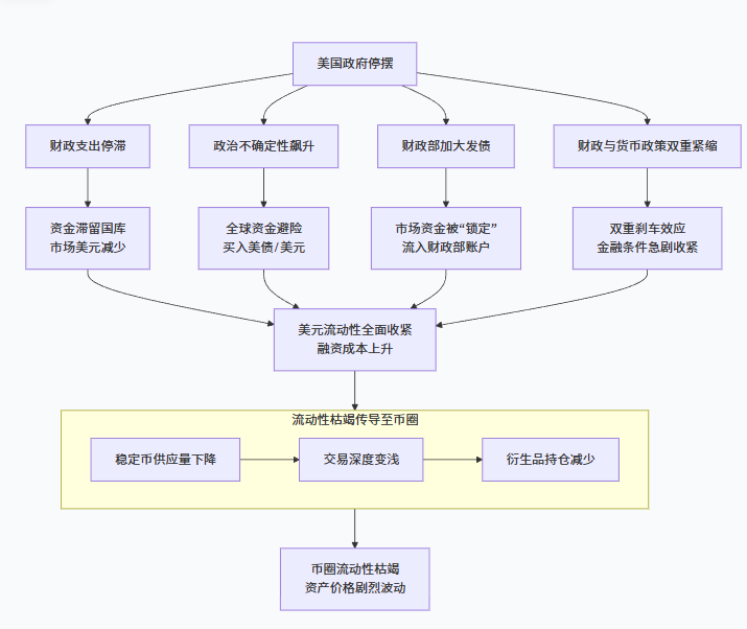

The financial storm triggered by Washington's political deadlock is being transmitted through two clear channels, delivering a chill directly to every investor's account in the crypto market.

On November 13, East 8th District time, the 41-day-long U.S. federal government shutdown crisis was about to come to an end, as the Senate passed a compromise plan. This record-breaking shutdown not only affected millions of federal employees and government services, but also, through intricate financial chains, had a significant impact on the global cryptocurrency market.

During the shutdown, the U.S. Treasury General Account (TGA) balance soared from about $300 billion to over $1 trillion, draining massive liquidity from the market. Meanwhile, the combination of an economic data black hole and policy uncertainty led to a sharp decline in global investors' risk appetite.

I. Root Cause of the Shutdown: The Vicious Cycle of Political Game and Governance Failure

This round of the U.S. federal government shutdown began on October 1, 2025, with the direct trigger being the severe disagreement between the Democratic and Republican parties over subsidies related to the Affordable Care Act.

● This shutdown exposed deep-rooted problems in the U.S. political system. The Democrats demanded that the issue of healthcare subsidies be settled first, while the Republicans insisted on ending the shutdown before discussing healthcare, with both sides refusing to compromise.

● Temporary funding bills have evolved from "stopgap measures" to "routine operations". The Senate's "filibuster" procedure makes it extremely difficult to pass bills, as it allows senators to delay or block a vote on a particular bill by extending debate.

● During the shutdown, White House National Economic Council Director Hassett warned that if the shutdown continued, fourth-quarter GDP could turn negative. Treasury Secretary Besant also admitted that the impact of the shutdown on the economy was becoming "increasingly worse".

