News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 14)|Czech Central Bank Becomes First to Buy Bitcoin; White House Warns of 1.5% Q4 GDP Hit; Monad Mainnet and MON Token Launch Set for Nov 242The most important crypto moments of the year3Bitcoin falls to $98K as futures liquidations soar: Should bulls expect a bounce?

Saylor Dismisses Sell-Off Rumors as Strategy Increases Bitcoin Holdings Amid Market Drop

Cointribune·2025/11/15 23:33

Coinpedia Digest: This Week’s Crypto News Highlights | 15th November, 2025

Coinpedia·2025/11/15 23:24

Cathie Wood’s ARK Invest Buys Circle, BitMine, and Bullish Shares Amid Market Dip

Coinpedia·2025/11/15 23:24

Bitcoin Heads Into Weekend Under Pressure as Price Tests Key Support Levels

Coinpedia·2025/11/15 23:24

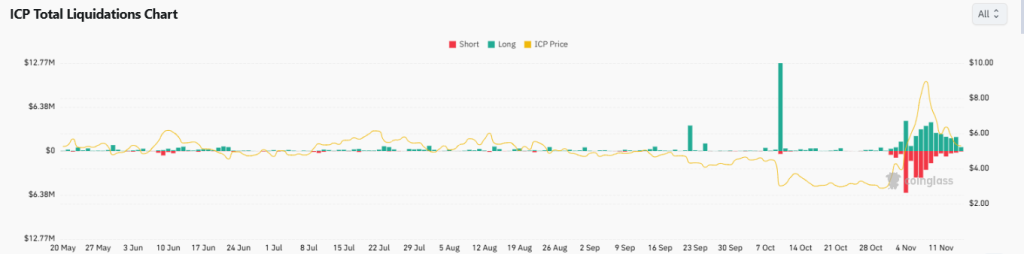

Internet Computer Price Prediction 2025: Is ICP Aimed for $1 Fall Before a Reversal Ahead?

Coinpedia·2025/11/15 23:24

Why XRP Price Didn’t Surge After the ETF Launch?

Coinpedia·2025/11/15 23:24

Bitcoin’s “Silent IPO”: A Sign of Market Maturity and Future Implications

AICoin·2025/11/15 22:06

AiCoin Daily Report (November 15)

AICoin·2025/11/15 22:05

Surviving Three Bull and Bear Cycles, Dramatic Revival, and Continuous Profits: The Real Reason Curve Became the “Liquidity Hub” of DeFi

Curve Finance has evolved from a stablecoin trading platform into a cornerstone of DeFi liquidity through its StableSwap AMM model, veTokenomics, and strong community resilience, demonstrating a sustainable development path. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still in the process of iterative improvement.

MarsBit·2025/11/15 21:59

Flash

- 02:19Opinion: Cryptocurrency Index ETFs Will Lead the Next Wave of AdoptionJinse Finance reported that Will Peck, Head of Digital Assets at WisdomTree, expects that ETFs holding diversified cryptocurrency portfolios will fill an important gap in the market over the next few years and will become one of the next waves of adoption. Multi-asset cryptocurrency baskets can provide users with exposure to the entire industry while mitigating the "idiosyncratic risk" of investing in a single token. Will Peck stated, "We call cryptocurrency an asset class, but it is actually a technology. The underlying return drivers for each token are actually quite different, even though they are generally correlated, simply because the market is at this stage." Several crypto index ETFs have been launched this year. On Thursday, asset management firm 21Shares announced the launch of two crypto index ETFs: the 21Shares FTSE Crypto 10 Index ETF (ticker: TTOP) and the 21Shares FTSE Crypto 10 ex-BTC Index ETF (ticker: TXBC). Both provide broad digital asset portfolio exposure by tracking the FTSE Russell crypto indexes, holding the top ten crypto assets by market capitalization (with TXBC excluding bitcoin), rather than investing in a single token.

- 01:35Data: 567.26 BTC flowed into a certain exchange, valued at approximately $541 millions.ChainCatcher News, according to Arkham data, at 09:29, a certain exchange received three large BTC transfers, totaling 567.26 BTC (with a total value of approximately $541 million), all from anonymous addresses. 1. 135.48 BTC were transferred from an anonymous address (starting with bc1q8q0st...) to a certain exchange, valued at approximately $129 million2. 279.46 BTC were transferred from an anonymous address (starting with bc1qndnh5...) to a certain exchange, valued at approximately $266 million3. 152.32 BTC were transferred from an anonymous address (starting with bc1qec0t8...) to a certain exchange, valued at approximately $145 million

- 01:26Data: Only about 5% of altcoin supply is in profit, the divergence between Bitcoin and altcoins is unprecedentedChainCatcher News, Glassnode stated in an article that the relative profit realized by altcoins has dropped to a deep capitulation zone, with only about 5% of the altcoin supply in a profitable state, while the profitability ratio of bitcoin has just begun to decline sharply. This unusual divergence between bitcoin and altcoins is unprecedented in previous cycles.

![[Bitpush Daily News Selection] Financial Times: Tether is considering leading a funding round of approximately $1.16 billion for German tech startup Neura Robotics; the US SEC has issued post-shutdown document processing guidance, and multiple crypto ETFs may be expedited; US Bureau of Labor Statistics: September 2025 employment data will be released on November 20, and October state employment and unemployment data will be released on November 21.](https://img.bgstatic.com/multiLang/image/social/06829a455cc5ced5cafaf4b9bf53d5281763243641786.png)