News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 10)|Trump Proposes $2,000 Tariff “Dividend” for Every American, Market Sees Potential Boost for Bitcoin; CBOE to Launch Perpetual Bitcoin & Ethereum Futures Contracts2Can Bitcoin bulls avoid the cycle’s fourth ‘death cross’ at $102K?321Shares And Canary Ignite XRP ETF Approval Process

Four Stablecoins, Four Blockchains: Visa’s Big Step in Digital Payments

Cointribune·2025/10/30 22:24

Is Virtuals Protocol (VIRTUAL) Poised for a Bullish Rally? This Emerging Fractal Setup Saying Yes!

CoinsProbe·2025/10/30 22:24

Ondo Finance Partners with Chainlink to Strengthen Onchain Institutional Finance

CoinsProbe·2025/10/30 22:24

Aster (ASTER) Nearing Potential Bottom? This Key Emerging Fractal Suggests So!

CoinsProbe·2025/10/30 22:24

African payment giant Flutterwave taps Polygon blockchain for cross-border payments

Coinjournal·2025/10/30 22:09

Uphold relaunches XRP rewards debit card in the US with up to 10% back for users

Coinjournal·2025/10/30 22:09

Garden Finance exploit: over $5.5M stolen, 10% white hat bounty announced

Coinjournal·2025/10/30 22:09

Jiuzi Holdings taps SOLV Foundation for its $1B Bitcoin investment plan

Coinjournal·2025/10/30 22:09

Hedera Powers New Verifiable AI Agent Governance System for Governments and Enterprises

