News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 13)|SEC Proposes "Token Taxonomy"; US House Passes Bill to End Government Shutdown; Trump Signs Temporary Funding Bill at 10:45am (UTC+8) 2Bitcoin’s 4-year cycle is broken, and this time, data proves it3Price predictions 11/12: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, HYPE, LINK, BCH

Hedera integrates ERC-3643 standard to enhance asset tokenization compliance capabilities

PANews·2025/11/13 11:02

Rethinking Sideways Trading: Major Cryptocurrencies Are Undergoing a Massive Whale Shakeout

Ignas also pays special attention to lending protocols that generate fees.

Chaincatcher·2025/11/13 10:11

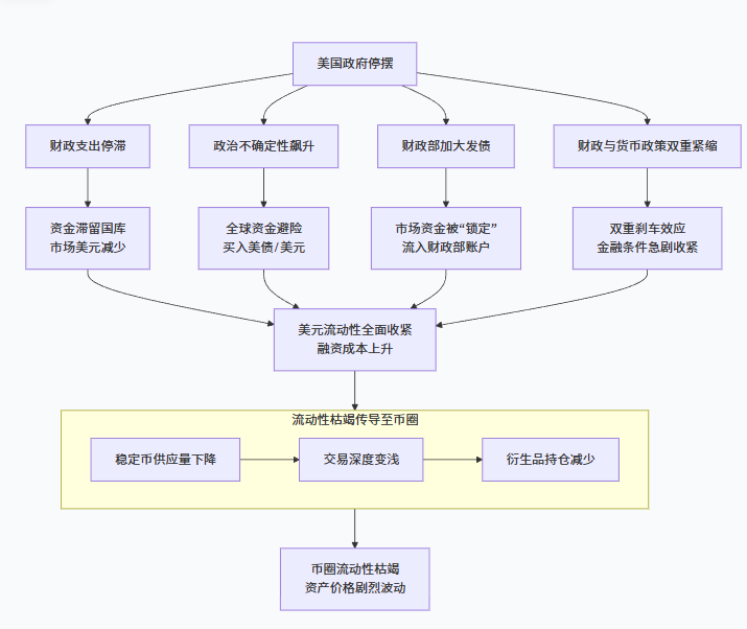

How could a U.S. government shutdown strangle crypto market liquidity?

AICoin·2025/11/13 10:06

Unexpected Change! The Independence of the Federal Reserve Faces Unprecedented Challenge

AICoin·2025/11/13 10:06

Morning News | Lighter 24-hour trading volume surpasses $11 billion; Circle Q3 financial report released; Strategy U.S. stock market value falls below its BTC holdings value

Overview of important market events on November 12.

Chaincatcher·2025/11/13 06:24

Latest Speech by US SEC Chairman: Farewell to a Decade of Chaos, Crypto Regulation Enters an Era of Clarity

The US SEC Chairman further elaborated on the "Project Crypto" initiative, outlining new boundaries for token classification and regulation.

BlockBeats·2025/11/13 05:42

Circle Q3 report released: Is there a bigger game ahead?

What are the highlights of Circle's Q3 financial report, the first listed stablecoin company?

ForesightNews 速递·2025/11/13 05:03

Exodus' Q3 net profit increased more than 20 times, with Bitcoin revenue accounting for over 60%.

Cointime·2025/11/13 04:51

Flash

- 11:26Analyst: Whales are accelerating Bitcoin accumulation due to favorable macroeconomic factorsAccording to ChainCatcher, while the overall crypto market has been moving sideways this week, Bitcoin has been trapped in a narrow range of fluctuations. However, analysts point out that beneath the calm surface, there is large-scale accumulation of positions taking place. Meanwhile, after experiencing the largest single-day net inflow in a month, Bitcoin spot ETFs have once again seen a wave of redemptions. On Wednesday, Bitcoin spot ETFs saw outflows of about $278 million, while Ethereum spot ETFs saw outflows of about $184 million. In contrast, Solana spot ETFs recorded a net inflow of $18.06 million. Timothy Misir, Head of Research at BRN, stated: "Whales continue to accumulate, with more than 45,000 Bitcoins added this week, marking the second-largest accumulation since 2025." At current prices, this equates to approximately $4.6 billion in capital inflows. He added that this indicates that structural positions are gradually being established despite weak capital flows and sluggish market momentum. Blockchain data shows that these purchases are mostly accompanied by increased withdrawals from trading platforms to cold storage accounts, suggesting institutional positioning rather than retail speculation. After the U.S. government officially reopened this week—ending a 41-day shutdown following the House of Representatives' passage of a long-delayed spending bill—about $40 billion in delayed liquidity was released. This has restored a certain level of confidence in global markets, supporting what Misir described as "cautious optimism regarding the improved macro environment and risk sentiment."

- 11:26Vanguard Group discloses purchase of 6 million shares of NakamotoAccording to ChainCatcher, monitored by Bitcoin Treasuries.NET, Vanguard Group, which manages $11 trillion in assets, has disclosed its purchase of 6 million shares in the Bitcoin treasury company Nakamoto (NAKA). Vanguard Group still does not offer Bitcoin to its clients.

- 11:26Bitdeer to raise $400 million through convertible senior notes offeringJinse Finance reported that Nasdaq-listed bitcoin mining company Bitdeer announced it will raise $400 million through the issuance of convertible senior notes. The company also plans to grant the initial purchasers of the notes an option to purchase up to an additional $60 million of notes within 13 days from the initial issuance date, which means the company's total fundraising could reach up to $460 million. The new funds are intended for data center expansion, ASIC miner research and development, AI and HPC cloud business expansion, as well as general corporate purposes.