News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

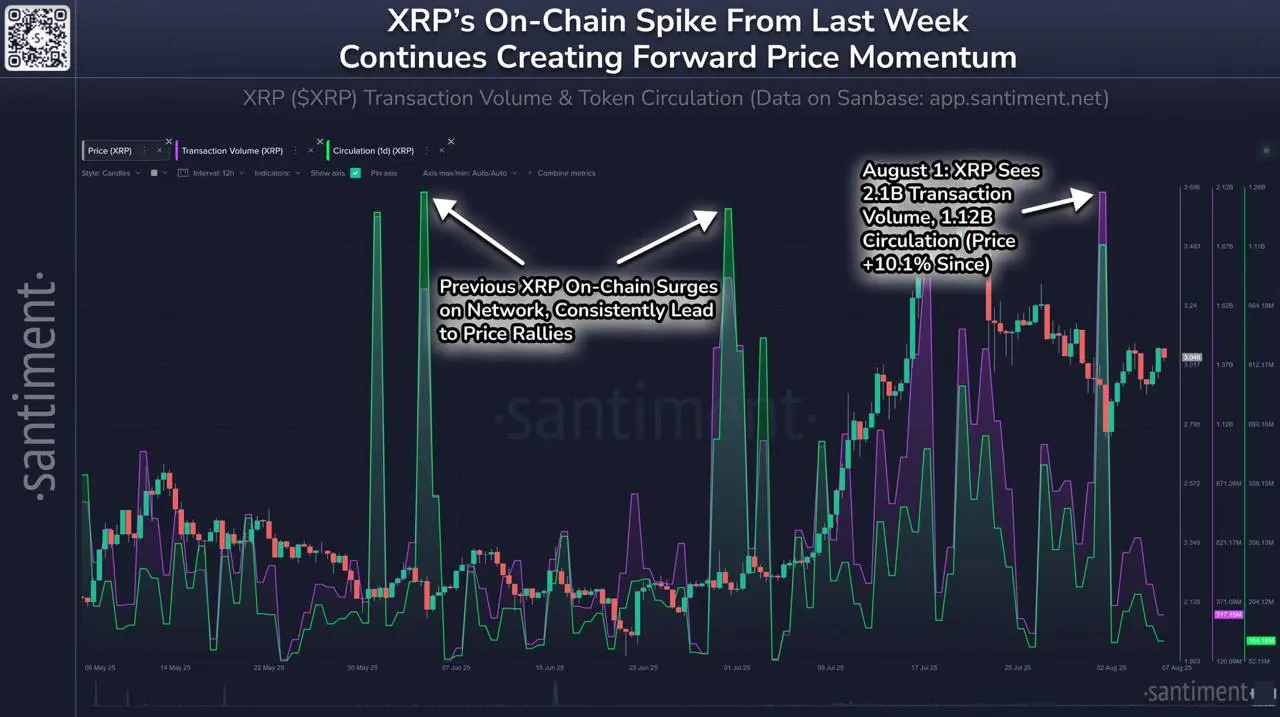

Share link:In this post: SEC has waived the “bad actor” designation for Ripple after the settlement of their 5-year dispute. The waiver means Ripple can now return to raising capital in the private markets. XRP has seen substantial gains, but analysts say there is more to come.

Share link:In this post: Microsoft has announced that it will discontinue its Lens application in the coming weeks. The company has released the timeline for the removal of the application from the iOS and Android app stores. Microsoft has urged users to switch to the Copilot artificial intelligence application.

Share link:In this post: A Colorado man has pleaded guilty to operating a multi-million-dollar fraudulent investment scheme. The suspect, Timothy McPhee, is also being charged with tax evasion and conspiracy to defraud the United States. McPhee is expected to be sentenced on October 23, facing up to 30 years in prison for his crimes.

Share link:In this post: Ethiopian Electric Power has announced plans to shut down all crypto mining operations in the country. According to the EEP, no new contracts will be taken, and all existing ones will be reconsidered. EEP wants to focus electricity on domestic consumers and strategic industries.

Quick Take Bitcoin rose above $121,000 while ether reached $4,300 late night Sunday, following Trump’s executive order on allowing 401(k) accounts to invest in crypto. Spot ETF flows and corporate crypto treasuries remain key drivers of the current market cycle, analysts said.

The DeFi TVL patterns are similar to the 2021 altseason, which sent Ethereum to its record high.

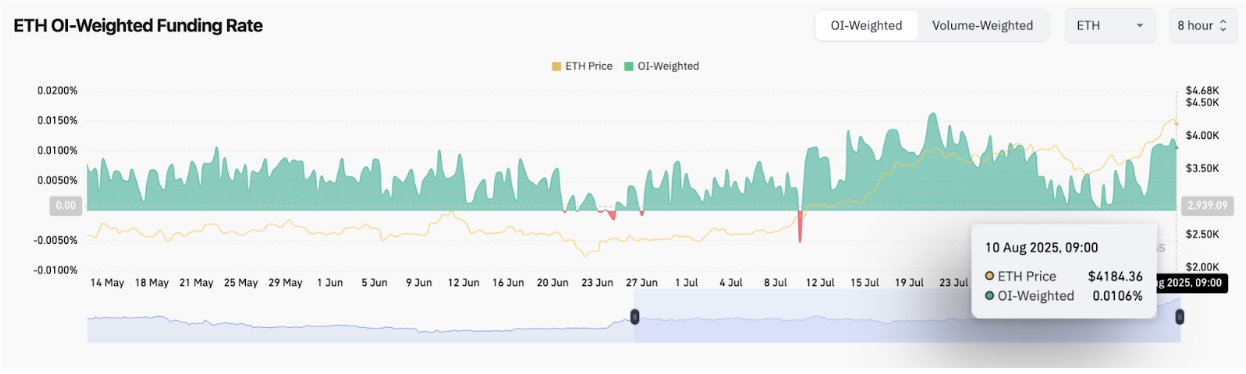

Ethereum price surged 6.5% to $4,330 on August 10 as Fundamental Global unveiled a $5B ETH treasury accumulation plan.

- 08:22Analysis: Realized BTC miner inflow value to exchanges reaches all-time high, indicating potential selling pressureChainCatcher news, CryptoOnchain posted on social media that the Realized Miner Inflows to exchanges have reached a historical peak of $1.87 billions in bitcoin value, marking the largest miner-held value transfer in bitcoin history. There are two possible explanations: · Miner capitulation under pressure: Rising operational costs and network difficulty may force miners to sell, and historically, such phases often coincide with cycle bottoms; · Strategic profit-taking: Some miners may be locking in significant profits at local highs in preparation for potential pullbacks. Regardless of the reason, the sharp increase in realized inflows highlights the scale of value transfer from miners to exchanges. This could create significant supply-side resistance, potentially suppressing upward momentum and increasing the likelihood of heightened market volatility.

- 08:01Bitdeer’s total Bitcoin holdings surpass 1,935 BTC, with 106.2 BTC mined this weekChainCatcher news, Nasdaq-listed Bitcoin mining company Bitdeer released its latest Bitcoin holdings data on the X platform. As of September 12, its total Bitcoin holdings had increased to 1,935.6 BTC (note: this amount refers to pure holdings). In addition, its Bitcoin mining output for this week was 106.2 BTC, while 105.6 BTC were sold during the same period.

- 07:53Data: A certain whale address bought 3,956 ETH at an average price of $4,780According to ChainCatcher, a whale address starting with 0x15f spent 18.91 million DAI to purchase 3,956 ETH three hours ago, with an average cost of $4,780.