Billionaire Carl Icahn’s Hedge Fund Sees Six Straight Years of Losses After Failed Short Bets: Report

Unsuccessful short-selling has reportedly put billionaire Carl Icahn’s private hedge fund into a six-year-long red streak.

Icahn’s private hedge fund, which accepts no outside capital, is down 8.8% on the year already, Institutional Investor reports .

In a filing, the company said that “market hedges” were mostly to blame for the losses, which overshadowed gains in otherwise viable long positions.

“The negative performance of our investment segment’s short positions was driven primarily by net losses from broad market hedges of $147 million and net losses in the energy sector of $81 million.”

Icahn’s investment portfolio is a component of Icahn Enterprises (IEP), which is made up of six other segments, including energy, automotive, food packaging, real estate, home fashion and pharma.

As of Friday’s close, shares of Icahn Enterprises were trading at $9.27, down over 83% since April 2023, and 93% down from its all-time high of $149, last seen in 2013.

Icahn Enterprises accelerated its decline in May of 2023 when short seller firm Hindenburg Research came out with a report alleging that IEP was highly levered by debt, which may have to be refinanced at higher rates. Hindenburg also alleges that IEP is issuing new units to pay dividends, instead of taking funds from profits or operational cash flow.

Following the report from Hindenburg, IEP cut its dividends in half.

In April of this year, Icahn and his affiliates redeemed $208 million from his personal interest in the hedge fund, as per regulatory filings.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

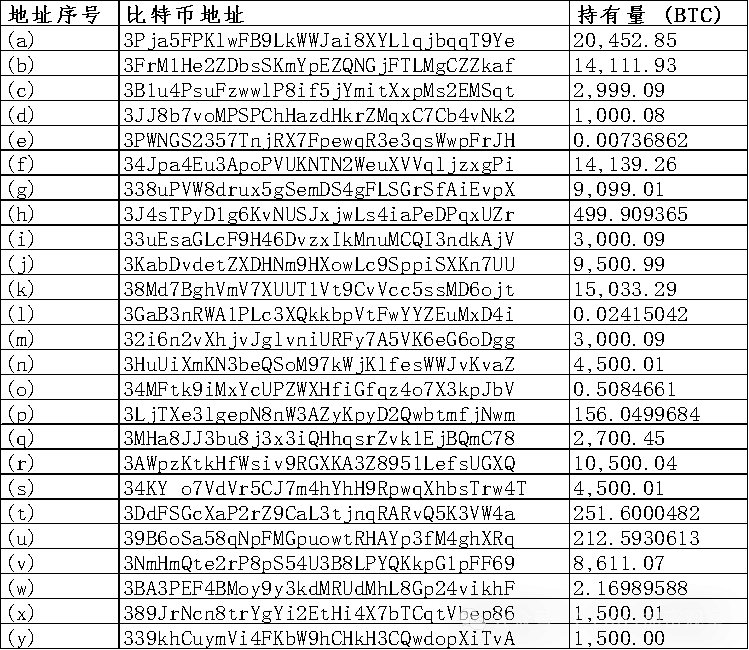

The U.S. "national team" turns on itself: The perfect scam of swallowing 127,000 bitcoins

ZK Roadmap "Dawn": Is the roadmap to Ethereum's endgame accelerating across the board?

ZKsync has become a representative project of the Ethereum ZK track and has shown outstanding performance in the RWA sector, with on-chain asset issuance second only to the Ethereum mainnet. Its technological advancements include a high-performance sequencer and privacy chain architecture, accelerating Ethereum's transition into the ZK era. Summary generated by Mars AI. The accuracy and completeness of this summary's content, generated by the Mars AI model, are still in the iterative update stage.

20x in 3 months, is the ZEC $10,000 prophecy coming true?