Bitget Daily Digest (Nov 14)|Czech Central Bank Becomes First to Buy Bitcoin; White House Warns of 1.5% Q4 GDP Hit; Monad Mainnet and MON Token Launch Set for Nov 24

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

YFI Gains 0.38% Over 24 Hours Despite Year-Long Downtrend

- YFI rose 0.38% in 24 hours to $4768, contrasting a 40.84% annual decline and 5.56% weekly drop. - Analysts highlight need for improved utility/adoption to reverse long-term bearish trends despite short-term resilience. - Technical indicators show no strong reversal patterns, with bearish pressure dominating despite 1-month 0.45% recovery. - Mixed performance reflects complex market dynamics between temporary buying interest and structural bear market challenges.

Bitcoin News Update: Hyperliquid's BTC Short Balances on Edge: $17 Million Profit Nears as $111,000 Liquidation Threatens

- Hyperliquid's largest BTC short holds $17M unrealized gains, risking liquidation above $111,770 amid volatile $106K price. - 20x leveraged position shows 4.86% profit from $111K entry, with 55% of platform's $5.3B total positions in shorts. - $30M POPCAT manipulation incident exposed liquidity risks, causing $63M liquidations and $4.9M HLP losses. - BTC faces bearish pressure below $101K despite 15/1 technical buy signals, as ETF inflows revive institutional demand.

Bitcoin News Today: Bitcoin’s Recent Decline Ignites Discussion: Is This a Temporary Correction or the Start of a Larger Downtrend?

