Bitget Daily Report (October 29)|Fed to Announce Rate Decision; Market Expects 25bp Cut; Visa Adds Multi-Chain Stablecoin Payments; Western Union to Launch Stablecoin on Solana

Today's Outlook

- The U.S. Federal Reserve will announce its interest rate decision at 02:00 on October 30, 2025, followed by a press conference at 02:30. Markets are closely watching the subsequent policy direction.

- The 15th Blockchain Life International Web3 & Cryptocurrency Forum concludes today, October 29, 2025, in Dubai, UAE, bringing together global leaders and investors in the blockchain industry.

- Visa announced support for four stablecoins across four blockchains, enabling exchange with over 25 fiat currencies and fostering a multi-chain integrated payments network.

Macro & Hot Topics

- The Fed will announce a new rate decision on October 29. Markets widely anticipate a 25bps rate cut to 4%. The potential end of quantitative tightening (QT) could impact risk appetite across crypto markets.

- Mike Selig, Chief Legal Advisor of the US SEC Cryptocurrency Working Group, has been nominated by the White House as Chairman of the CFTC. If appointed, this could reshape US crypto regulatory powers.

- Western Union has announced plans to issue a stablecoin on the Solana blockchain in 2026 in partnership with Anchorage, along with a digital asset wallet service provider network.

- CZ (Changpeng Zhao) is considering suing US Senator Elizabeth Warren for defamation. Warren accused him of being “convicted for money laundering”, while CZ was found in violation of the Bank Secrecy Act but not convicted of money laundering. CZ’s lawyers state they will proceed with legal action if no retraction is made.

Market Updates

- BTC and ETH are showing short-term consolidation amid cautious market sentiment. In the past 24 hours, total liquidations were about $523 million, with $367 million from longs and $156 million from shorts.

- All three major US stock indices closed higher: Dow Jones up 0.34%, Nasdaq up 0.80%, and S&P 500 up 0.23%.

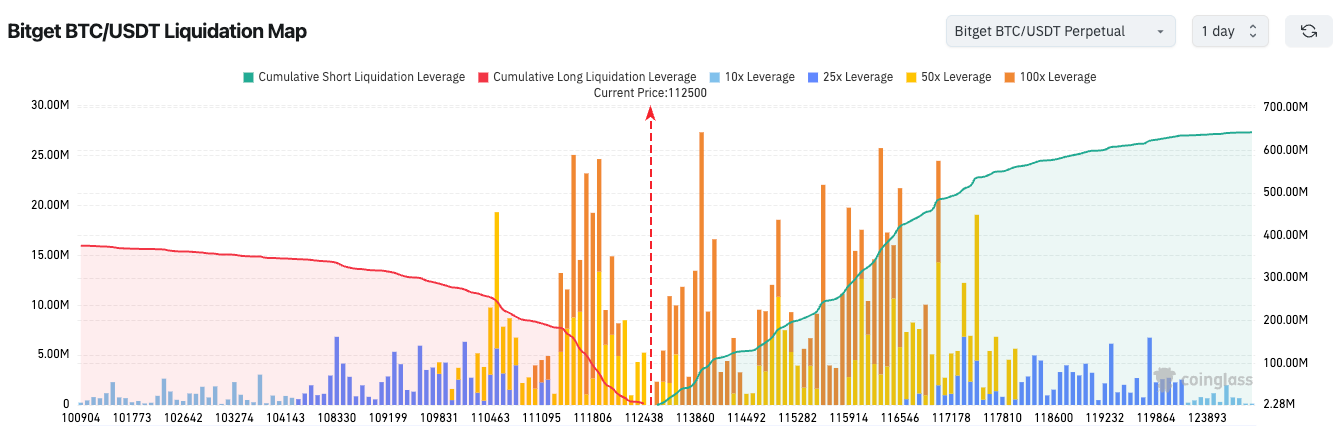

3.The Bitget BTC/USDT liquidation map shows the current BTC price at 112,518 USDT. Heavy leveraged long positions are concentrated above 113,000. A breakout may accelerate upward momentum, while failure could increase short-term risks.

