News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 14)|Czech Central Bank Becomes First to Buy Bitcoin; White House Warns of 1.5% Q4 GDP Hit; Monad Mainnet and MON Token Launch Set for Nov 242The most important crypto moments of the year3Bitcoin falls to $98K as futures liquidations soar: Should bulls expect a bounce?

Saylor Dismisses Sell-Off Rumors as Strategy Increases Bitcoin Holdings Amid Market Drop

Cointribune·2025/11/15 23:33

Coinpedia Digest: This Week’s Crypto News Highlights | 15th November, 2025

Coinpedia·2025/11/15 23:24

Cathie Wood’s ARK Invest Buys Circle, BitMine, and Bullish Shares Amid Market Dip

Coinpedia·2025/11/15 23:24

Bitcoin Heads Into Weekend Under Pressure as Price Tests Key Support Levels

Coinpedia·2025/11/15 23:24

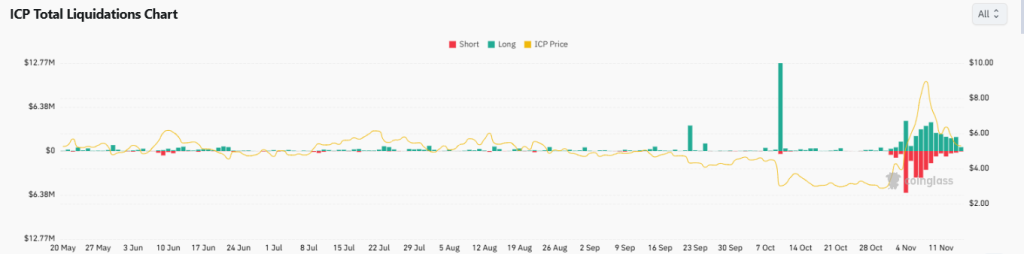

Internet Computer Price Prediction 2025: Is ICP Aimed for $1 Fall Before a Reversal Ahead?

Coinpedia·2025/11/15 23:24

Why XRP Price Didn’t Surge After the ETF Launch?

Coinpedia·2025/11/15 23:24

Bitcoin’s “Silent IPO”: A Sign of Market Maturity and Future Implications

AICoin·2025/11/15 22:06

AiCoin Daily Report (November 15)

AICoin·2025/11/15 22:05

Surviving Three Bull and Bear Cycles, Dramatic Revival, and Continuous Profits: The Real Reason Curve Became the “Liquidity Hub” of DeFi

Curve Finance has evolved from a stablecoin trading platform into a cornerstone of DeFi liquidity through its StableSwap AMM model, veTokenomics, and strong community resilience, demonstrating a sustainable development path. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still in the process of iterative improvement.

MarsBit·2025/11/15 21:59

Flash

- 01:35Data: 567.26 BTC flowed into a certain exchange, valued at approximately $541 millions.ChainCatcher News, according to Arkham data, at 09:29, a certain exchange received three large BTC transfers, totaling 567.26 BTC (with a total value of approximately $541 million), all from anonymous addresses. 1. 135.48 BTC were transferred from an anonymous address (starting with bc1q8q0st...) to a certain exchange, valued at approximately $129 million2. 279.46 BTC were transferred from an anonymous address (starting with bc1qndnh5...) to a certain exchange, valued at approximately $266 million3. 152.32 BTC were transferred from an anonymous address (starting with bc1qec0t8...) to a certain exchange, valued at approximately $145 million

- 01:26Data: Only about 5% of altcoin supply is in profit, the divergence between Bitcoin and altcoins is unprecedentedChainCatcher News, Glassnode stated in an article that the relative profit realized by altcoins has dropped to a deep capitulation zone, with only about 5% of the altcoin supply in a profitable state, while the profitability ratio of bitcoin has just begun to decline sharply. This unusual divergence between bitcoin and altcoins is unprecedented in previous cycles.

- 01:16Data: A certain whale holds large short positions in BTC, XRP, and ZEC, with a total value exceeding 190 millions USD.ChainCatcher news, according to monitoring by Lookonchain, a certain whale has taken large short positions on BTC, XRP, and ZEC, with a total value exceeding $190 million. The current positions are as follows: 40x short BTC position valued at $148 million, entry price $96,065.2, liquidation price $97,560.2; 20x short XRP position valued at $27.3 million, entry price $2.225, liquidation price $2.5; 10x short ZEC position valued at $20.6 million, entry price $652, liquidation price $775.

![[Bitpush Daily News Selection] Financial Times: Tether is considering leading a funding round of approximately $1.16 billion for German tech startup Neura Robotics; the US SEC has issued post-shutdown document processing guidance, and multiple crypto ETFs may be expedited; US Bureau of Labor Statistics: September 2025 employment data will be released on November 20, and October state employment and unemployment data will be released on November 21.](https://img.bgstatic.com/multiLang/image/social/06829a455cc5ced5cafaf4b9bf53d5281763243641786.png)