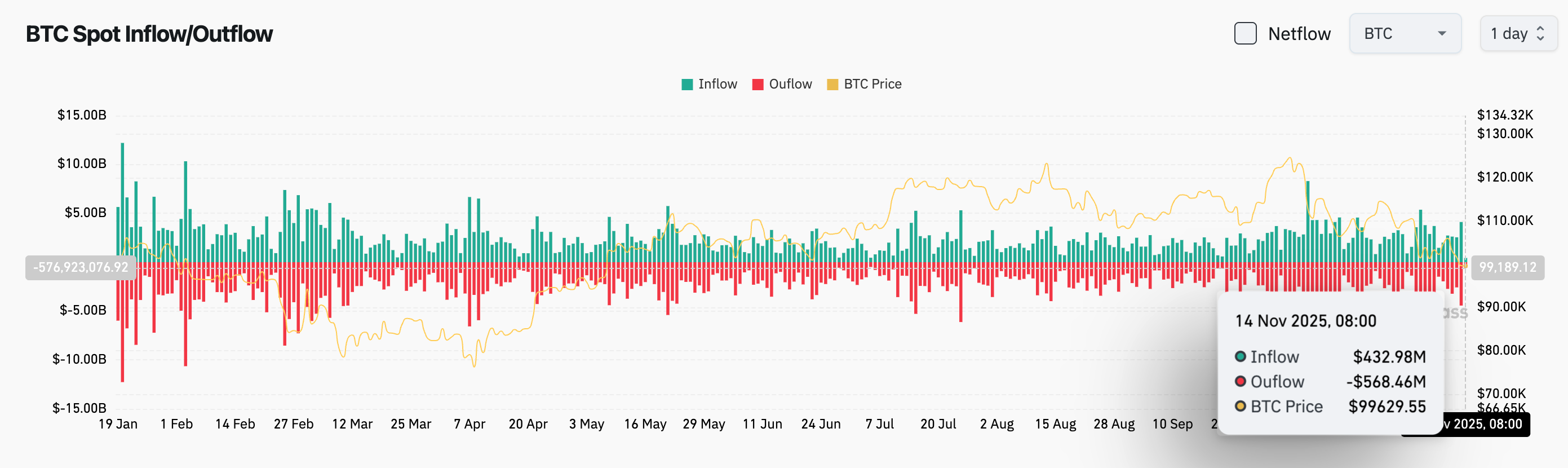

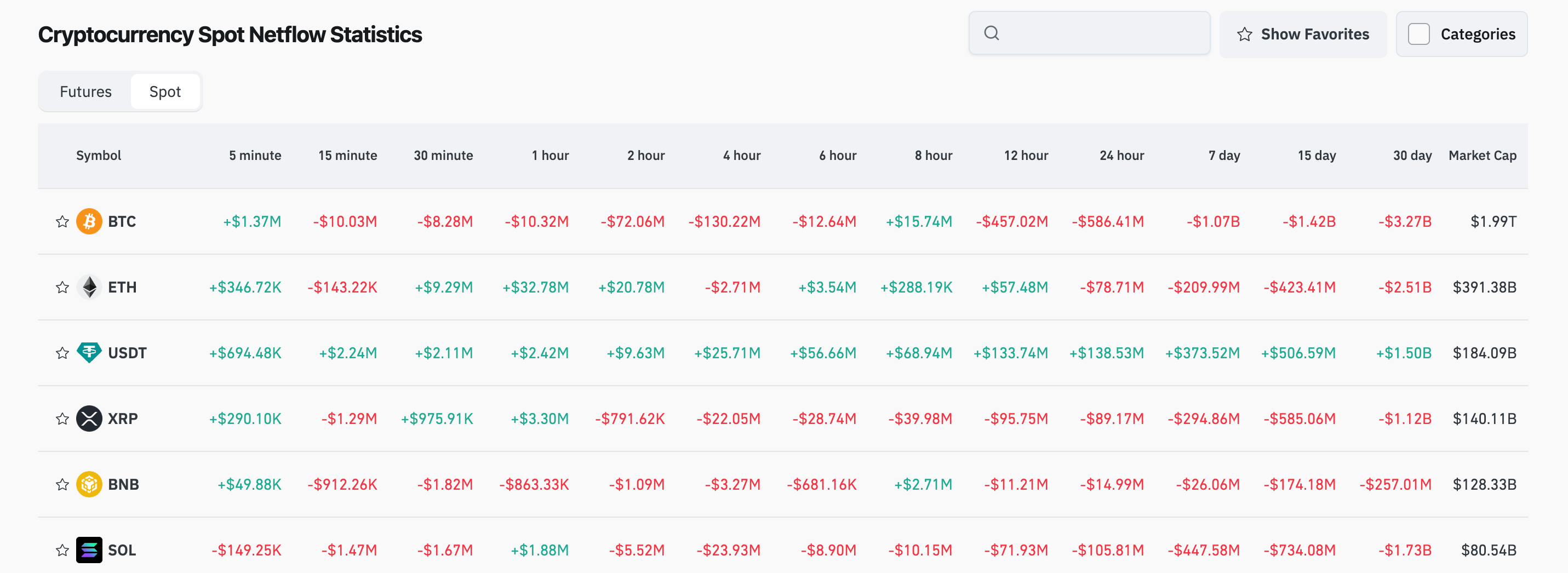

- Bitcoin long-term holders offloaded 815,000 BTC in 30 days, pushing price below $100,000 and triggering $683M liquidations. - Analysts link the selling to profit-taking after prolonged rallies, with open interest dropping 27% to $68.37B as demand remains subdued. - Market debates whether this marks a mid-cycle correction (22% average drawdowns historically) or a broader bearish shift. - Despite volatility, 72% of BTC supply remains in profit, and DeFi TVL exceeding $1T signals potential long-term resilie

Bitcoin Updates: Metaplanet Increases Its Bitcoin Assets While Competitors Shift Focus from Mining

- Metaplanet boosted Bitcoin holdings via $100M credit and 75B yen buybacks, now holding 30,823 BTC ($3.5B) to drive capital strategy. - Q3 revenue surged 115.7% to ¥2.438B as peers like TeraWulf shift from mining to HPC amid declining crypto profitability. - Japan's JPX considers stricter crypto treasury rules after Metaplanet lost 82% of peak value since May amid market volatility. - BitMine Immersion accelerated Ethereum accumulation to 110,288 ETH ($12.5B) while Hyperscale Data targets 100% Bitcoin/mar