News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.16)|CME to Launch ADA, LINK and XLM Futures on Feb 9; Bitmine Purchases 24,068 ETH; Polygon Lays Off 30% to Pivot Toward Stablecoin Payments2Atomic Wallet raises red flags in viral $479k Monero loss claim3Bitcoin Sheds 30% of Open Interest: Is a Rebound Imminent?

Florida Governor DeSantis challenges President Trump’s AI deregulation push

Cointelegraph·2026/01/14 21:33

Acushnet (GOLF) Shares Rise—Here’s What’s Driving the Move

101 finance·2026/01/14 21:33

Bitcoin News Today: As Fed 95% Set to Hold Rates, BTC Rise +1.7%, Investors Eye This Top Crypto Presale Offering 22,367% ROI

BlockchainReporter·2026/01/14 21:15

Procter & Gamble's CEO may experience a significant increase in personal wealth due to stock-based rewards

101 finance·2026/01/14 21:09

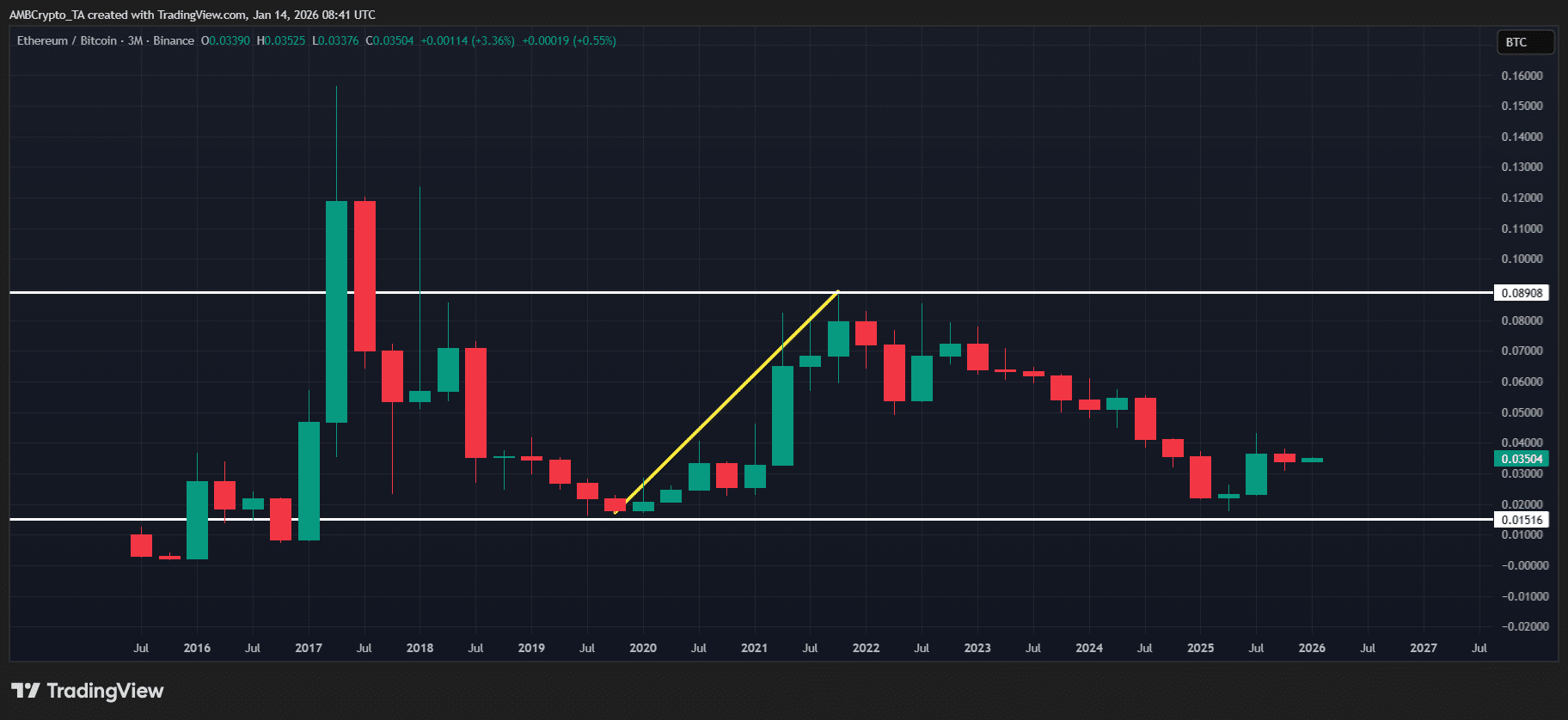

2019 déjà vu? Why Ethereum could outperform Bitcoin again

AMBCrypto·2026/01/14 21:03

Helium Mobile ends early access plans, sparks subscriber backlash

Cointelegraph·2026/01/14 21:00

China's Z.AI Releases First Major AI Image Generation Model Trained Without American Chips

Decrypt·2026/01/14 20:55

Saks Global files for bankruptcy protection. How will this affect customers?

101 finance·2026/01/14 20:51

Why Wells Fargo (WFC) Stock Is Declining Today

101 finance·2026/01/14 20:36

Flash

23:06

USDT0 Co-founder: Tokenized gold will become the collateral layer for on-chain finance, just as stablecoins have become the settlement layer.USDT0 co-founder Lorenzo R. stated: "As gold prices continue to reach new highs, the tokenized gold market is also heating up rapidly, and 2026 is expected to be a breakthrough year." He believes that tokenized gold will become the collateral layer for on-chain finance, just as stablecoins have become the settlement layer. He said: "The structural pressures driving the development of stablecoins—interest rate volatility, geopolitical fragmentation, and declining trust in sovereign debt—are now converging on gold-backed assets." He added: "It is becoming increasingly clear that programmable gold will evolve from a niche risk-weighted asset class to the default hard asset standard for on-chain finance."

22:40

Cathie Wood: Bitcoin is a “good source of diversification” for investors seeking higher returnsAccording to Jinse Finance, Ark Invest CEO Cathie Wood believes that due to bitcoin’s low correlation with other major asset classes, it can serve as a valuable diversification tool in institutional investment portfolios. In a comprehensive report, Wood pointed out that bitcoin’s low correlation with other major asset classes—including gold, stocks, and bonds—is a reason asset allocators should take bitcoin seriously. She wrote: “For asset allocators seeking higher risk-adjusted returns, bitcoin should be an excellent source of diversification.”

22:19

Superstate Founder: Long-standing Legal and Operational Barriers to Asset Tokenization Are Beginning to ShiftJinse Finance reported that Robert Leshner, founder of tokenization company Superstate, stated that long-standing legal and operational barriers are beginning to shift. In an email, he said, "With the emergence of credible, issuer-led on-chain equity structures, public equities are shifting from 'prohibited from trading' to 'tradable'." A series of trading platforms, including a certain exchange, have begun offering tokenized versions of the most popular stocks. Leshner added that the trend of moving from wrapped synthetic assets to direct token issuance is also accelerating.

News