News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

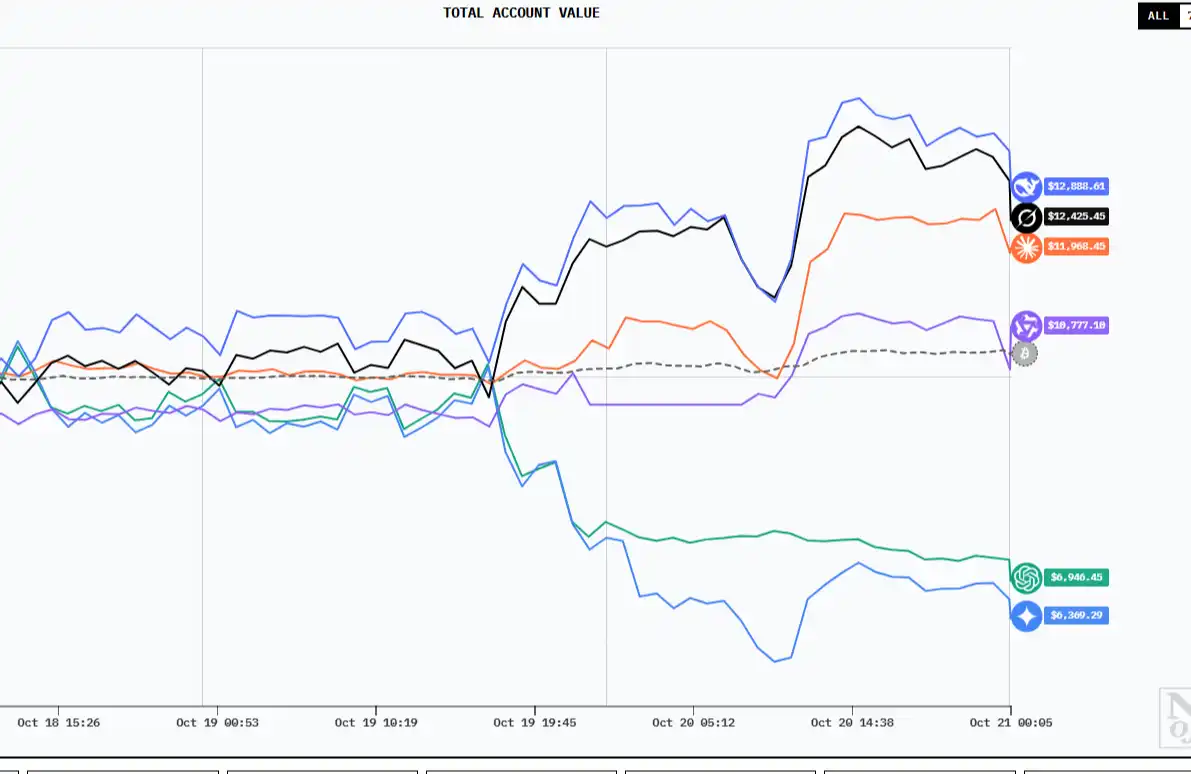

AI is shifting from being a "research tool" to becoming a "frontline trader." So, how do they think?

Stablecoins, acting as "narrow banks," are quietly absorbing liquidity and reshaping the global financial architecture.

This time, there are more super political action committees, and some have taken clearer stances in aligning with Republican candidates.

Binance has teamed up with BNB Chain to support its top "flagship project."

Although the Solana ETF has been launched, network revenue trends are declining. Jito is at the intersection of new capital inflows and microstructure improvements.

Stablecoins Reshape Global Financial Architecture by Embracing a “Narrow Banking” Model to Absorb Liquidity

Solana provides Base with a $500 million annual "implicit subsidy," yet few people are aware of it.

This time, there are more Super PACs, some of which have taken a more explicit stance aligning with Republican candidates.

- 10:22A certain whale deposited 5,000 ETH into an exchange, with a potential profit of approximately $14.43 million.Foresight News reported, according to monitoring by The Data Nerd, a whale (address starting with 0x742) deposited 5,000 ETH, worth approximately $19.91 million, to an exchange 9 hours ago. Six months ago, this whale purchased these ETH at an average price of about $1,582, with an estimated profit of around $14.43 million (return on investment of 152%). In addition, looking back three years ago, the whale accumulated 8,240 ETH at an average price of about $1,195, and sold them last year at a price of approximately $2,954.

- 10:21ETH Dencun upgrade will go live on the mainnet on December 3rdForesight News reported, according to Solid Intel, the Ethereum Dencun upgrade has now been launched on the final testnet, Hoodi. This upgrade is scheduled to be deployed on the mainnet on December 3.

- 10:11Jack Yi: Large funds are unlikely to flow into crypto in the short term, so for now we choose to take a break.ChainCatcher reported that Jack Yi, founder of LD Capital, posted on X, stating that the current market is in a deep correction trend, while AI and gold remain hot topics. Large funds are unlikely to flow into crypto in the short term, resulting in most DATs being below 1 and a continued loss of fundraising capability.“Therefore, we have chosen to take a break for now. Of course, the market is constantly changing, and everyone should make their own judgments based on their understanding and the trends. However, we choose to wait for a confirmed bottom before reinvesting.”