News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The Federal Reserve announced a 25 basis point rate cut and halted quantitative tightening (QT), but the market experienced short-term panic due to Powell's hawkish comments regarding uncertainty over a rate cut in December. Bitcoin and Ethereum prices declined. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still in the process of iterative improvement.

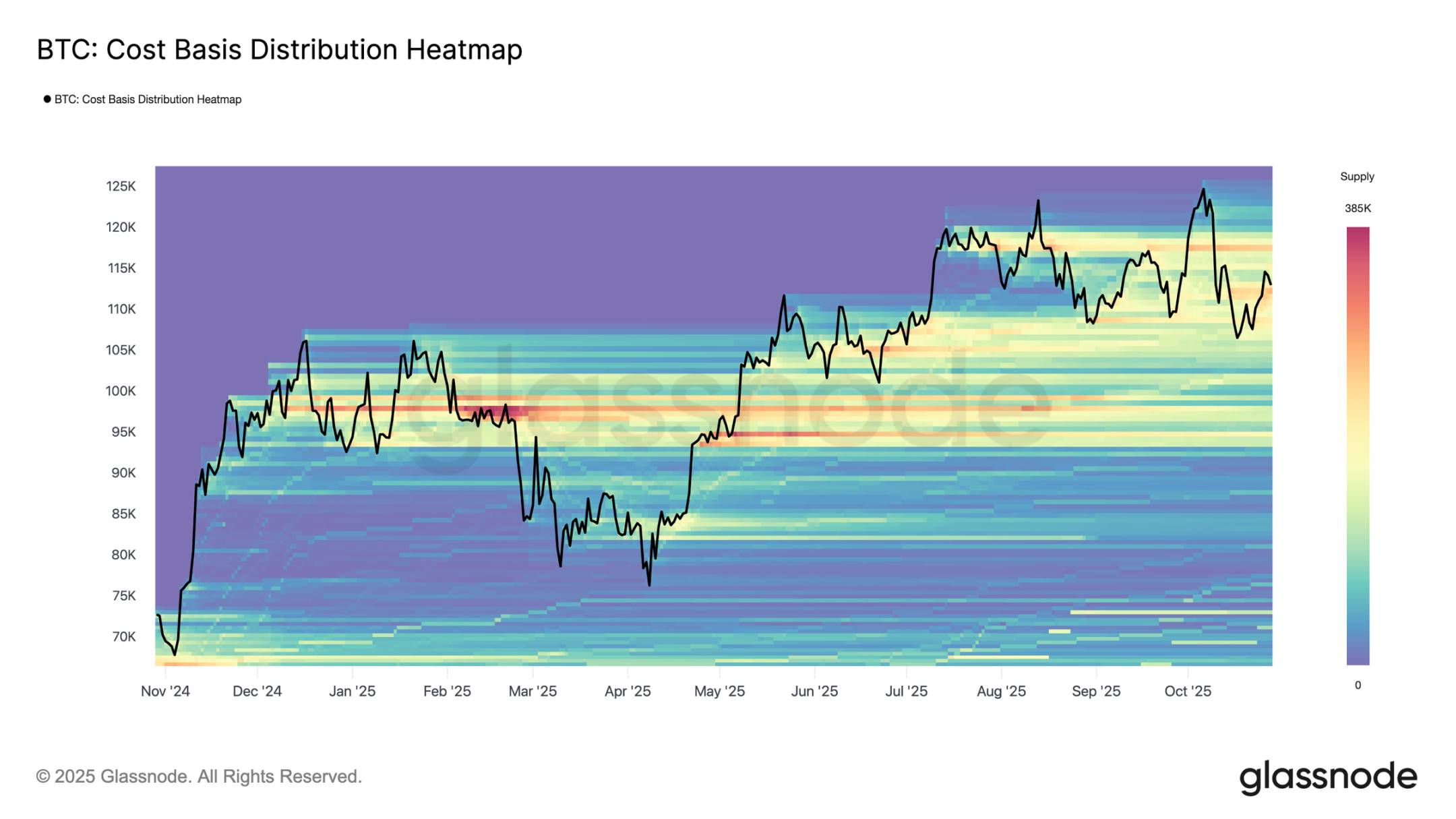

Bitcoin (BTC) traders are watching mid-November closely as multiple signals point to a potential local bottom near $100,000. The 50-day moving average is expected to cross below the 200-day SMA, forming a “death cross” that historically marks exhaustion, not major downturns.

Bitcoin is showing clear signs of weakness, and market confidence is being put to the test.

Solana’s stalled rally and plunging inflows point to fading investor confidence, with the altcoin now battling to defend $183 support after multiple failed breakout attempts.

In a new report, FTX founder Sam Bankman-Fried claims his exchange was solvent and blames its collapse on lawyers—not fraud—sparking backlash from investigators who accuse him of rewriting history.

Bitcoin's recent drop was a "textbook shakeout of weak hands," analysts say, noting long-term conviction is intact. Unrealized losses remain minor, suggesting the bull cycle structure holds.

- 04:04Spot SOL ETF saw a net inflow of 137 million USD last week, with BSOL leading at a net inflow of 127 million USD.Jinse Finance reported, according to SoSoValue data, during last week's trading days (Eastern US time, November 3 to November 7), the weekly net inflow of SOL spot ETFs reached $137 million. The SOL spot ETF with the highest weekly net inflow last week was Bitwise Solana Spot ETF BSOL, with a weekly net inflow of $127 million and a historical total net inflow of $324 million; followed by Grayscale Solana Spot ETF GSOL, with a weekly net inflow of $9.76 million and a historical total net inflow of $11.94 million. As of press time, the total net asset value of Bitcoin spot ETFs is $576 million, with the ETF net asset ratio (market value as a percentage of Bitcoin's total market value) at 0.64%, and the historical cumulative net inflow has reached $336 million.

- 03:58The US Senate has passed a procedural vote on the "plan to end the government shutdown."ChainCatcher reports that the U.S. Senate has officially passed a new continuing appropriations bill, which will fund the government until January 30 to end the government shutdown. All votes have been counted, with 60 in favor and 40 against.

- 03:53Data: Ethereum spot ETFs saw a net outflow of $508 million last week, the third highest in history.ChainCatcher news, according to SoSoValue data, the Ethereum spot ETF had a net outflow of $508 million in a single week. The Ethereum spot ETF with the highest weekly net inflow last week was Invesco ETF QETH, with a weekly net inflow of $2.59 million. The historical total net inflow of QETH has reached $23.9 million. The second was 21Shares ETF TETH, with a weekly net inflow of $519,000, and TETH's historical total net inflow has reached $18.76 million. The Ethereum spot ETF with the largest weekly net outflow last week was BlackRock ETF ETHA, with a weekly net outflow of $297 million. ETHA's historical total net inflow has reached $13.87 billion. The second was Fidelity ETF FETH, with a weekly net outflow of $109 million, and FETH's historical total net inflow has reached $2.58 billion. As of press time, the total net asset value of Ethereum spot ETFs is $22.66 billion, with the ETF net asset ratio (market value as a percentage of Ethereum's total market value) at 5.42%. The historical cumulative net inflow has reached $13.86 billion.