News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.16)|CME to Launch ADA, LINK and XLM Futures on Feb 9; Bitmine Purchases 24,068 ETH; Polygon Lays Off 30% to Pivot Toward Stablecoin Payments2Atomic Wallet raises red flags in viral $479k Monero loss claim3Bitcoin Sheds 30% of Open Interest: Is a Rebound Imminent?

Morning Minute: Tom Lee Supports Mr. Beast with a $200 Million Investment

101 finance·2026/01/16 14:12

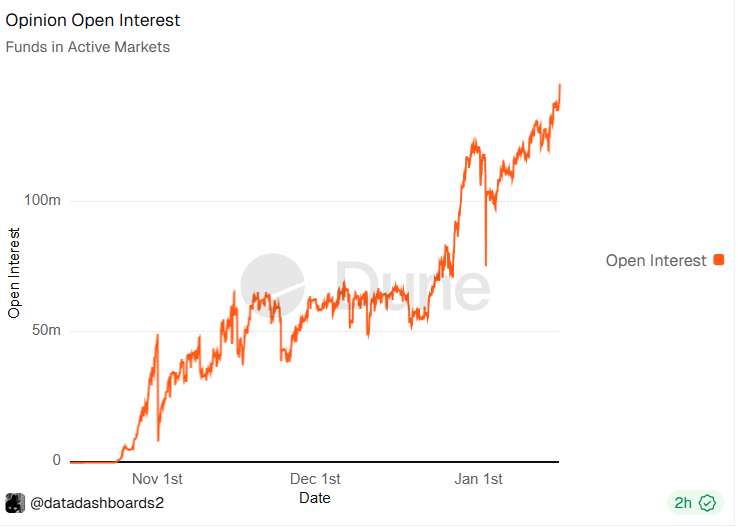

Opinion prediction platform reaches record open interest

Cointelegraph·2026/01/16 14:00

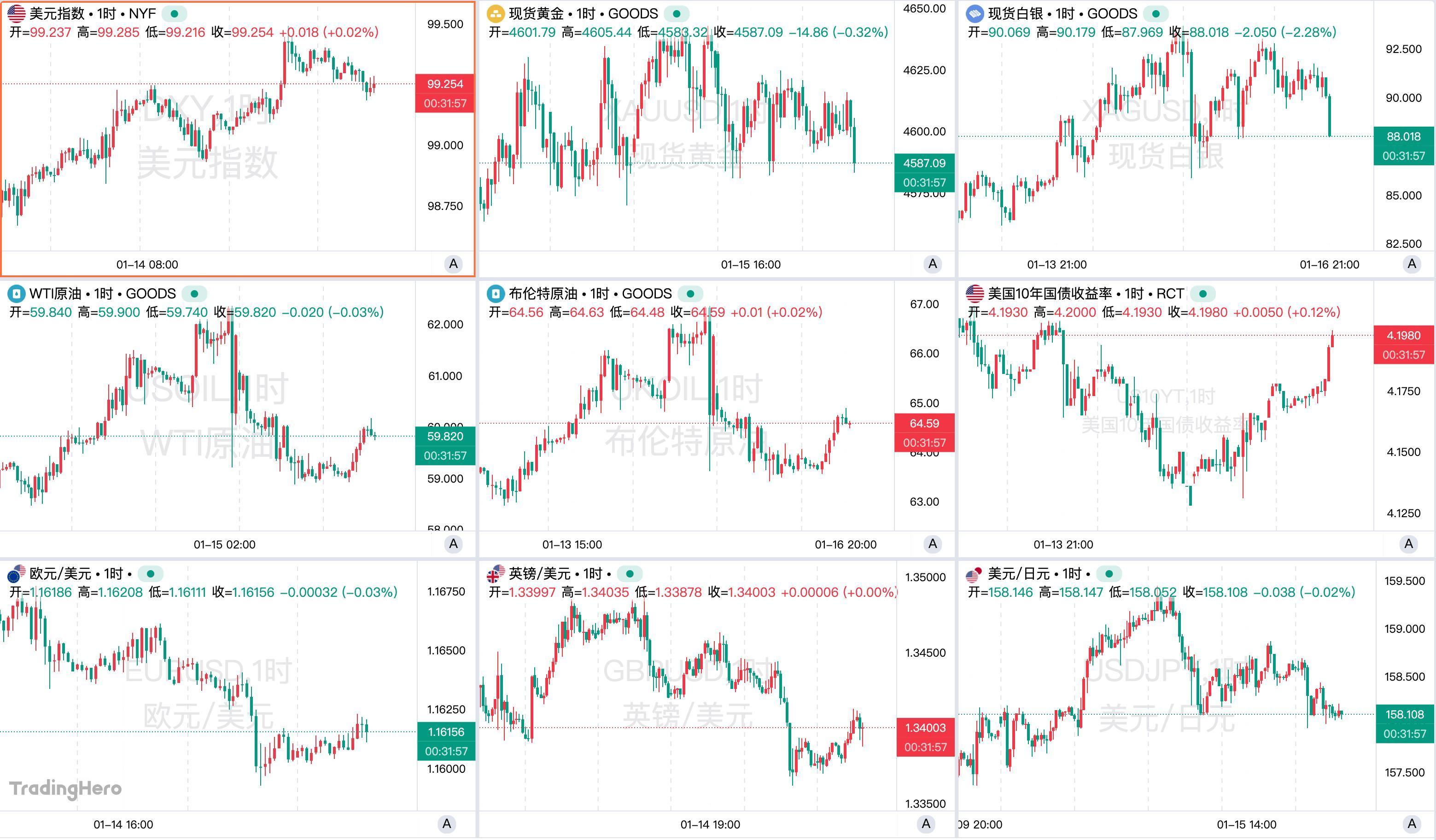

Swiss Franc gains slightly while the US Dollar takes a breather following a surge fueled by economic data

101 finance·2026/01/16 14:00

As major technology companies become increasingly involved in the energy sector, they face greater risks

101 finance·2026/01/16 13:51

BDT & MSD Appoints Centerview Banker Adam Beshara to Senior Leadership Role

101 finance·2026/01/16 13:42

Decred Jumps Over 60% as It Extends Lead Against Privacy Coins

Cryptotale·2026/01/16 13:33

Qianwen: In the Era of AI and the Internet, Is Alibaba Making a Comeback?

海豚投研·2026/01/16 13:30

Former Bitcoin Bull Jefferies Analyst Reveals He Has Completely Removed BTC From His Portfolio – Here’s Why

BitcoinSistemi·2026/01/16 13:30

Flash

12:32

Maple launches yield-bearing stablecoin syrupUSDCJinse Finance reported that Token Terminal disclosed Maple has launched an interest-bearing stablecoin, syrupUSDC. Holders of syrupUSDC can deposit USDC into Maple's lending pools to provide financing for institutional borrowers. The yield for holders comes from the interest paid by these borrowers.

12:22

On this day in history: 17 years ago, Satoshi Nakamoto released Bitcoin v0.1 AlphaJinse Finance reported that an exchange posted on the X platform to commemorate this day in history: 17 years ago, on January 17, 2009, Satoshi Nakamoto released the first version of the Bitcoin client v0.1, namely Bitcoin v0.1 Alpha, which allowed anyone to launch their own node from any computer.

12:18

Crypto Banter founder: Has sold all BitMine holdings, does not believe the company should invest in influencersForesight News reported that Ran Neuner, founder of Crypto Banter, tweeted, "I have sold all my BMNR shares. I invested in an Ethereum treasury company, not Tom Lee's venture capital fund. I was hoping to get more ETH per share. I like MrBeast, and I know influencer marketing better than most, but I cannot believe that an Ethereum treasury company should be making these investments."

News