News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.16)|CME to Launch ADA, LINK and XLM Futures on Feb 9; Bitmine Purchases 24,068 ETH; Polygon Lays Off 30% to Pivot Toward Stablecoin Payments2Atomic Wallet raises red flags in viral $479k Monero loss claim3Bitcoin Sheds 30% of Open Interest: Is a Rebound Imminent?

Digg unveils its new competitor to Reddit for everyone to access

101 finance·2026/01/14 19:18

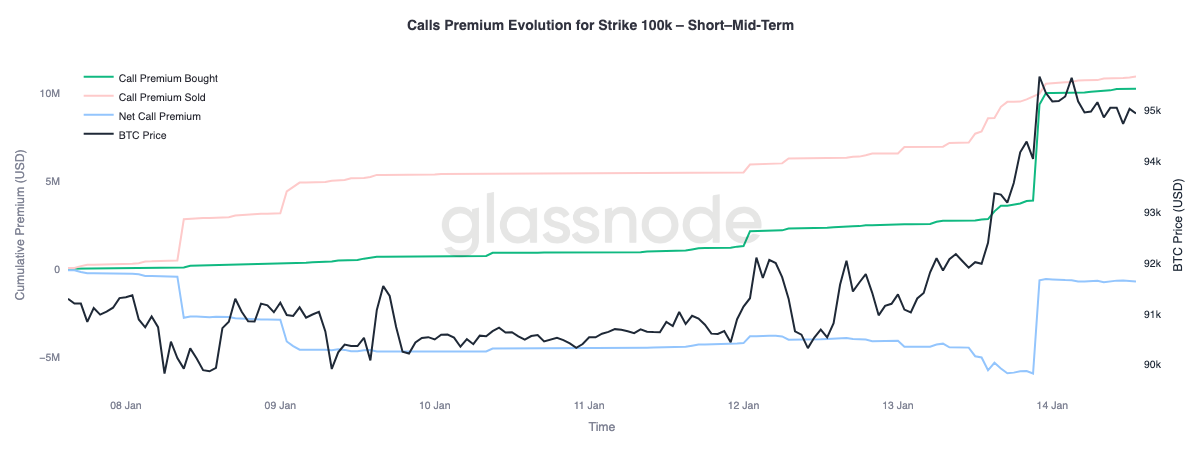

Bouncing Into Supply

Glassnode·2026/01/14 19:15

Blackstone and General Atlantic-supported Liftoff Mobile submits application for initial public offering

