News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

After several weeks of decline, XRP is finally showing signs of recovery as US inflation slightly cools.

In-depth analysis of the technical barriers and EVM challenges faced by Prop AMM (Professional Automated Market Makers).

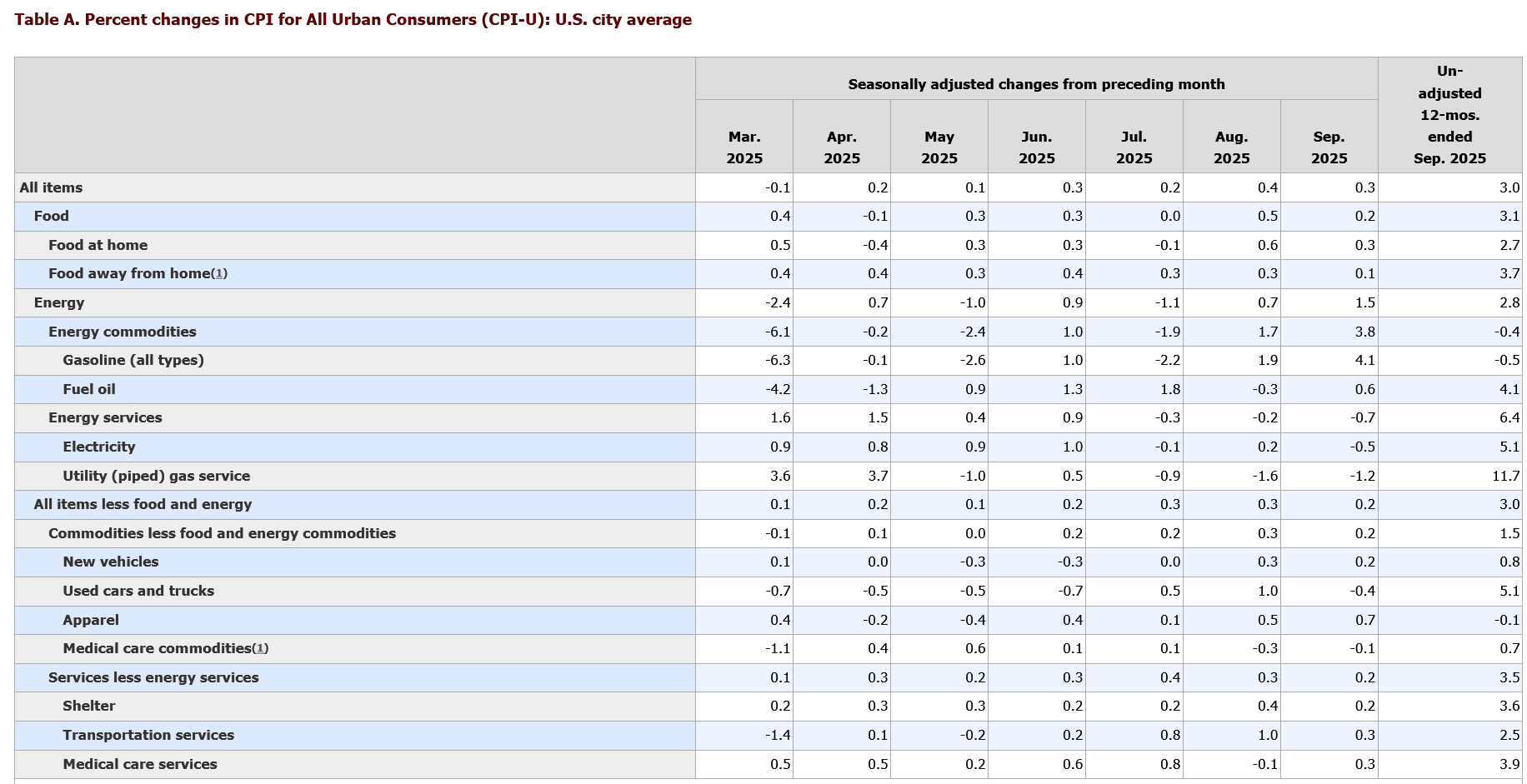

Crypto Market Sees Green: Bitcoin Soars to $111,500 and Altcoins ETH, XRP, BNB Enjoy 3-5% Gains Amid Lower US Inflation

The Uniswap Foundation has granted funding to Brevis to develop and implement a "Trustless Routing Rebate Program," offering up to $9 million in gas fee rebates to routers integrating v4 Hook pools. This system will utilize Brevis' ZK Data Coprocessor and Pico zkVM to compute and verify all rebate amounts in a trustless manner, without relying on centralized databases or hidden computation. By providing economic incentives to aggregators, this initiative encourages them to prioritize Hook integration, thereby accelerating the adoption of v4.

- 01:24The "smart money" that went 25x long on ETH after the 1011 flash crash still holds 17,900 ETH long positions, with an unrealized profit of $4.076 million.According to Jinse Finance, on-chain analyst Ai Yi (@ai_9684xtpa) has monitored that the "smart money that went 25x long on ETH after the 1011 flash crash" still holds 17,863.62 ETH long positions, valued at $70.55 million. The entry price for this long position was $3,722.18, with an unrealized profit of $4.076 million, ranking second among Hyperliquid ETH long positions. Reportedly, this whale went 25x long on ETH after the market flash crash on October 11, and did not close the position during two instances when ETH broke above $4,000.

- 01:20Data: After Huang Licheng's liquidation, he continued to open small trial positions. Currently, his ETH and HYPE long positions have an unrealized profit of about $680,000.According to ChainCatcher, on-chain analyst Yu Jin monitored that "Brother Machi" Huang Licheng, after suffering a liquidation loss of $12.56 million in principal due to the market crash on October 11, has not made any large-scale positions since then. Over the past half month, he has frequently opened positions on Hyperliquid with small amounts of funds, mostly tens of thousands of dollars. Data shows that after the liquidation, he cumulatively transferred in about $1.85 million USDC, and the current account balance is $1.13 million, which includes a floating profit of about $680,000 from long positions in ETH and HYPE. This is also his most profitable trade since the liquidation (if he manages to successfully take profit).

- 01:02After the major liquidation on October 11, "Maji" successively invested $1.85 million in contract trading, but now only $1.13 million remains.According to Jinse Finance, after "Maji" was liquidated for $12.56 million in principal during the sharp drop on 10.11, he has not opened any large positions since then. Over the past half month, he has only been trading with a few hundred thousand dollars at a time, "playing small games"—when he loses it all, he just transfers in another few hundred thousand dollars to continue trading. However, even so, he has been losing more than winning. After the liquidation on 10.11, he has successively transferred a total of $1.85 million into Hyperliquid, and now there is only $1.13 million left in the address. This $1.13 million also includes his current unrealized profit of $680,000 from his ETH and HYPE long positions.

Trending news

MoreData: After Huang Licheng's liquidation, he continued to open small trial positions. Currently, his ETH and HYPE long positions have an unrealized profit of about $680,000.

Hyperliquid News Today: Hyperliquid Repurchases Face Off Against Major Whale Short Positions: Crypto Derivatives Amidst Intense Volatility