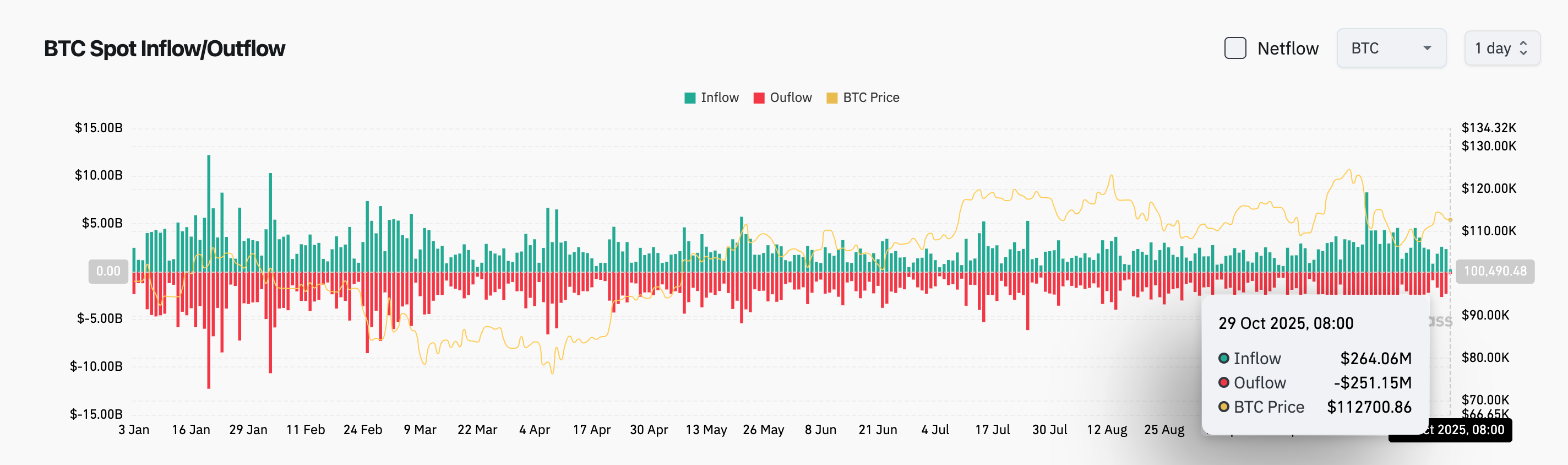

4.In the last 24 hours, BTC spot inflows totalled $264 million, outflows $251 million, making for a net inflow of $13 million.

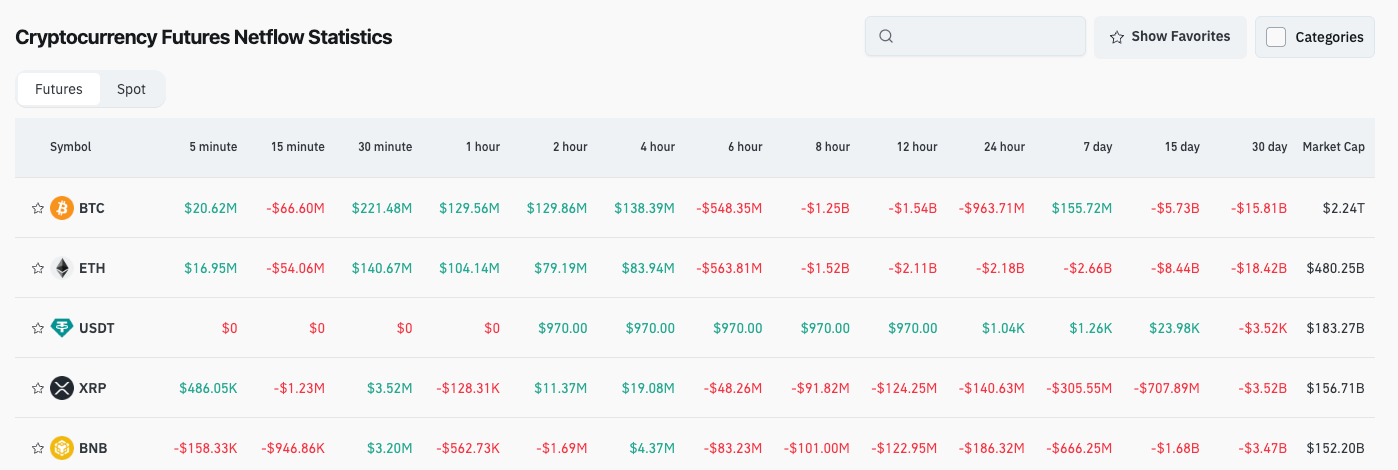

5.Over the past 24 hours, major contract tokens including BTC, ETH, USDT, XRP, and BNB saw net outflows, suggesting potential trading opportunities.

News Updates

- With the Fed’s interest rate decision approaching, institutions and treasuries continue to add BTC and ETH. Single-day ETF net inflows reached 1,251.93 BTC and 41,200 ETH, reflecting strong institutional demand.

- Leading DeFi protocols have announced integration of multi-chain liquidity aggregation, supporting Ethereum, Arbitrum, Optimism, and others, to enable efficient cross-chain asset management and liquidity.

- According to a CoinDesk Research report, 65% of institutional investors have started or are exploring investment in on-chain real world assets (RWAs), with the market expected to reach $5 trillion by 2030.

Project Updates

- Ethereum: Fusaka upgrade has completed deployment on the Hoodi testnet.

- Bitget Wallet: Officially integrated HyperEVM, fully connecting with Hyperliquid’s $5 billion on-chain ecosystem.

- Bitget: Launched Common (COMMON) Launchpool event and spot trading pair.

- Bitget: Partnered with Doppler Finance to release an XRP yield solution.

- MegaETH: Layer-2 ICO oversubscribed with $360.8 million raised and over 100,000 KYC completions.

- Grayscale: Solana Trust ETF set to officially list on October 29.

- Bitwise: Solana Staking ETF (BSOL) has listed on the NYSE with $223 million in first-day AUM.

- Strive: Added 72 BTC on October 28, increasing total holdings to 5,958 BTC.

- Major unlock events for SUI, GRASS, EIGEN and others this week, with cumulative released value over $653 million; market watching impact of token unlocks.

Disclaimer: This report was generated by AI and human-verified for accuracy. It is not intended as investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TWINT wants to open platform for stablecoins and tokenized deposits

Regulated crypto yield wins as institutions demand substance

Four XRP price charts that are predicting a rally toward $3

Bitcoin slips at $113K as S&P 500 hits new all-time high into Fed rate move