News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

As the yen exchange rate hits a nine-month low, investors are pulling back from long positions. With a 300 basis point interest rate differential between the US and Japan, carry trades are dominating the market, putting the yen at further risk of depreciation.

U.S. sanctions have dealt a heavy blow to Russia’s oil giants, and the IEA says this could have the most profound impact on the global oil market so far. Although Russian oil exports have not yet seen a significant decline, supply chain risks are spreading across borders.

Uniswap's new proposal reduces LP earnings, while Aero integrates LPs into the entire protocol's cash flow.

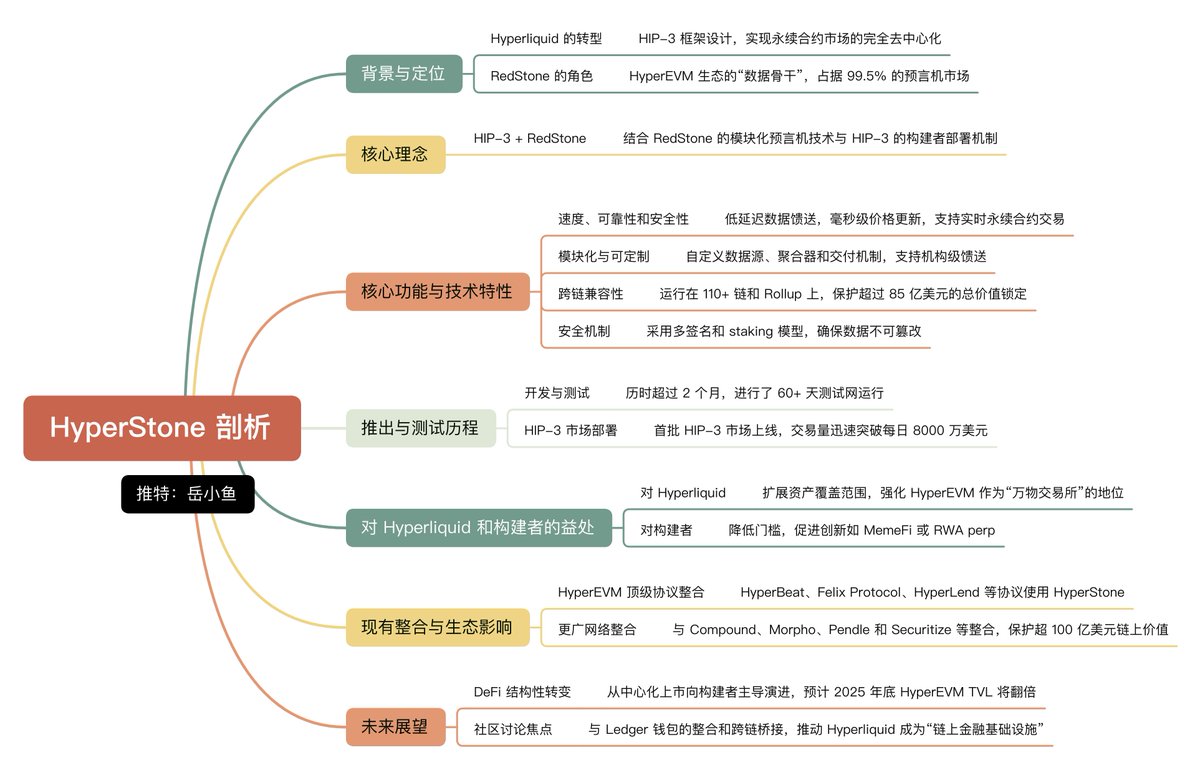

The future of Hyperliquid lies in HIP-3, and the foundation of HIP-3 is HyperStone.

Asset issuance in the crypto industry is entering a new era of compliance.

By the end of the third quarter, the circulating supply of USDC reached $73.7 billion, representing a year-on-year increase of 108%.

As platforms such as Uniswap and Lido promote token buybacks, various protocols are facing questions regarding control and sustainability amid growing concerns over centralization.

Even with the surge in BTC, early whales are either switching to ETFs or cashing out and exiting, with no further wealth spillover effect.

Arc previously launched its public testnet and made it accessible to developers and enterprises. Currently, more than 100 institutions have participated.

This year, the state of the economy has become the most crucial factor in determining whether the Christmas rally will arrive as expected.

- 13:49Solana treasury company Upexi launches $50 million stock buyback planJinse Finance reported that Upexi, a Solana treasury company listed on Nasdaq, announced that its board of directors has approved a share repurchase plan to buy back $50 million worth of outstanding common stock. The timing, method, price, and quantity of the repurchase will be determined at management’s discretion based on stock price, market conditions, and available liquidity.

- 13:36Czech central bank becomes the first central bank to purchase bitcoinChainCatcher reported that the Czech National Bank (CNB) has announced the creation of a digital asset pilot portfolio worth $1 million, covering bitcoin, USD stablecoins, and tokenized deposits. The project aims to test the central bank's processes for purchasing, holding, and managing blockchain assets over a period of 2 to 3 years. This investment is not included in foreign exchange reserves. CNB Governor Aleš Michl stated that the move is intended to explore the potential role of bitcoin in reserve diversification.

- 13:36BNY Global launches stablecoin reserve fundAccording to Golden Ten Data, ChainCatcher reported that BNY Global has announced the launch of a stablecoin reserve fund, aiming to provide investors with a more stable digital asset investment option.