News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(Nov 29)|All Major U.S. Stock Indices Closed Lower; Next Year’s FOMC Voters Emphasize Inflation Risks and Oppose Further Rate Cuts; 72 out of Top 100 Tokens Down More Than 50% from All-Time Highs2Bitcoin’s Current Correction: At the End of the “Four-Year Cycle,” Government Shutdown Intensifies Liquidity Shock3Zcash Price Prediction 2025: Why ZEC Might Hit $360, Shedding 35% From ATH?

Four Stablecoins, Four Blockchains: Visa’s Big Step in Digital Payments

Cointribune·2025/10/30 22:24

Is Virtuals Protocol (VIRTUAL) Poised for a Bullish Rally? This Emerging Fractal Setup Saying Yes!

CoinsProbe·2025/10/30 22:24

Ondo Finance Partners with Chainlink to Strengthen Onchain Institutional Finance

CoinsProbe·2025/10/30 22:24

Aster (ASTER) Nearing Potential Bottom? This Key Emerging Fractal Suggests So!

CoinsProbe·2025/10/30 22:24

African payment giant Flutterwave taps Polygon blockchain for cross-border payments

Coinjournal·2025/10/30 22:09

Uphold relaunches XRP rewards debit card in the US with up to 10% back for users

Coinjournal·2025/10/30 22:09

Garden Finance exploit: over $5.5M stolen, 10% white hat bounty announced

Coinjournal·2025/10/30 22:09

Jiuzi Holdings taps SOLV Foundation for its $1B Bitcoin investment plan

Coinjournal·2025/10/30 22:09

Hedera Powers New Verifiable AI Agent Governance System for Governments and Enterprises

