News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Curve Finance has evolved from a stablecoin trading platform into a cornerstone of DeFi liquidity through its StableSwap AMM model, veTokenomics, and strong community resilience, demonstrating a sustainable development path. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still in the process of iterative improvement.

The US crypto regulatory framework is undergoing a redistribution of authority, with clear divisions of responsibility between the CFTC and SEC: the SEC focuses on securities, while the CFTC is responsible for the spot market of digital commodities. The advancement of new bills and the arrangement of hearings indicate that the regulatory boundaries have been formally clarified in official documents for the first time. Summary generated by Mars AI. This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

A Ukrainian drone attack has caused the suspension of oil exports at Russia's Novorossiysk port, interrupting a daily supply of 2.2 million barrels. As a result, international oil prices surged by over 2%.

The twilight of financialization: when debt cycles can only create nominal growth.

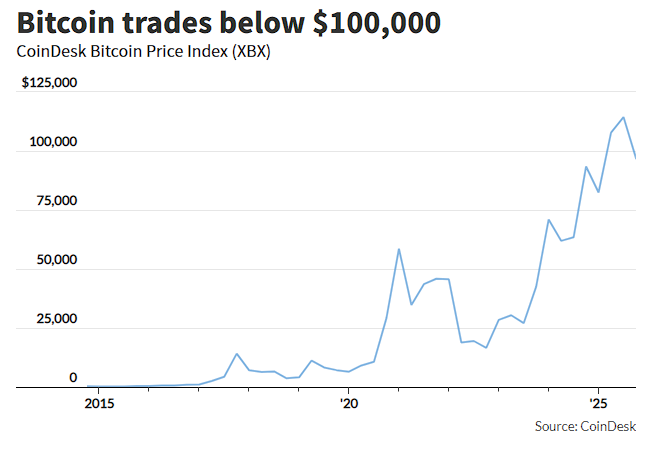

Compared with the capital inflows into tech stocks and gold's sharp rebound after a plunge, bitcoin was a clear exception in Friday's market: it defied the trend by dropping 5%, hitting a six-month low, and has now declined for three consecutive weeks. This contrast highlights the unusual situation in the bitcoin market: even as it maintains a high correlation of 0.8 with the Nasdaq 100 Index, bitcoin exhibits an asymmetric pattern of "falling more on declines and rising less on rallies." Meanwhile, intensified whale sell-offs and concentrated selling by long-term holders are jointly suppressing bitcoin.

- 21:48Michael Saylor: Will announce his next round of Bitcoin purchase plans on Monday morningJinse Finance reported that Michael Saylor stated Strategy will announce its next round of Bitcoin purchases on Monday morning, and said, "People will be surprised." He also added, "We have been accelerating the pace of acquisitions."

- 21:27Tether considers investing $1.2 billion in German robotics company Neura RoboticsJinse Finance reported that the company behind Tether is considering its largest investment to date: investing $1.16 billion in Neura Robotics, a rapidly growing German robotics company. Neura Robotics is dedicated to developing humanoid robots. According to sources cited by the Financial Times, the two parties are in negotiations, and the potential deal would value Neura between $9.29 billion and $11.6 billion.

- 20:33SEC Chairman: A "token taxonomy" will be developed based on the Howey investment contract securities analysisJinse Finance reported that Paul Atkins, Chairman of the U.S. Securities and Exchange Commission, stated that the agency will soon consider formulating a formal "token taxonomy," which will be based on the long-standing Howey investment contract securities analysis. The Howey Test originated from a 1946 case in which people purchased a Florida orange grove, expecting to profit from the labor of the growers. It defines a security as an investment of funds in a common enterprise with profits to be derived from the efforts of others.

Trending news

More[Bitpush Daily News Selection] Financial Times: Tether is considering leading a funding round of approximately $1.16 billion for German tech startup Neura Robotics; the US SEC has issued post-shutdown document processing guidance, and multiple crypto ETFs may be expedited; US Bureau of Labor Statistics: September 2025 employment data will be released on November 20, and October state employment and unemployment data will be released on November 21.

Blockchain Betting's Legal Challenge: Is It Considered Gambling or a Derivative?

![[Bitpush Daily News Selection] Financial Times: Tether is considering leading a funding round of approximately $1.16 billion for German tech startup Neura Robotics; the US SEC has issued post-shutdown document processing guidance, and multiple crypto ETFs may be expedited; US Bureau of Labor Statistics: September 2025 employment data will be released on November 20, and October state employment and unemployment data will be released on November 21.](https://img.bgstatic.com/multiLang/image/social/06829a455cc5ced5cafaf4b9bf53d5281763243641786.png)