News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The Federal Reserve announced a 25 basis point rate cut and halted quantitative tightening (QT), but the market experienced short-term panic due to Powell's hawkish comments regarding uncertainty over a rate cut in December. Bitcoin and Ethereum prices declined. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still in the process of iterative improvement.

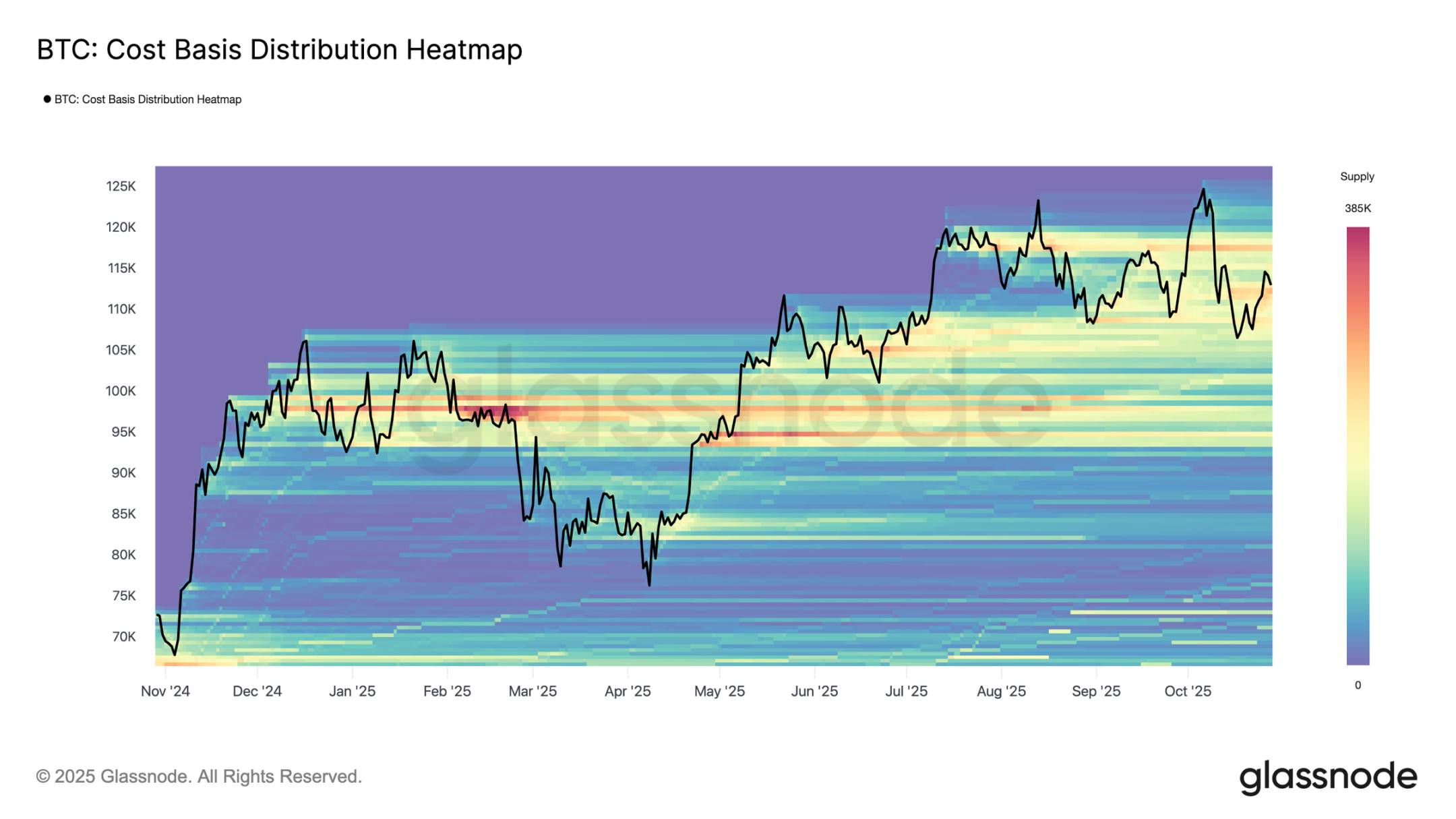

Bitcoin (BTC) traders are watching mid-November closely as multiple signals point to a potential local bottom near $100,000. The 50-day moving average is expected to cross below the 200-day SMA, forming a “death cross” that historically marks exhaustion, not major downturns.

Bitcoin is showing clear signs of weakness, and market confidence is being put to the test.

Solana’s stalled rally and plunging inflows point to fading investor confidence, with the altcoin now battling to defend $183 support after multiple failed breakout attempts.

In a new report, FTX founder Sam Bankman-Fried claims his exchange was solvent and blames its collapse on lawyers—not fraud—sparking backlash from investigators who accuse him of rewriting history.

Bitcoin's recent drop was a "textbook shakeout of weak hands," analysts say, noting long-term conviction is intact. Unrealized losses remain minor, suggesting the bull cycle structure holds.

- 21:53Nvidia drives US chip stocks higher, with AMD, TSMC, and Micron Technology all rising over 3%According to ChainCatcher, citing Golden Ten Data, the rally of Nvidia (NVDA.O) has driven after-hours gains in U.S. chip stocks, with AMD (AMD.O), TSMC (TSM.N), and Micron Technology (MU.O) all rising by more than 3%.

- 21:48The White House is taking action to block legislation restricting AI chip exportsJinse Finance reported, citing AXIOS, that according to four informed sources, senior White House officials are pressuring members of Congress to exclude restrictions on AI chip exports to "countries of concern" from the annual national defense policy bill. David Sacks, the White House director of AI and cryptocurrency, has been leading the effort to drop the bill, and his efforts are now supported by the White House Office of Legislative Affairs, making it highly unlikely that the bill will be included in the must-pass defense legislation. Sources said that government officials have been calling key lawmakers, including House Majority Leader Scalise, telling them to oppose the bill. The bill requires chip companies to meet U.S. customer procurement requirements before exporting to "countries of concern." It also includes certain export license exemptions for "trusted" entities. Previously, Nvidia CEO Jensen Huang successfully convinced key U.S. government officials that it is beneficial for American companies to serve countries of concern. If the "Guarding National AI Innovation and Access Act" (GAIN AI Act) does not make it into the final version of the National Defense Authorization Act, Nvidia will be a big winner.

- 21:48Bitcoin miners' transaction fee revenue drops to its lowest point in 12 monthsAccording to Jinse Finance, Bitcoin miners' income consists of two parts: block rewards and transaction fees. Currently, block rewards bring miners about $45 million in daily revenue. Transaction fees contribute approximately $300,000 per day to miners, marking a 12-month low and accounting for less than 1% of total miners' income.