News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

In Brief Arthur Hayes rapidly ramps up altcoin purchases amid market optimism. His acquisitions include Ethereum, Pendle, Lido DAO, and Ether.fi. Market sentiment shifts to "greed" territory, aligning with Hayes’s strategic timing.

In Brief HBAR displays a sideways trend, declining 2% in 24 hours against market uptrends. Coinglass data shows $6.42 million outflows, indicating cautious investor sentiment. Technical indicators suggest continued weakening, with potential price pressure intensifying.

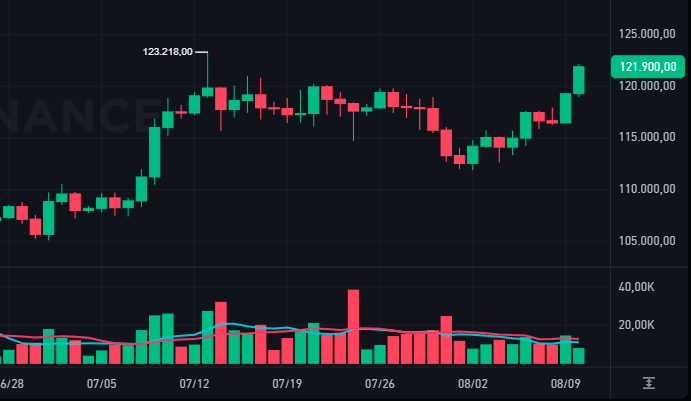

Whales have been accumulating Chainlink, Cardano, and PEPE in anticipation of the US CPI release, with LINK rising by 30%, ADA reaching a 14-day high, and PEPE seeing a 17% increase.

Global M2 money supply is climbing again, raising hopes for a potential Bitcoin price surge.Why M2 Matters for CryptoThe Road Ahead for BTC

Etherex sees a massive 503% TVL surge in 7 days, hitting $119.6M on Ethereum Layer 2 network Linea.What’s Driving the Surge?Implications for DeFi and Layer 2 Adoption

Large investors are scooping up millions in Chainlink, signaling rising confidence in LINK’s future.Millions Spent in Hours on LINKWhat This Means for the Market

- 22:58Robinhood has tokenized 500 US stocks and ETFs for EU users.Jinse Finance reported that Robinhood has tokenized 500 US stocks and ETFs on Arbitrum for EU users. According to Dune Analytics data, Robinhood has tokenized 493 assets with a total value exceeding $8.5 million. The cumulative minting volume has surpassed $19.3 million, but about $11.5 million in burn activities have offset this loss, indicating that the market is growing but trading remains active. Stocks account for nearly 70% of all deployed tokens, followed by exchange-traded funds (ETFs) at about 24%, while commodities, crypto ETFs, and US Treasury allocations are less significant.

- 22:58OpenSea CEO: We will not abandon NFTs, but rather expand into a universal on-chain trading hubJinse Finance reported that OpenSea CEO Devin Finzer denied claims that the company is abandoning non-fungible tokens (NFTs), stating that the marketplace is "evolving" into a universal platform for trading various on-chain assets. Finzer said: "We are building a universal interface for the entire on-chain economy—tokens, collectibles, culture, digital and physical." He added: "The goal is simple: as long as it exists on-chain, you should be able to trade it on OpenSea, seamlessly across any chain, while maintaining full control over your assets."

- 22:42Roman Storm asks the open-source software community: Are you worried about being prosecuted for developing DeFi platforms?Jinse Finance reported that Roman Storm, developer of the Tornado Cash privacy protocol, asked the open-source software community whether they are concerned about being prosecuted retroactively by the US Department of Justice for developing decentralized finance (DeFi) platforms. Storm asked DeFi developers: How can you be sure you won't be prosecuted by the Department of Justice for "MSB" (building non-custodial protocols), and then be accused of having to build custodial protocols instead? If SDNY can charge developers for building non-custodial protocols... then what safety is left?