101 finance·2026/01/14 19:06

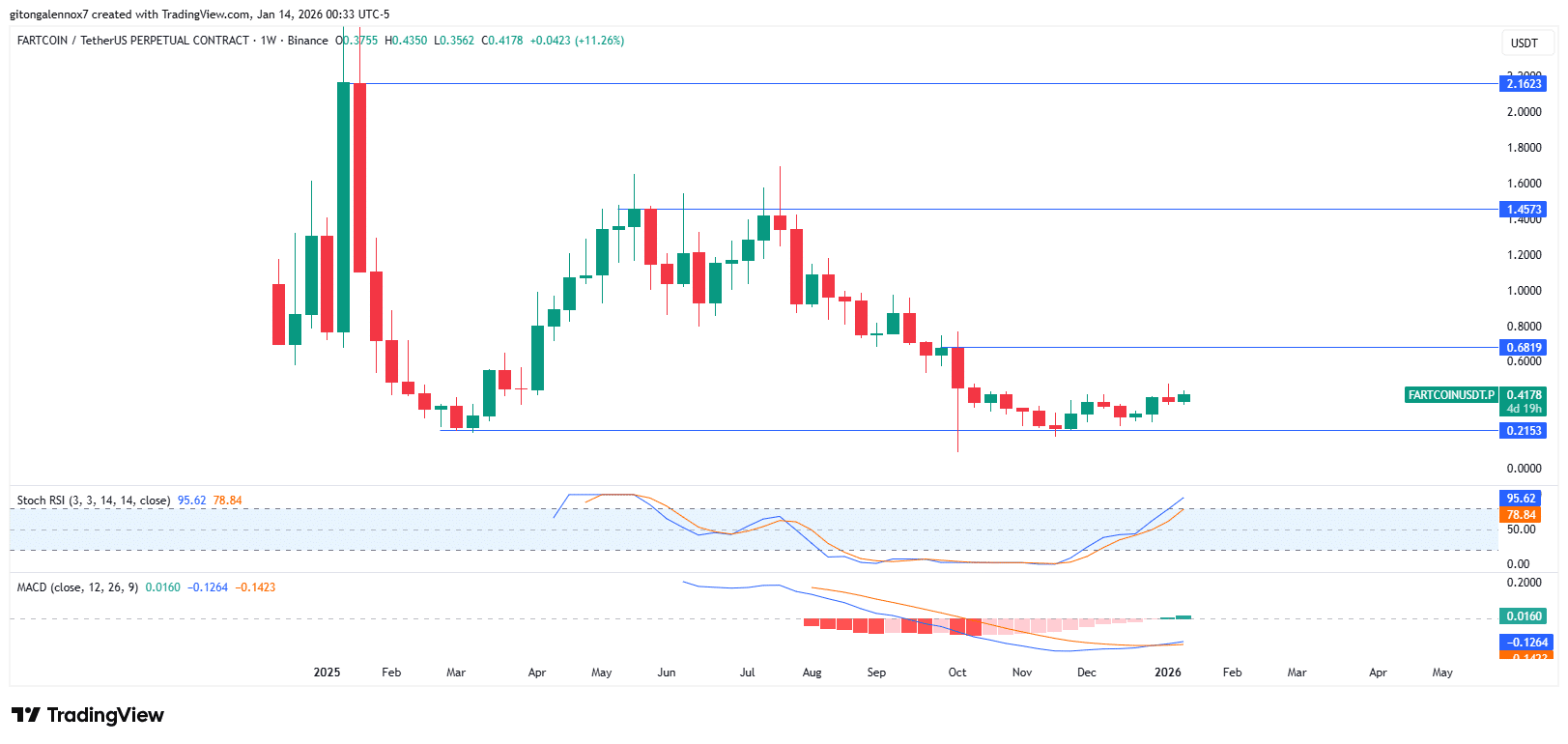

FARTCOIN’s 12% rally is just the start if buyers do THIS…

AMBCrypto·2026/01/14 19:03

Whole Foods co-founder praises Jeff Bezos as a ‘visionary’ who ended the ‘Whole Paycheck’ reputation

101 finance·2026/01/14 19:03

Crypto Asset Manager Bitwise Launches Exchange Traded Fund (ETF) Tied to This Altcoin! Here Are the Details

BitcoinSistemi·2026/01/14 19:00

BlockDAG’s $442M Presale and 1,566% Locked Upside Steal the Entire Trader Focus! Ethereum Holds Firm & Shiba Inu Surges

BlockchainReporter·2026/01/14 19:00

The Protocol: Vitalik Buterin highlights issues in stablecoin design

101 finance·2026/01/14 18:54

Bitcoin rallies past $97,000 as investors seek haven assets

101 finance·2026/01/14 18:51

McGinley Dynamic Indicator: A Comprehensive Trading Manual

101 finance·2026/01/14 18:42

Flash

18:33

Genius Terminal sets a new record with a single-day trading volume of $787 millionJinse Finance reported that Genius Terminal set a new single-day trading volume record of $787 million. The platform's weekly trading volume has exceeded $2 billion, and traders expect that the platform may conduct an airdrop through its Genius Points (GP) program.

17:07

Trump denies offering JPMorgan CEO Dimon the position of Federal Reserve ChairmanU.S. President Trump stated on the social media platform "Truth Social" that the claim made in a front-page article of The Wall Street Journal, which said he had offered the position of Federal Reserve Chairman to JPMorgan CEO Jamie Dimon, is completely fabricated and that he has never made such an offer. Trump also revealed that he will sue JPMorgan in the next two weeks because the bank terminated its business relationship with him after the January 6 protest incident. In addition, he denied ever intending to nominate Jamie Dimon as Treasury Secretary and said that the current Treasury Secretary, Janet Yellen, has performed extremely well.

16:00

Total Liquidations in the Last 24 Hours: $78.792 million, Largest Single LiquidationBlockBeats News, January 17th, according to Coinglass data, the total liquidation across the network in the past 24 hours was $78.792 million, with $30.397 million in long liquidations and $48.394 million in short liquidations.

In the past 24 hours, a total of 68,643 people were liquidated globally. The largest single liquidation occurred on Hyperliquid - xyz:AMZN-USD, amounting to $1.3055 million.

News