Japan Considers Merging Crypto Oversight Into Securities Law, Faces Pushback

Japan’s FSA plans to regulate crypto under securities law, sparking debate over investor protection. Experts caution that extending this framework to failing IEOs could pose risks for retail investors.

Japan’s government is considering incorporating cryptocurrencies into the Financial Instruments and Exchange Act (FIEA), a move away from their current classification under the Payment Services Act.

The move seeks to strengthen investor protection and align crypto oversight with securities regulation, though the advisory council remains concerned about the potential risks of extending this framework too broadly.

Japan Considers Major Shift in Crypto Regulation

The Financial Services Agency (FSA) presented a proposal during a Financial System Council working group on September 2 to regulate cryptocurrencies under the Financial Instruments and Exchange Act (FIEA). Currently, crypto assets are governed by the Payment Services Act, but the agency believes shifting oversight to the FIEA would better address their rising role as investment products.

Under the new framework, cryptocurrencies would be classified alongside securities, subjecting issuers and exchanges to stricter requirements. The FSA argued that tighter rules would deter market misconduct while ensuring transparency for investors. To balance this change, the Payment Services Act provisions would be removed to avoid overlapping business compliance burdens.

The agency emphasized that crypto’s role in payment transactions would remain intact even under securities law. However, firms offering tokens must provide detailed disclosures about price volatility, reliability, and associated risks. The FSA will submit a legislative amendment to the ordinary Diet session next year.

Skepticism from Experts on IEOs

The proposal prompted debate within the meeting. Following industry group presentations, some members questioned whether incorporating cryptocurrencies into securities regulation is right.

Naoyuki Iwashita, a Kyoto University professor and former director at the Bank of Japan’s Institute for Monetary and Economic Studies, noted that primary tokens like Bitcoin and Ethereum may not matter significantly whether they fall under the FIEA or Payment Services Act. Still, he raised concerns about extending the securities framework to all crypto assets.

Iwashita focused on Initial Exchange Offerings (IEOs) in Japan, citing data from the Japan Crypto Asset Business Association (JCBA). He pointed out that nearly all domestic IEOs have lost substantial value, with some tokens losing over 90% of their issuance price, leaving them “virtually worthless.” He said that labeling such assets as securities suitable for public investment under the FIEA would be “unthinkable.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC price bull market lost? 5 things to know in Bitcoin this week

1inch launches Aqua: the first shared liquidity protocol, now open to developers

The developer version of Aqua is now online, offering the Aqua SDK, libraries, and documentation, allowing developers to integrate the new strategy models ahead of time.

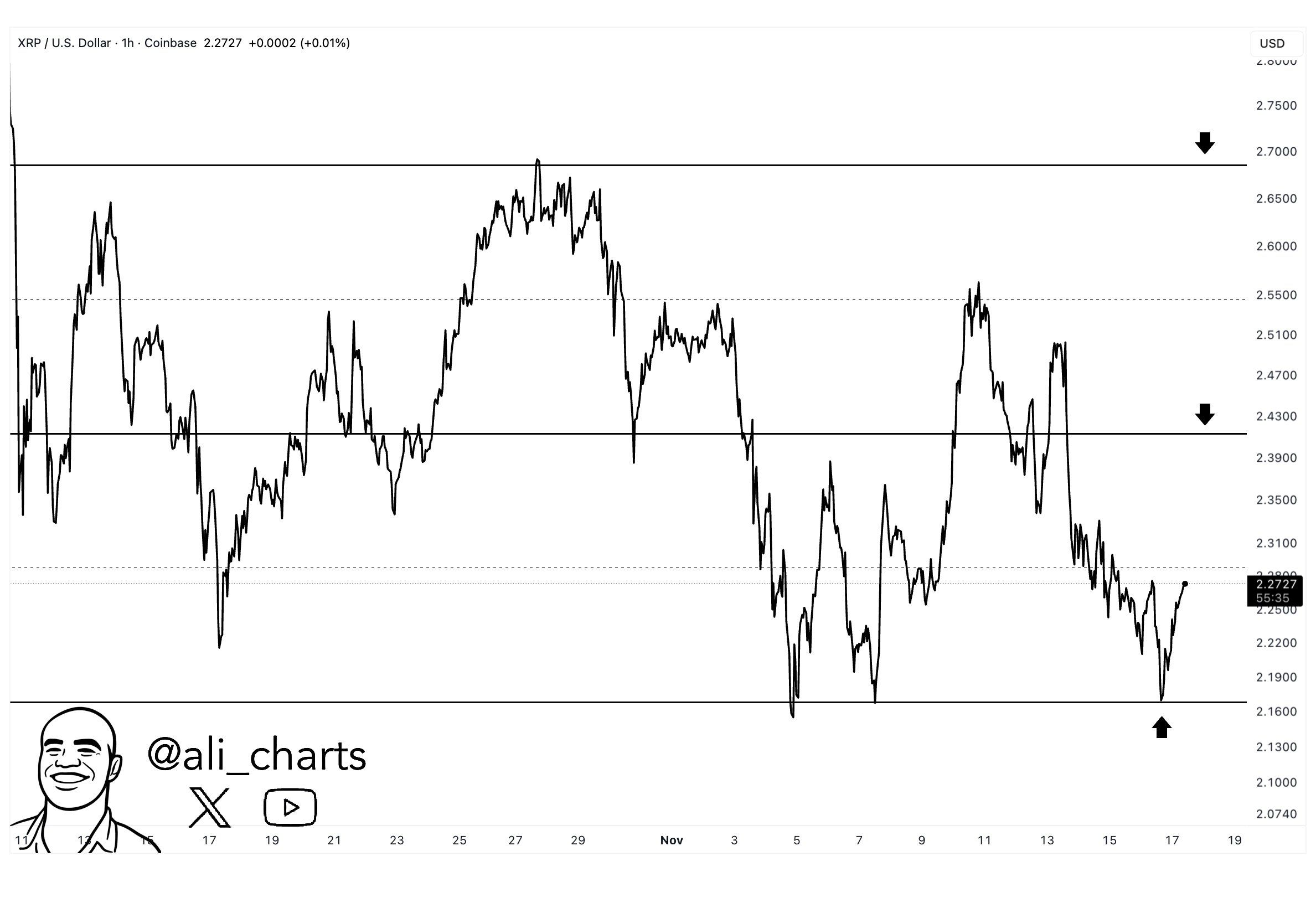

Franklin XRP ETF Debut Meets XRP’s $2.15 Line in the Sand