CryptoNewsFlash·2025/10/30 22:00

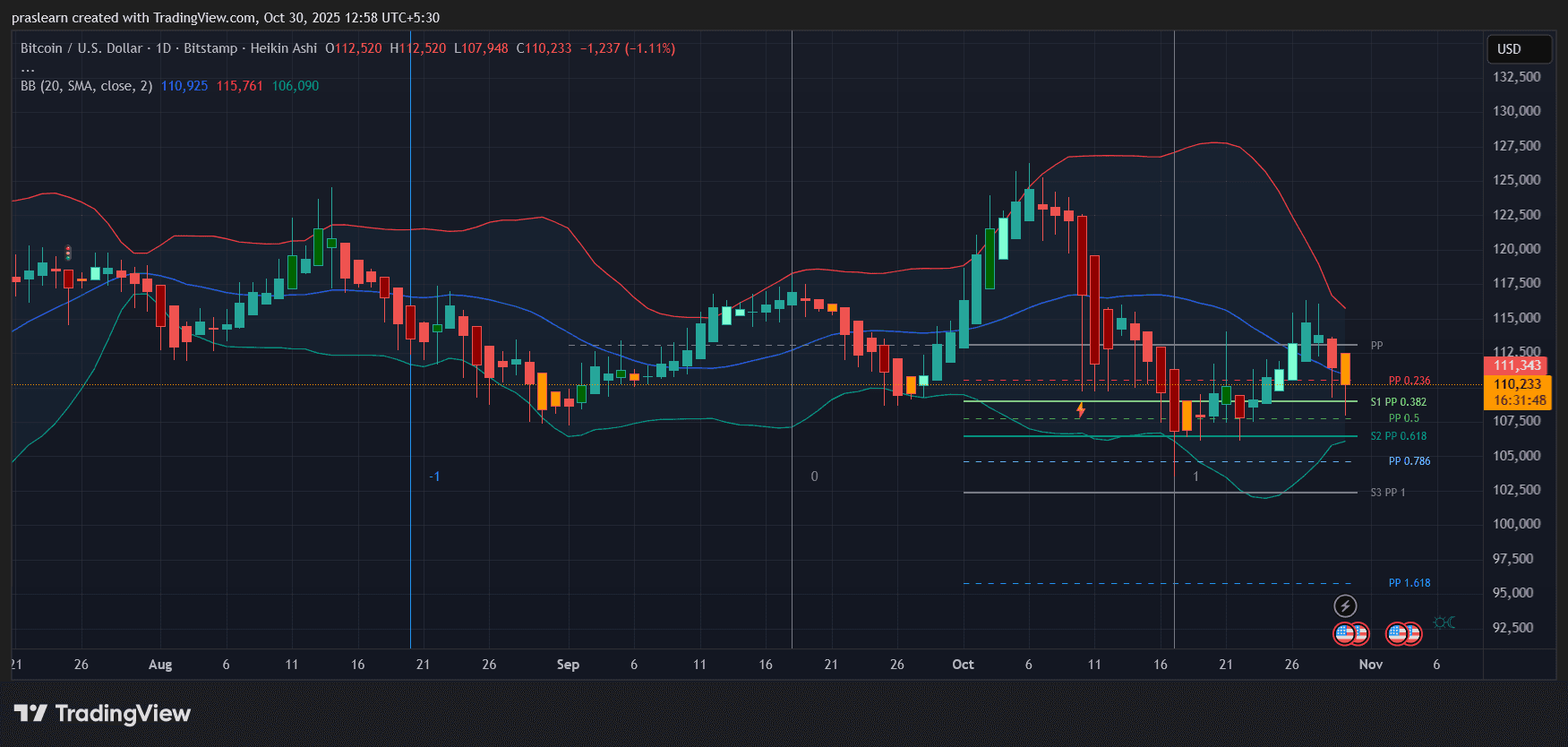

Will the Fed’s Rate Cut Spark a New Bitcoin Rally?

Cryptoticker·2025/10/30 21:54

Flash

- 02:03Data: Hyperliquid platform whales currently hold $5.263 billions in positions, with a long-short ratio of 0.84.ChainCatcher news, according to Coinglass data, the current whale positions on the Hyperliquid platform amount to $5.263 billions, with long positions at $2.402 billions, accounting for 45.63% of the total, and short positions at $2.862 billions, accounting for 54.37%. The profit and loss for long positions is -$73.6123 millions, while the profit and loss for short positions is $165 millions. Among them, the whale address 0x5b5d..60 is currently holding a 10x full-position short on ETH at the price of $3,527.7, with an unrealized profit and loss of $6.6114 millions.

- 01:52ABI senior official: Italian banks support the digital euro project but hope for phased investmentForesight News: According to Reuters, Marco Elio Rottigni, General Manager of the Italian Banking Association (ABI), stated at a press conference held in Florence that Italian banks support the European Central Bank's digital euro project because it embodies the concept of "digital sovereignty." However, they hope that the investments required for the implementation of this project can be carried out in phases, as the costs are very high. At the end of last month, the ECB's Governing Council decided to advance to the next phase of the digital euro project, stating that if timely approval is obtained from legislators, a pilot project for its digital currency could be launched in 2027, with an official rollout in 2029. However, according to the Financial Times, the plan has faced opposition from the German Banking Industry Committee (the largest banking lobby group in Germany) and conservative European Parliament member Fernando Navarrete. In a report released last week, Fernando Navarrete stated that the digital euro should not be used for payments between financial intermediaries, payment service providers, and other market participants (i.e., wholesale payments), as central bank money settlement systems already exist and the euro system is further exploring the use of different technologies to handle these payments.

- 01:35BTC OG whale holds 40,000 ETH long positions, currently facing over $2 million in unrealized losses, with a liquidation price of $2,533.69.ChainCatcher News, the address holding 40,000 ETH (approximately $135 million) has an unrealized loss of $2.05 million, with an entry price of $3,445.58 and a liquidation price of $2,533.69. Address: 0xb317D2BC2D3d2Df5Fa441B5bAE0AB9d8b07283ae. Previously, a high-profile BTC OG whale who switched to ETH transferred a large amount of funds from address (0x2eA) to an intermediary address (0x4f9) on October 10, and the latter injected funds multiple times into the trading address (0xb31). Shortly before the black swan event, the two related addresses (0x2eA) precisely opened a short position on ETH, and (0xb31) opened a short position on BTC, both subsequently making profits.