- RENDER trades above $3.60 support, preserving its short-term bullish setup.

- Global crypto market cap surged from $1.73T to $2T since August 3.

- RSI and MACD readings suggest building upside momentum for RENDER.

RENDER is holding strong above the $3.60 mark as buyers step up their game, riding the wave of a broader market rebound.Eyes are on breakout targets that could set the stage for a sharper rally ahead.

RENDER Price Action Stabilizes After Wedge Breakout

According to chart data shared by Jonathan Carter, RENDER recently broke out from a falling wedge.The pattern which has persisted since December has kept the market capped for months, with repeated bounces off the $2.90 support zone. Each test produced sizable reactions, showing heavy buying interest at lower levels.

RENDER saw a peak at $4.80 , before the price slid sharply to under $3.40 in early August. Buyers stepped in near the lows, pushing RENDER back into a short-term uptrend. On the 4-hour chart, the token is trading at $3.835 inside an upward channel, with $3.60 acting as a strong support level.

Source: CryptoRank

Source: CryptoRank

Momentum indicators are shifting in favor of the bulls. MACD is now above the signal line,and the green histogram bars are expanding. RSI has climbed to 61.89, indicating strengthening momentum but still leaving room before overbought conditions.

The Stochastic RSI has also turned up from oversold territory, reinforcing the positive .A close above $3.90 could set the stage for more upward move.

Crypto Market Recovery Supports Sentiment

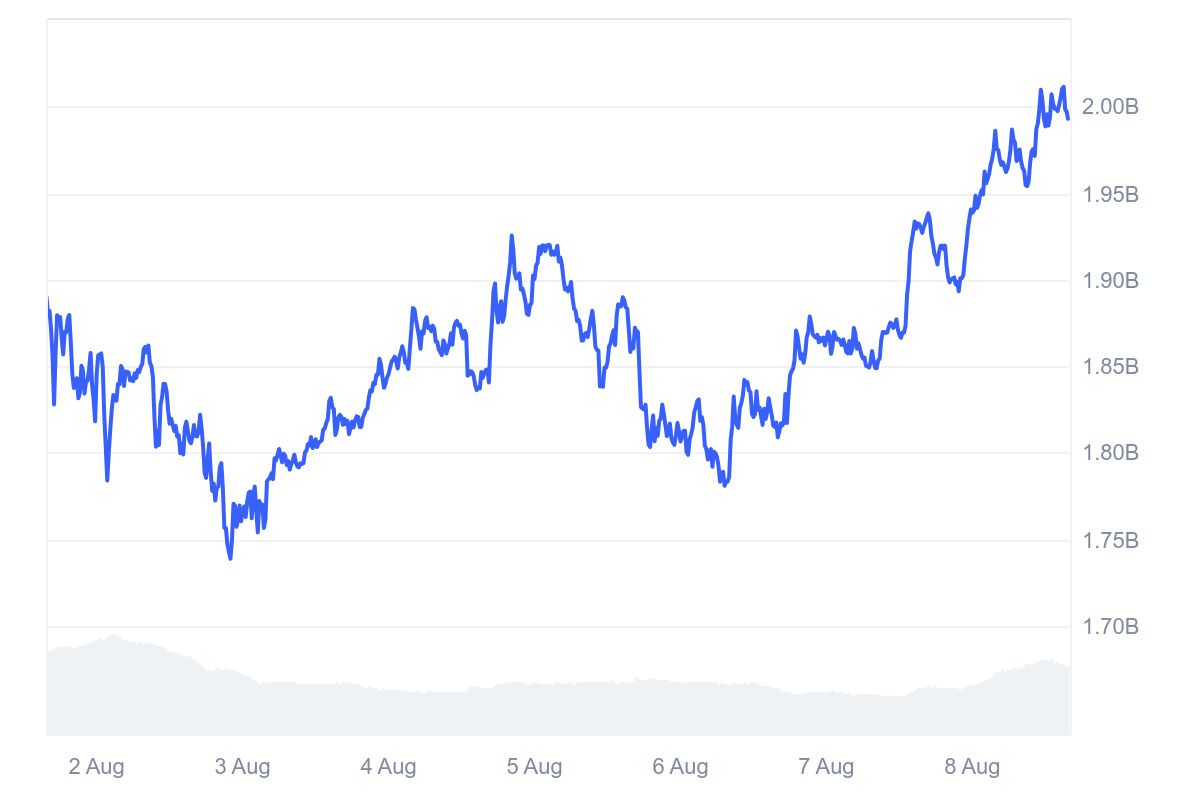

Aggregated data shows the total cryptocurrency market cap rising from $1.73 B on August 3 to just over $2 B by August 8. The rebound followed a sharp drop at the start of the month but unfolded in a consistent series of higher highs and higher lows.

Source: CoinMarketCap

Source: CoinMarketCap

The strongest rally occurred between August 7 and August 8, when the market broke above $1.90 B and pushed through the $2 B mark. Trading volume increased slightly during this push, signaling fresh capital moving into the market.

This wider recovery is adding momentum to coins like RENDER, as improving sentiment helps bulls defend key support and challenge higher resistance zones.Support sits at $3.60. A break below may open the way back to $3.20. Resistance is at $3.90, with a breakout targeting $4.20 next.

![[October 11 Insider Whale] Twelve consecutive wins harvest 12.6 million, profiting from both long and short positions and leading market followers](https://img.bgstatic.com/multiLang/image/social/41e5d1ea953744c460d0cf212fd2c61b1761294785118.png)