II. Transmission Chain One: Precision Strike of Liquidity Squeeze

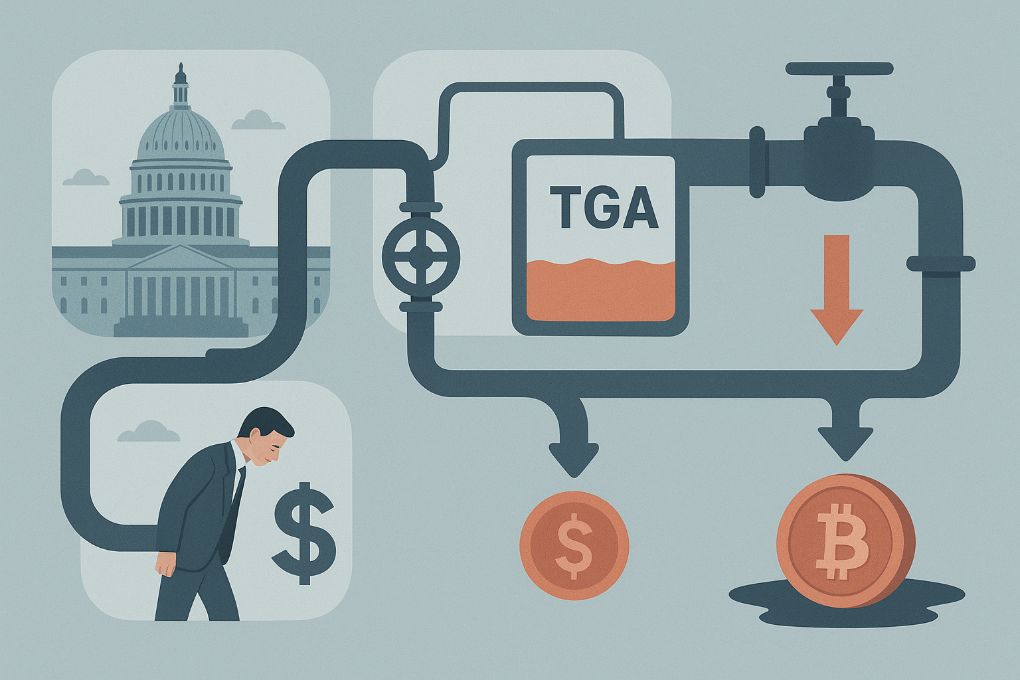

This chain describes the physical-level draining of funds, centered on the U.S. Treasury's TGA account at the Federal Reserve. The whole process is like a sophisticated financial pipeline system, siphoning liquidity from the market.

● Government shutdown → Fiscal cycle interruption → TGA balance surge → Dollar liquidity tightening → Higher financing costs for market makers → Crypto market liquidity dries up

Fiscal Cycle Interrupted, TGA Becomes a "Financial Black Hole"

● Under normal circumstances, the U.S. Treasury's fund cycle maintains a dynamic balance: funds are deposited into the TGA account through taxes and bond issuance, and then injected into the market through fiscal spending, forming a healthy liquidity cycle.

● The shutdown completely broke this balance. According to Treasury data, U.S. fiscal revenue in September rose to $543.663 billion, while spending plummeted to $345.713 billion due to the government shutdown.

● The TGA account continued to absorb funds through taxes and bond issuance, while fiscal spending stalled, creating a massive "inflow-only" liquidity situation. This caused the TGA balance to surge from about $300 billion to over $1 trillion, effectively draining more than $700 billion in cash from the market.

Dollar Liquidity Tightens, Financing Costs Soar

● The "black hole effect" of the TGA directly triggered a dollar liquidity crisis within the financial system. The key benchmark for measuring interbank dollar financing costs—the Secured Overnight Financing Rate (SOFR) surged by 22 basis points on October 31, far above the Federal Reserve's target range.

● At the same time, commercial banks' use of the Fed's standing repo facility also increased significantly, approaching historical highs. This clearly indicates a severe "dollar shortage" in the banking system, with short-term financing costs spiking sharply.

● Federal Reserve officials have privately admitted that the tightening effect of the TGA surge is equivalent to several rate hikes, completely offsetting the Fed's previous efforts to maintain market liquidity.

Pressure Reaches the Heart of the Crypto World

The liquidity crunch in traditional financial markets directly affects the cryptocurrency market through two key channels:

● Market makers bear the brunt. Crypto market makers and exchanges are highly dependent on short-term financing from traditional financial markets to provide liquidity. When short-term rates like SOFR spike, market makers' financing costs soar, and profit margins are severely squeezed.

● A top market maker's risk control executive, who requested anonymity, revealed: "During the shutdown, our dollar financing costs more than doubled, forcing us to drastically reduce our market-making scale on major exchanges." This directly led to wider bid-ask spreads and poorer market depth in the crypto market.

● Stablecoin reserve management also faces huge pressure. Most stablecoins are backed by dollar assets (such as short-term U.S. Treasuries). When these highly liquid assets in traditional financial markets become difficult to trade, it directly affects stablecoin issuers' reserve asset management. Data shows that dollar liquidity tightening caused stablecoin OTC premiums to drop from +0.3% to -1.1%, indicating that the "apparent dollar shortage" has affected the stablecoin market.

