News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

"Don't trust, verify." This famous quote precisely captures the core power of decentralization: users do not need to trust others, but can personally verify the authenticity and reliability of the blockchain state—such as the history of users, assets, and transactions.

Matr1x is an innovative Web3 gaming platform that integrates gaming, artificial intelligence, e-sports, and blockchain technology, aiming to reshape the global gaming and digital content industries. The team has extensive experience in game development and has secured over 20 million USD in funding. Matr1x has launched several Web3 games and e-sports platforms, demonstrating its innovation in tokenomics and ecosystem development. Through models such as "Watch to Earn," Matr1x is committed to promoting high-quality development of Web3 games and has established a significant presence in the market.

The stablecoin sub-sector is moving from concept to reality, shifting from speculation to practical application.

Stablecoins are absorbing liquidity in the style of “narrow banks,” quietly reshaping the global financial architecture.

This time, there are more super political action committees, and some of them have taken a clearer stance in aligning themselves with Republican candidates.

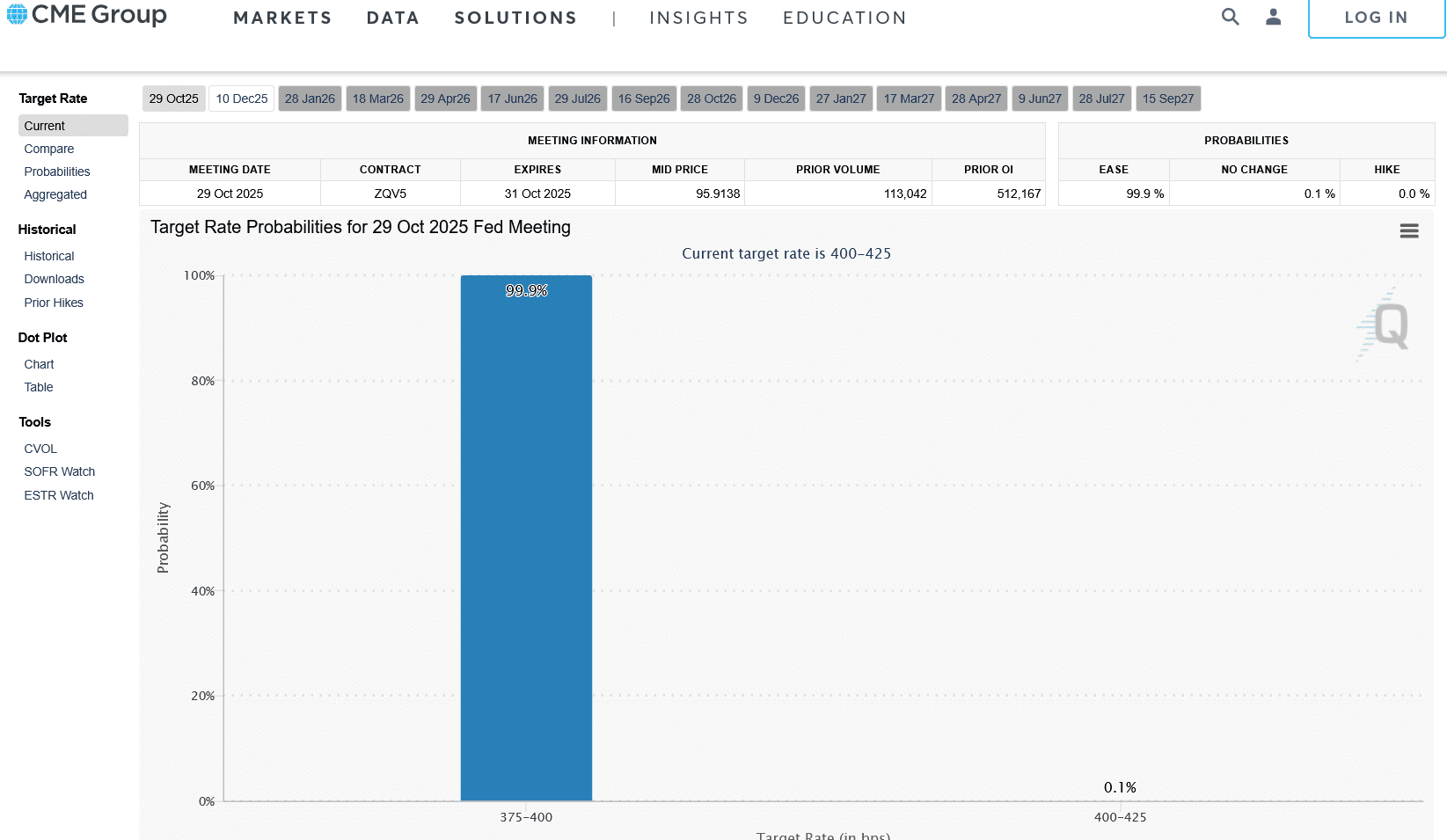

- 18:27The Federal Reserve's overnight reverse repurchase agreement (RRP) usage was $5.886 billion on Wednesday.Jinse Finance reported that the Federal Reserve's overnight reverse repurchase agreement (RRP) usage was $588.6 million on Wednesday, compared to $715.2 million in the previous trading day.

- 18:19Atlanta Fed President Bostic to retire in February next yearBlockBeats News, November 12, the Federal Reserve Bank of Atlanta announced that its President, Bostic, intends to retire at the end of his term on February 28 next year. Cheryl Venable will serve as interim president.

- 18:18Detailed Analysis of SEC Chairman's Classification of Crypto Assets: NFTs, Network Tokens, and Digital Tools Are Not SecuritiesBlockBeats News, November 13, Paul Atkins, Chairman of the U.S. Securities and Exchange Commission (SEC), today outlined his crypto "token taxonomy" plan to clearly distinguish which cryptocurrencies are considered securities. In the SEC press release, Paul Atkins shared his current views on various types of crypto assets, summarizing that Atkins only emphasizes tokenized products as securities, while non-tokenized NFTs, network tokens (ETH, SOL), and "digital tools" with practical functions (such as authentication) are not considered securities. His detailed views are as follows: "Digital commodities" or "network tokens" are not securities. Their value is essentially related to the programmatic operation of "fully functional" and "decentralized" crypto systems, and is generated from this, rather than from the expectation of profits arising from the essential managerial efforts of others; "Digital collectibles" are not securities. These assets are intended for collection and/or use, and may represent or grant the holder rights to digital expressions or references to artworks, music, videos, trading cards, in-game items, or internet memes, characters, current events, or trends. Buyers of digital collectibles do not expect to profit from the day-to-day managerial efforts of others; "Digital tools" are not securities. These crypto assets have practical functions, such as memberships, tickets, credentials, proofs of ownership, or identity badges. Buyers of digital tools do not expect to profit from the day-to-day managerial efforts of others; "Tokenized securities" are, and will continue to be, securities. These crypto assets represent ownership of financial instruments listed in the definition of "securities," which are maintained on a crypto network. Paul Atkins stated that this list is not exhaustive and will be further refined in the future.