News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The Federal Reserve announced a 25 basis point rate cut and halted quantitative tightening (QT), but the market experienced short-term panic due to Powell's hawkish comments regarding uncertainty over a rate cut in December. Bitcoin and Ethereum prices declined. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still in the process of iterative improvement.

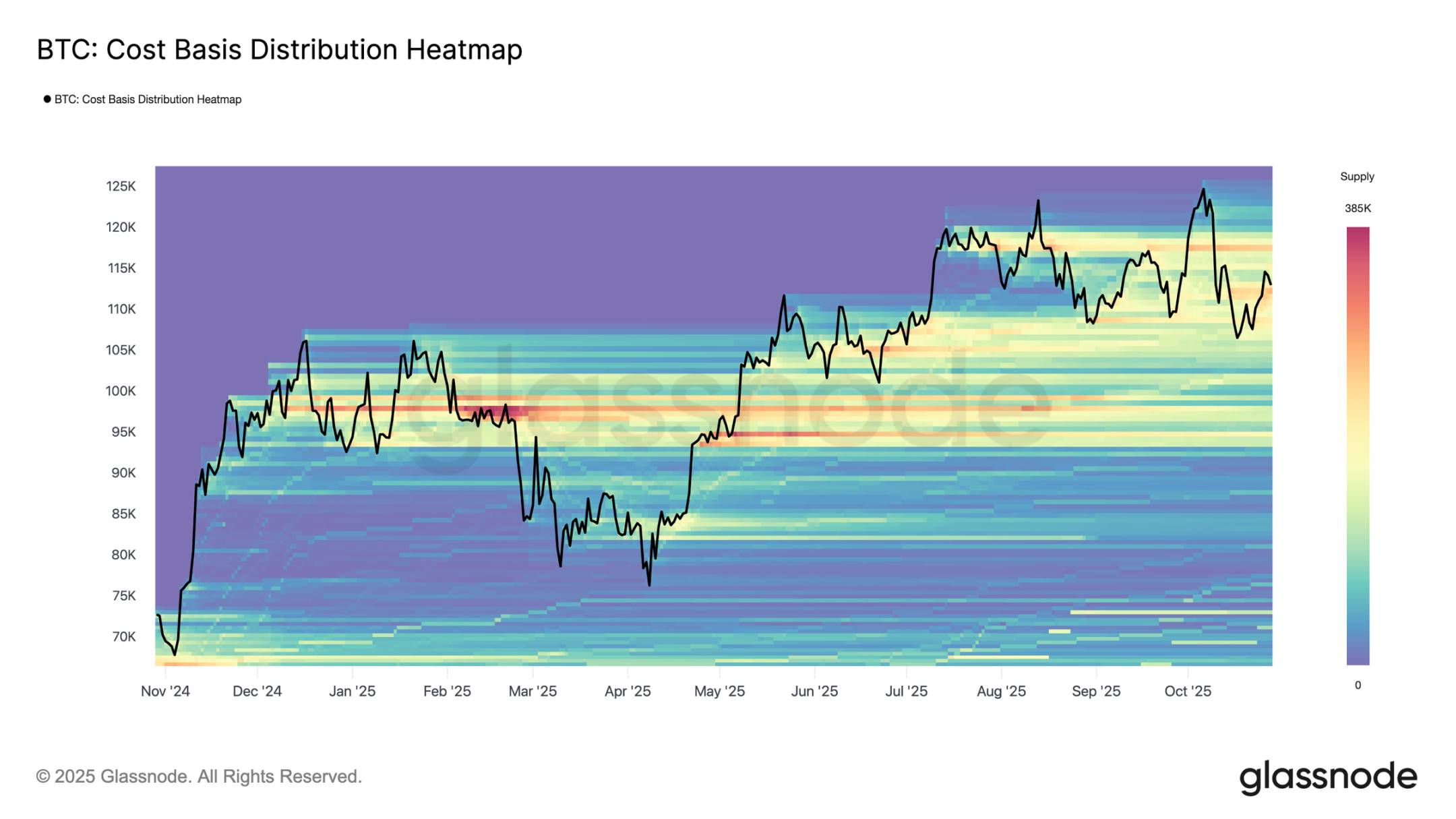

Bitcoin (BTC) traders are watching mid-November closely as multiple signals point to a potential local bottom near $100,000. The 50-day moving average is expected to cross below the 200-day SMA, forming a “death cross” that historically marks exhaustion, not major downturns.

Bitcoin is showing clear signs of weakness, and market confidence is being put to the test.

Solana’s stalled rally and plunging inflows point to fading investor confidence, with the altcoin now battling to defend $183 support after multiple failed breakout attempts.

In a new report, FTX founder Sam Bankman-Fried claims his exchange was solvent and blames its collapse on lawyers—not fraud—sparking backlash from investigators who accuse him of rewriting history.

Bitcoin's recent drop was a "textbook shakeout of weak hands," analysts say, noting long-term conviction is intact. Unrealized losses remain minor, suggesting the bull cycle structure holds.

- 06:56Eric Trump: Bitcoin will continue to soarNews on November 8, Eric Trump recently expressed strong optimism about bitcoin in an interview: "First of all, the biggest families want bitcoin, the largest private wealth funds want bitcoin. Fortune 500 companies are all valuing it. People are hoarding bitcoin. I mean, there are some major countries that are using all their excess energy to mine bitcoin. Guys, I don't know how many more times I can tell you, I think it's gonna continue to soar. I think it's gonna do really well, and I am all in. (I think it's gonna continue to rip. I think it's gonna do really well, and I am all in.)"

- 06:43On-chain Whale Movements Overview: ZEC Long-Short Divergence Widens, "1011 Insider Whale" and Several Whales Increase Long Positions in EthereumBlockBeats News, November 8, according to monitoring data from Hyperinsight, Ember, and on-chain analyst Ai Aunt (@ai_9684xtpa), here is an overview of last night and this morning’s trending and active whale movements on-chain: As ZEC continues to surge, the divergence between long and short positions among on-chain contract whales is widening. The largest ZEC short position on Hyperliquid continues to increase its margin to avoid liquidation. Meanwhile, the largest ZEC position on Hyperliquid is rolling over its profits and currently holds a long position of 55,000 ZEC ($33.89 million). On the other hand, the “1011 Insider Whale” has just closed its bitcoin long position and simultaneously increased its ethereum long position by 5 times to 40,000 ETH. “Maji” continued to increase its ETH long position last night and this morning. As of press time, its 25x leveraged ETH long position amounts to $10.32 million. It is worth noting that in the past 12 hours, a new wallet withdrew 2.5 million TRUMP (worth $18.85 million) from a certain exchange, instantly becoming the largest TRUMP holding wallet (excluding project-locked contracts, liquidity pools, and CEX addresses). The related token price may see volatility opportunities.

- 06:43Hyperliquid has launched ICP perpetual contractsBlockBeats News, November 8, according to the official page, Hyperliquid has launched ICP perpetual contracts, supporting up to 5x leverage.