III. Transmission Chain Two: Psychological Impact of Risk Appetite Shift

This chain describes the reversal of market psychology and sentiment, with uncertainty as the core driver. When investors are lost in an information fog, their behavior becomes conservative and cautious.

● Government shutdown → Economic data blackout + policy uncertainty → Global risk aversion rises → Funds exit risk assets → Crypto market faces sell-off → Liquidity spirals downward

Economic Data "Black Hole" and Policy Uncertainty

● The government shutdown caused key statistical agencies such as the U.S. Department of Labor and Department of Commerce to cease operations, resulting in a complete halt of key official economic data such as CPI and non-farm payroll reports. The market lost its "eyes" for judging economic health, and the Fed, investors, and businesses were all moving forward in a fog.

● The chief economist at Morgan Stanley wrote in a client report: "Making economic decisions without data is like a blind man feeling an elephant. We advise clients to remain cautious until the situation becomes clear."

● This uncertainty was further amplified by Trump's tariff policies. The U.S. government announced additional tariffs on a variety of imported goods, raising concerns about escalating global trade tensions. Meanwhile, geopolitical risks such as the Russia-Ukraine conflict and the Israel-Palestine conflict continued to escalate, collectively pushing up the global market's fear index.

Global Risk Aversion Rises and Capital Migration

● Faced with this "perfect storm," investors' risk aversion sentiment surged dramatically. The Fear and Greed Index released by the University of Chicago once showed a reading of 23, clearly indicating the market was in the "fear" zone.

● Cryptocurrencies are widely regarded by the global mainstream investment community as "the crown of risk assets". When the market de-risks, they are the first to be sold off. During the shutdown, crypto funds saw four consecutive weeks of net outflows, totaling $4.7 billion.

● A Wall Street hedge fund manager admitted: "When uncertainty reaches this level, our first reaction is to reduce exposure to risk assets, and cryptocurrencies are naturally the first to go."

Spiral Decline in Market Liquidity

● Capital outflows triggered a series of chain reactions. Sustained selling pressure met with buyers holding back due to wait-and-see sentiment, causing coin prices to come under downward pressure. More importantly, in a highly uncertain environment, market makers will proactively narrow bid-ask spreads and reduce position sizes to control their own risk.

● This directly led to poorer market depth, with large trades more likely to trigger sharp price swings. At the same time, falling prices would trigger forced liquidation of leveraged long positions, forming a negative cycle of "decline → liquidation → sell-off → further decline".

IV. End of the Shutdown and a New Chapter for the Market

With the U.S. Senate passing a temporary funding bill on November 11, the 41-day government shutdown is about to end. The market's attention immediately shifted to the new landscape of the post-shutdown era.

Liquidity "Flood Release" and Market Rebound

● The most direct positive is the return of liquidity. After the shutdown ends, the Treasury will need to reinject the massive funds in the TGA account back into the market, with the goal of rebuilding the cash balance to just $600 billion, meaning at least $500 billion in net liquidity will be released.

● Historical data supports an optimistic outlook. Within 30 days after the October 2013 shutdown ended, bitcoin rose 54%; within 30 days after the 2018-2019 shutdown ended, bitcoin rose 15%. After this shutdown ended, bitcoin prices quickly rebounded above $105,000.

Potential New Stimulus and Market Outlook

● An even bigger wave of liquidity may be on the way. President Trump announced a "tariff dividend" plan exceeding $400 billion, which, if implemented, will further inject massive liquidity into the market.

● Analysts point out that bitcoin seems to have found its "IPO pricing," an early sign of a market bottom. From a technical analysis perspective, if it can break through the $104,300 resistance level, bitcoin prices could further test $111,999 or even $117,552.

When Washington's political deadlock comes to an end and frozen liquidity flows again like spring water, only those investors who can see these patterns clearly will be able to better grasp the direction in the coming market. The U.S. government shutdown is like a stone thrown into the global financial pool, and the ripples it creates eventually reach every corner of the crypto world.