CryptoNewsFlash·2025/10/30 22:00

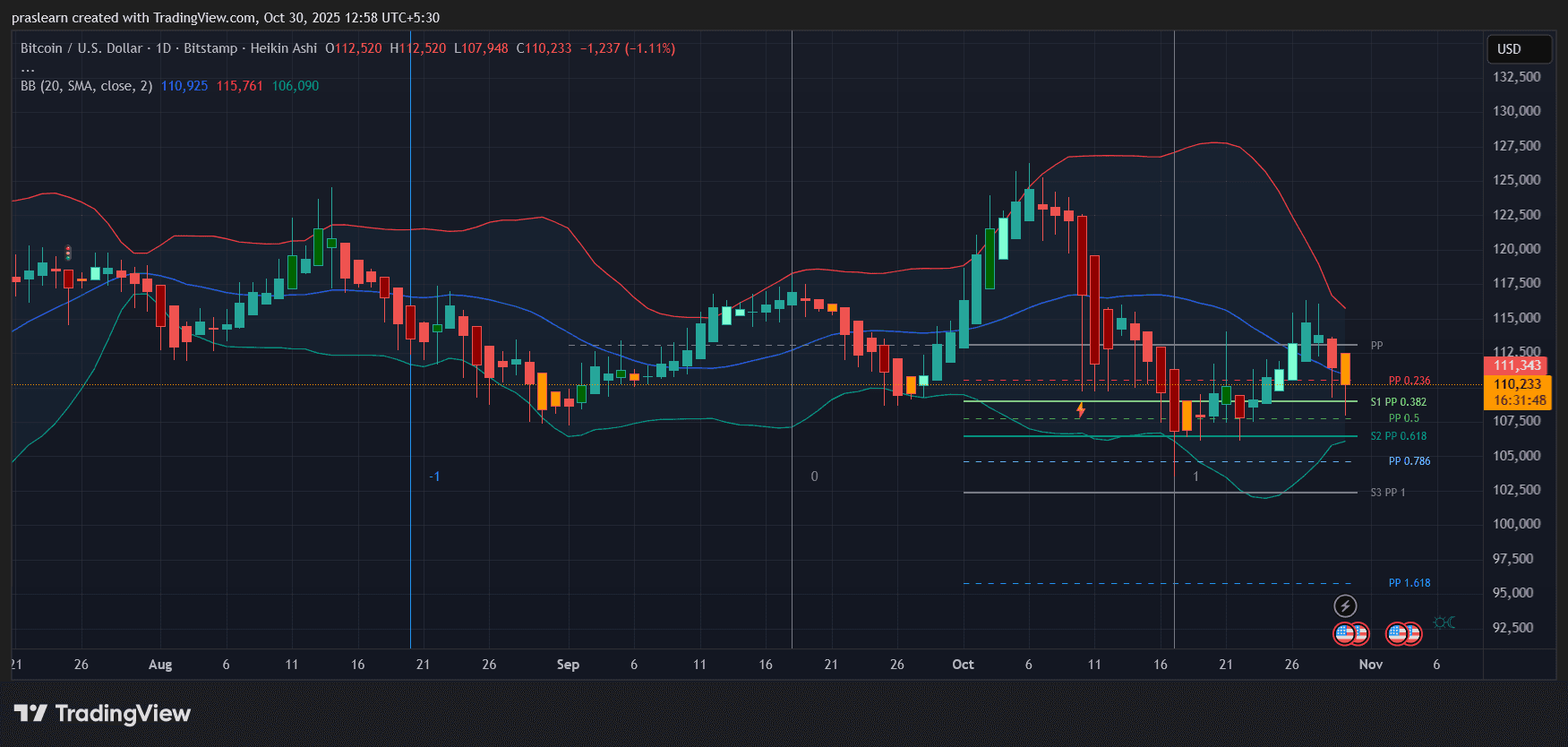

Will the Fed’s Rate Cut Spark a New Bitcoin Rally?

Cryptoticker·2025/10/30 21:54

Flash

- 05:52Moderate Democratic Senators "Defect" to Facilitate Vote Passage, Multiple Democrats Urge Colleagues to Stand FirmBlockBeats News, November 10, according to the Associated Press, although New York Senate Democratic leader Chuck Schumer, along with most Democratic senators, voted against it, some moderate Democrats "defected," resulting in the Senate's procedural vote on "ending the government shutdown" being passed. The report stated that moderates had originally expected more Democrats to stand with them, as 10 to 12 Democratic senators participated in the negotiations. However, in the end, only five Democrats changed their voting stance—exactly the number of votes Republicans needed. On Sunday night, the vote was temporarily delayed because three conservative Republican senators, who frequently criticize spending bills, refused to vote and were seen discussing with Senator Thune at the back of the chamber. However, after speaking with Trump, they ultimately voted in favor. It is reported that after more than two hours of discussion among Democrats, Schumer said he could not "in good conscience" support the proposal. Vermont independent Senator Bernie Sanders, who attends caucus meetings with Democrats, said that giving up the fight was a "terrible mistake." Connecticut Democratic Senator Chris Murphy agreed, saying that in last week's election, people overwhelmingly voted for Democrats "to urge Democrats to stand firm." The report pointed out that Democrats had voted 14 times against reopening the government, demanding an extension of tax credits under the Affordable Care Act to reduce healthcare costs. Republicans stated they would not negotiate on healthcare reform, but as the framework of the agreement gradually emerged, Republican leaders had been secretly working with moderates.

- 05:52Some privacy sector tokens see significant gains, with DCR rising nearly 40% in a single dayBlockBeats News, November 10, according to market data, some tokens in the privacy sector have seen significant increases today, including: DCR surged nearly 40% in a single day, currently quoted at $32.94; Railgun rose by 39.3% in a single day, currently quoted at $4.9; STRK increased by 30.8% in a single day, currently quoted at $0.1713; BlockBeats reminds users that the prices of related tokens are highly volatile, and users should invest cautiously.

- 05:52After the key vote passed, the market bets that the U.S. government will restart between the 12th and 15th.BlockBeats News, November 10, after the procedural vote on the "End Government Shutdown Plan" was passed in the US Senate, the probability of "the US government will restart between the 12th and 15th" on Polymarket surged to 80%.