News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Power restructuring in probability games.

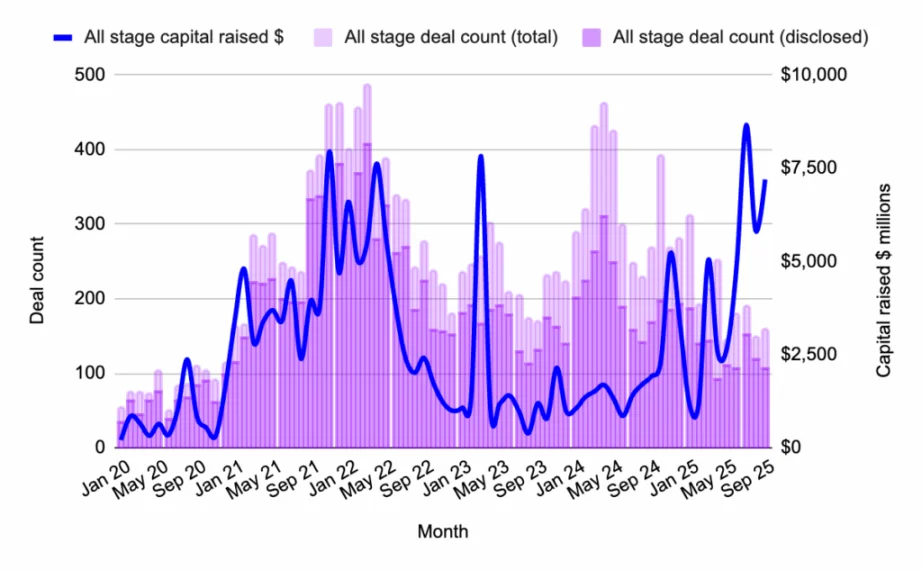

160 transactions raised $7.2 billions, marking the highest total since the spring surge.

ETF inflows dry up and digital asset trusts unwind as traders lose conviction; analysts say Bitcoin could revive sentiment with one strong breakout.

See how BlockDAG’s Buyer Battles boost activity, Hyperliquid gains from U.S. listings, and Cardano holds firm before a potential breakout.Hyperliquid Price Climbs After Robinhood LaunchCardano Maintains Strength Near $0.54 SupportBlockDAG’s Buyer Battles Drive Global Demand!Last Say: Which One Is the Best Crypto Investment

JPMorgan CEO Jamie Dimon says crypto is real and will improve transactions, marking a big shift from his earlier skepticism.Jamie Dimon: From Critic to Crypto Convert?Mainstream Finance Warming Up to CryptoWhy This Matters for the Industry

MicroStrategy earns $2.8B in Q3; Bitcoin holdings up $12.9B in 2025 with 26% BTC yield.Massive Bitcoin Holdings and High YieldWhat This Means for the Market

- 18:29The three major U.S. stock indexes have turned positive again, with the Nasdaq up 0.47%.ChainCatcher news, according to Golden Ten Data, the three major U.S. stock indexes have turned positive again, with the Dow Jones Index up 0.03%, the S&P 500 Index up 0.35%, and the Nasdaq Composite Index up 0.47%.

- 18:18The U.S. Bureau of Labor Statistics cancels the October nonfarm payrolls report; the November report is rescheduled for release on December 16.Jinse Finance reported that the U.S. Bureau of Labor Statistics announced it will not release the October non-farm payrolls report and stated that the employment data (establishment survey) originally scheduled for October will be merged into the November report. This combined report is scheduled to be released on December 16, which means that Federal Reserve officials will not have access to this key data at the last policy meeting of the year (the Fed interest rate decision will be announced in the early morning of December 11, Eastern Eight District time). The agency pointed out that the October household survey data, which is used to calculate key indicators such as the unemployment rate, will not be retrospectively collected. The U.S. non-farm payrolls report consists of two parts: the household survey and the establishment survey, with the establishment survey used to calculate non-farm employment data. The agency also stated that it will extend the data collection period for both the November household survey and the establishment survey.

- 18:18Federal Reserve Governor Milan calls for prioritizing banking regulatory reforms, saying cumbersome rules hinder industry developmentJinse Finance reported that Federal Reserve Governor Stephen Miran stated that he hopes the Fed will first readjust a series of regulatory rules for Wall Street before discussing other economic issues related to the central bank's balance sheet. "For many years, financial regulation has basically moved in one direction, continuously increasing restrictions on the banking industry," Miran said in remarks prepared for the Bank Policy Institute on Wednesday. He added that the interaction between regulation, financial markets, the economy, and the implementation of monetary policy is often underestimated. "While there is constant discussion about bank reserve balances and their interest, balance sheet composition, and Treasury market intermediation, I believe most of these discussions are downstream issues of the bank regulatory framework," he said. Miran emphasized that regulators should avoid overreacting, stating that the rules introduced after the 2008 crisis went too far. He pointed out that this has led to much traditional banking business moving outside the regulatory perimeter, partly due to 'cumbersome rules.' "While I have no bias against non-bank financial companies, credit allocation should be driven by market forces, not regulatory arbitrage," he said.