News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The founder laughed, while investors panicked.

A "Saving Private Ryan-style" bet by a Bitcoin evangelist.

The New York Stock Exchange's self-rescue initiative essentially redefines the business model of traditional exchanges. With the loss of the IPO market, declining trading volumes, and sluggish growth in data services, the traditional profit models of exchanges can no longer sustain their competitiveness.

From MYX to COAI, the so-called myths of tenfold or hundredfold returns are nothing more than a quicker exit route under the spotlight of Binance Alpha.

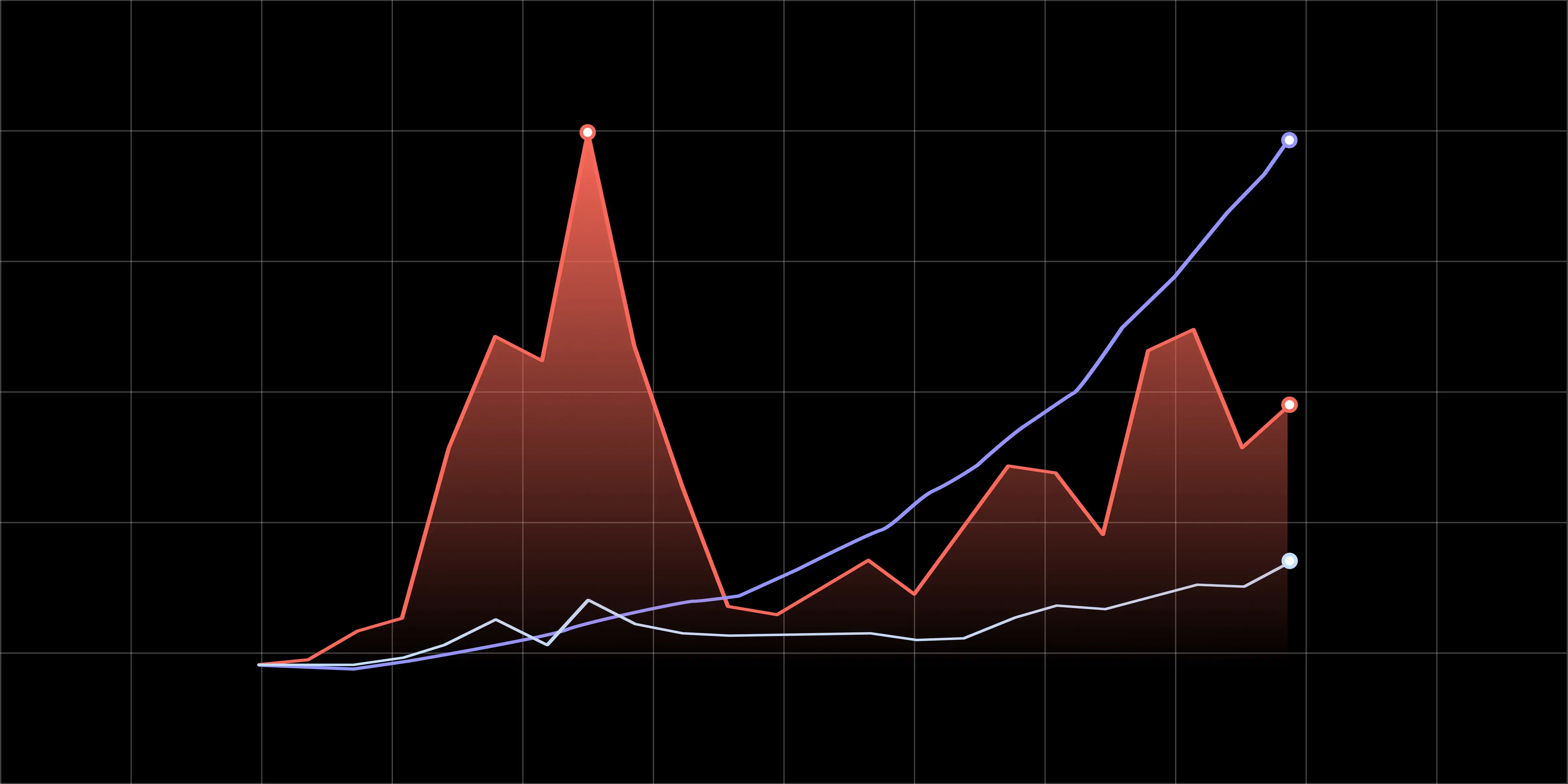

End of the four-year cycle: Five major disruptive trends in cryptocurrency by 2026.

The UTXO smart contract of TBC is not a simple modification of bitcoin, but rather an upgrade that, through a reconstruction of technical philosophy, transforms UTXO from a static value container into a dynamic financial engine.

- 05:40The US Senate may advance the crypto bill in DecemberJinse Finance reported, citing Cointelegraph, that U.S. Senate Banking Committee Chairman Tim Scott stated he plans to mark up the crypto market structure bill in December, aiming to send it to President Trump for signing in early 2026, with the goal of making the United States the "world's crypto capital." The bill aims to clarify the crypto regulatory powers of the CFTC and SEC.

- 05:10Zora: Injected $11 million liquidity into the ZORA-USDC pool on Uniswap v3On November 19, Zora announced in a post, "Today, $11 million in liquidity was injected from the treasury into the ZORA-USDC trading pool on Uniswap v3."

- 05:02Strike founder: Buy the dip, because the decline in bitcoin is essentially a currency collapse, not an asset collapseAccording to ChainCatcher, Jack Mallers, founder of the bitcoin payment app Strike, responded to the recent bitcoin market downturn in a post on X. He stated that investors need to understand that what is truly collapsing right now is not the asset, but the currency itself. Bitcoin is the only market honest enough to reveal this. The repeated record highs in gold prices indicate that the fiat currency system has already collapsed. Bitcoin acts like a liquidity alarm; buy the dip, because it is the currency that has the problem.