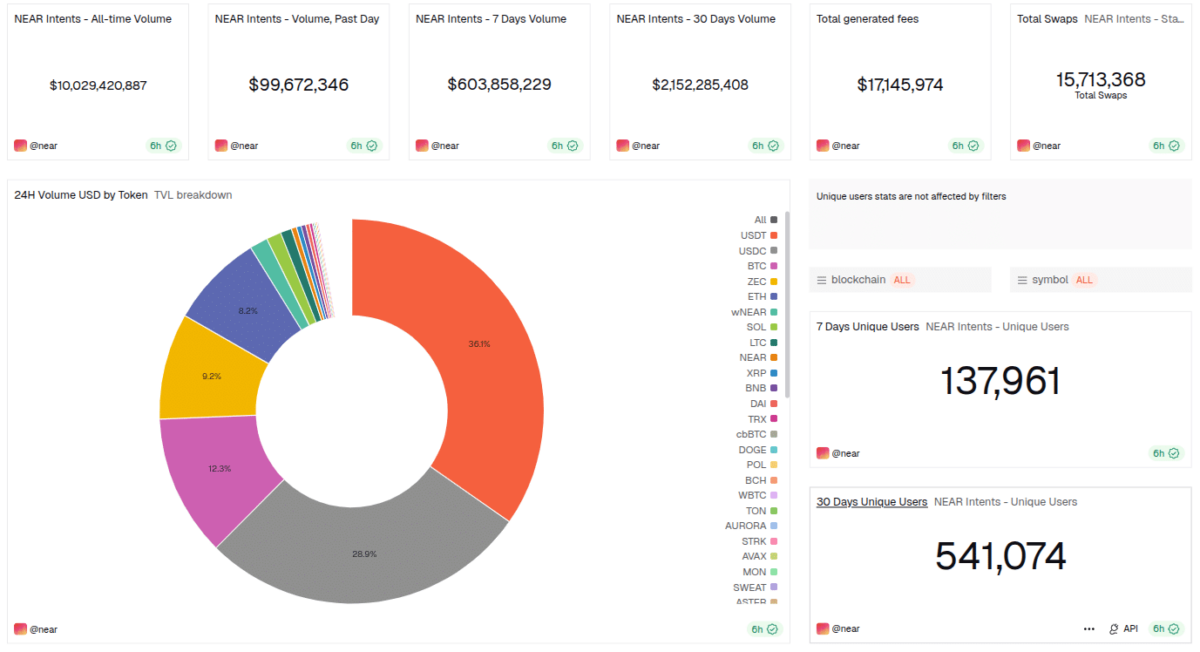

NEAR Intents Achieves $10B in Swap Volume as Industry Support, Adoption Grow

Coinspeaker·2026/01/16 18:39

PNC Bank CEO says stablecoins must choose: be a payment tool or a money market fund

101 finance·2026/01/16 18:30

Datadog Q4 2025 Results: Anticipated Highlights

101 finance·2026/01/16 18:18

Bitcoin deemed too vulnerable: Jefferies bets on gold against quantum threat

Cointribune·2026/01/16 18:06

CME Drops Chainlink Futures Bombshell as Micro LINK Goes Live for 24/7 Regulated Trading

Crypto Ninjas·2026/01/16 18:00

JPMorgan Chase wages war on yield-bearing stablecoins through the GENIUS Act

Cointelegraph·2026/01/16 17:57

Tesla given extension in US probe regarding its autonomous driving technology

101 finance·2026/01/16 17:57

Nasdaq Issues Delisting Notice to Bitcoin Mining Equipment Manufacturer Canaan

101 finance·2026/01/16 17:42

Jobs in skilled trades are 'not easy to enter': Carhartt CEO

101 finance·2026/01/16 17:33

Flash

09:15

AXS surpasses $1.7, with a 24-hour increase of 40.0%According to Jinse Finance, market data shows that AXS has surpassed $1.7, currently quoted at $1.68, with a 24-hour increase of 40.0%. The market is experiencing significant volatility, so please exercise proper risk control.

08:47

Stellar Community Fund announces upgrades and adjustments to optimize funding allocation methodsAccording to Odaily, Stellar has announced the upgrade of its community fund with the launch of Stellar Community Fund v7.0, aiming to accelerate ecosystem growth and help developers achieve scale more quickly. The fund has been in operation for six and a half years, and this upgrade follows the successful SCF Pilot vote through Soroban Governor, adapting to the network's maturity and developers' needs. SCF v7.0 will optimize and adjust the funding allocation method to encourage execution, speed, and delivery. Specifically, 10% of the funds will be paid at the time of the grant, 20% at the mid-development milestone stage, 30% at the advanced product readiness stage (testnet), and 40% upon mainnet launch verification and user experience readiness.

08:37

Opinion: Incentive-driven DeFi will disappear by 2026According to Odaily, Eli5DeFi posted on X stating that the incentive-driven DeFi model will disappear by 2026. DeFi protocols lose users when incentives end, essentially because risk-adjusted returns revert to real levels. The growth in total value locked (TVL) during the incentive phase often reflects subsidized participation rather than lasting user demand or fee income. It pointed out that the "rented liquidity" model has three stages: the incentive period attracts capital by compensating risk with high emissions; the normalization period sees reduced incentives and real returns emerge; and the exit period, where capital recalculates costs and withdraws after returns normalize. The collapse in retention is due to incentives temporarily masking structural weaknesses, including subsidized impermanent loss risk, yields that are essentially marketing expenses rather than income, highly internalized demand, and high friction costs. Eli5DeFi believes that only when the economic model remains effective after incentives normalize can retention rates improve. Protocols must address impermanent loss and principal risk, anchor yields to real demand rather than token inflation, and expand the ecosystem to increase revenue sources. Future DeFi should be evaluated based on sustainable income, capital efficiency, and risk-adjusted returns.

News