Key takeaways:

Bitcoin rebounded 4% from a key range under $90,000, outperforming US equities on Tuesday.

Tech stocks slid ahead of Nvidia’s pivotal Q3 earnings, which may determine the next phase of the AI trade.

The Coinbase premium gap plunged to negative $114, pointing to waning institutional demand, which may keep BTC range-bound in the short term.

Bitcoin ( BTC ) staged a sharp rebound on Tuesday, rising 4% from an intraday low of $89,300 to trade as high as $93,700 as BTC rallied from a key order block between $91,500 and $88,400. The bounce came as risk assets wobbled, briefly putting BTC in the unusual position of outperforming US equities.

Bitcoin one-day chart. Source: Cointelegraph/TradingView

Bitcoin one-day chart. Source: Cointelegraph/TradingView

For a change, Bitcoin led the broader market. Stocks slid again on Tuesday, with investors pulling back from tech and AI-related stocks. The Dow fell as much as 1.2%, the S&P 500 dropped 1.1% and the Nasdaq plunged 1.5%. Nvidia slipped another 2%, adding to its 10% decline this month ahead of closely watched Q3 earnings due Wednesday.

The volatility comes at a crucial moment for markets, with Nvidia’s results widely viewed as a potential breakout or bubble-check for the AI trade that has dominated the year. In October, Nvidia CEO Jensen Huang revealed that Nvidia had already secured $500 billion in chip orders for 2025–2026, signaling confidence that the AI boom still has room to run. Analysts took the comments as an indication of stronger-than-expected revenue potential for 2026.

But projections have cooled. Nvidia is now expected to post a 56% year-over-year revenue jump to $54.92 billion for the latest quarter, a strong figure, but well below the triple-digit growth rates it delivered earlier in the cycle.

Still, traders appear to be positioning for upside, with Bitcoin’s rebound suggesting a degree of speculative risk-taking returning ahead of what could be a pivotal earnings moment for AI and broader markets.

Related: Stablecoin giant Tether backs Ledn, targets global crypto lending

Key BTC metric suggests prolonged possible sideways action

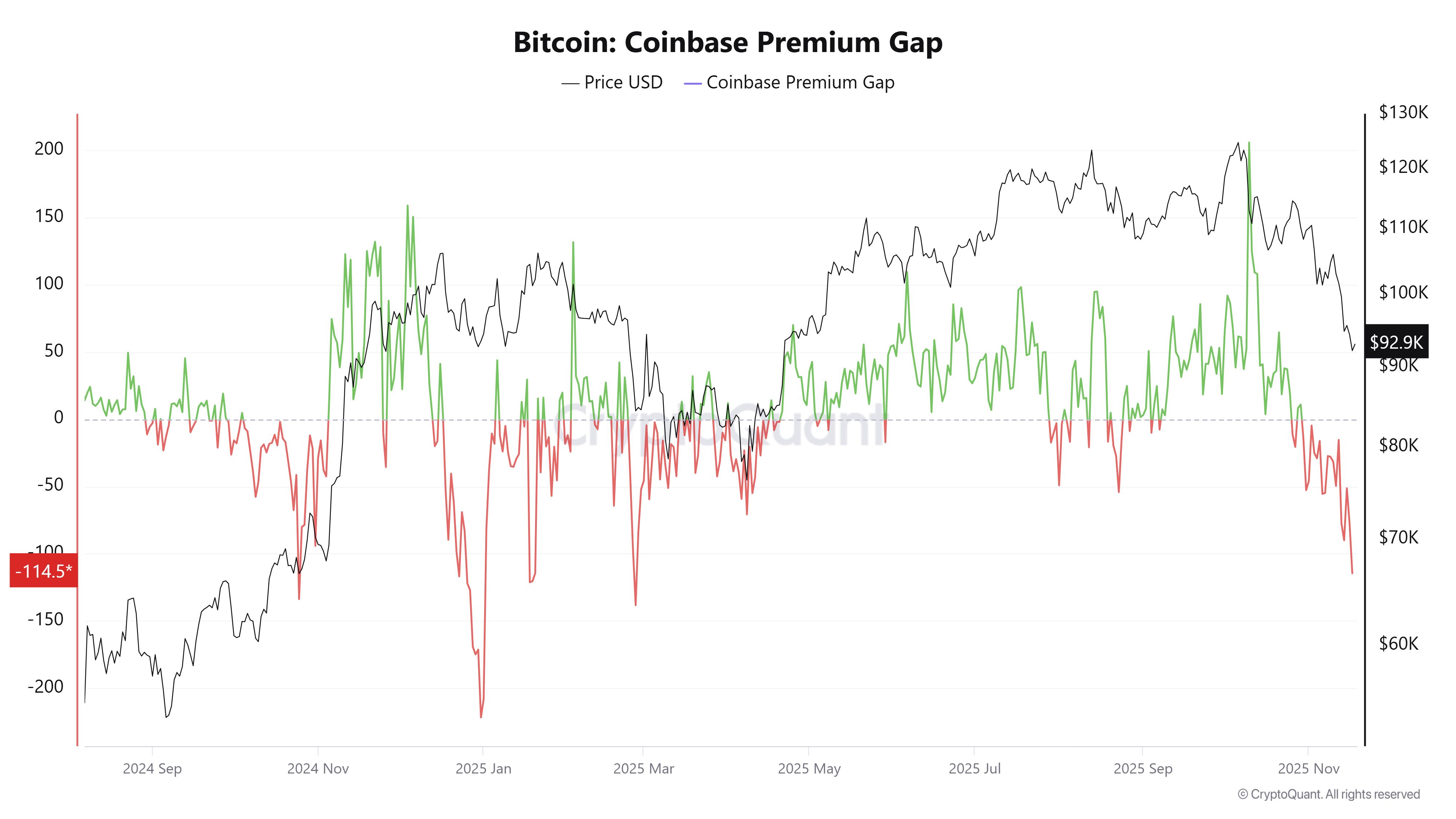

While Bitcoin’s rebound could lift market sentiment, onchain data suggested the recovery may not be as strong as it appears. According to CryptoQuant, the Coinbase premium gap has plunged to -$114.5 on Nov. 17, one of its lowest readings since Feb. 25. The last time the premium fell this sharply was in February 2025, when it hit –$138, coinciding with a period of institutional pullback.

Bitcoin Coinbase Premium Gap. Source: CryptoQuant

Bitcoin Coinbase Premium Gap. Source: CryptoQuant

The Coinbase premium gap tracks the price difference between Coinbase, favored by institutions and large players, and Binance, which is dominated by retail traders. In a bullish market, the premium typically turns positive as institutional demand accelerates.

However, a deep negative premium gap signaled the opposite, where the price action may be driven largely by Binance’s retail crowd, not institutions.

A persistently negative premium suggests the current market is influenced more by reactive traders who are quick to chase upside and faster to sell on dips.

Related: ETH falls into ‘buy zone,’ but volatility-adverse traders take a wait-and-see approach