Circle's protégé Arc is about to launch a token—can retail investors make money from it?

Arc previously launched its public testnet and made it accessible to developers and enterprises. Currently, more than 100 institutions have participated.

Arc previously launched its public testnet and opened it to developers and enterprises. More than 100 institutions have already participated.

Written by: 1912212.eth, Foresight News

On November 12, stablecoin giant Circle released its Q3 business update, revealing that it is exploring the issuance of a native token on its newly launched stablecoin public chain, the Arc network.

Circle is seeking to transform from a pure stablecoin provider to a more comprehensive blockchain ecosystem builder. As the issuer of USDC, this move could further consolidate Circle's leadership in the stablecoin financial sector while injecting new vitality into the Arc network.

Arc, launched by Circle, is a stablecoin public chain. Unlike general-purpose public chains such as Solana and Sui, it is a platform optimized for stablecoin payments, foreign exchange, and capital markets.

As an L1 blockchain project launched by Circle, the Arc network’s core team is led by Circle’s executive leadership, reflecting the stablecoin giant’s professional layout in blockchain infrastructure. Circle's CEO is Jeremy Allaire, who also serves as Arc’s co-founder, responsible for the company’s overall strategy, vision, and operational execution.

The Chief Product Manager is Sanket Jain, who is also Circle’s Chief Product Manager and co-founder of Gateway. He graduated from Cornell University with a major in Applied Economics, previously worked as a financial analyst at Fountain Financial, LLC, and as a corporate restructuring analyst at Houlihan Lokey. The Chief Software Engineer is Adrian Soghoian, who previously worked at Trigger Finance and Google Chrome, with many years of development experience.

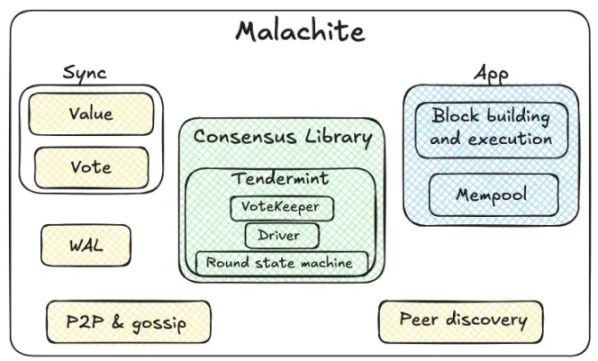

The core innovation of Arc lies in embedding USDC at the network’s base layer, avoiding the volatility issues of traditional gas tokens. Users can pay fees directly with USDC, enabling a seamless stablecoin transaction experience. In August this year, Circle Internet Group (CRCL) acquired Informal Systems’ high-performance consensus engine Malachite, adopting a permissioned Proof-of-Authority mechanism, with validator nodes operated by known authoritative institutions.

At the end of October, Arc launched its public testnet and opened it to developers and enterprises. More than 100 institutions have already participated. The Circle Payments Network has 29 financial institutions onboard; new partnerships have been added with Brex, Deutsche Börse, Finastra, Fireblocks, Kraken, Itaú, and Visa.

The Q3 financial report released by Circle Internet Group shows that the company’s revenue grew 66% year-on-year, reaching about $740 million, with net profit rising sharply. This strong performance is due to the surge in USDC circulation—by the end of the reporting period, USDC’s market cap had exceeded $75 billion, ranking as the world’s second-largest stablecoin, second only to Tether’s USDT.

Against the backdrop of tightening global regulatory environments, Circle’s compliance advantage is particularly prominent. Its USDC has been recognized by the EU’s MiCA regulations and is widely used on major exchanges and DeFi protocols.

Unlike traditional blockchains, Arc uses USDC as the native gas token, meaning transaction fees can be paid directly in USDC, enabling instant settlement and privacy options. The network is EVM-compatible for easy application migration by developers and is deeply integrated with Circle’s ecosystem, including USDC, CCTP (Cross-Chain Transfer Protocol), and Gateway tools.

In its Q3 report, Circle stated clearly: “We are exploring the possibility of issuing a native token on the Arc network, which will promote network participation, drive adoption, further align the interests of Arc stakeholders, and support the long-term growth and success of the Arc network.”

Although this statement is still in the “exploratory” stage, it is enough to spark market imagination.

Project Progress and Future Outlook

In the stablecoin market, Tether, as the issuer of USDT, is actively building its own blockchain ecosystem by launching the Plasma and Stable networks. This has directly prompted Circle to accelerate its exploration of native token issuance on the Arc network to maintain its competitive edge.

The stablecoin public chain Plasma, supported by Tether, is optimized for USDT payments, supports zero-fee USDT transfers, and is EVM-compatible. Its token launches and deposits have attracted countless investors and significant traffic. Currently, its token XPL has a market cap of $490 million, with an FDV still at $2.6 billion. Another Tether-backed stablecoin public chain, Stable, also attracted massive funds after opening for deposits. The first phase’s $1 billion cap was quickly filled, and the second phase’s $500 million cap was lifted due to high demand, with total deposits in the second phase nearing $1.8 billion.

With the expansion of stablecoin public chains, exchanges, and trading pairs, Tether firmly holds the dominant market position. USDC remains in a catch-up role.

Today, U.S. Treasury Secretary Bessent stated that by 2030, the scale of stablecoins could grow from $300 billion to $3 trillion, a tenfold increase.

The market is also highly receptive to the narrative of stablecoin public chains. Previously, USDE’s market cap soared to nearly $15 billion in just two years, and many stablecoins have emerged from public chains and DeFi protocols.

Circle, being listed in the U.S., can only meet the investment needs of U.S. investors, but has not met the needs of its native community. A native token is truly a powerful tool to attract community attention.

It not only helps attract more community participants and incentivize network participation, but can also increase Arc’s adoption rate. Circle emphasized in its report that this token will “drive network growth,” hinting that it may be linked with the USDC ecosystem to form a closed-loop economic model. With the addition of a native token, this ecosystem will become more attractive, greatly appealing to DeFi, RWA (Real World Assets), and cross-border payment applications.

Arc’s native token could solve current pain points of stablecoin networks, such as high gas fees and cross-chain fragmentation. Through governance incentives, Arc could become the preferred platform for RWA and DeFi, attracting institutional funds from the likes of BlackRock—Circle has already partnered with BlackRock on the USDC fund.

In addition, with the trend of AI and Web3 integration, Circle’s AI tools combined with tokens can accelerate the development of the developer ecosystem. On the challenge side, issuing a token requires balancing centralization and decentralization. Currently, Arc’s permissioned design may limit community participation, and if the token is not designed properly, it could trigger speculative bubbles. The market is highly competitive: L1s such as Solana and Base are already mature, so Arc needs to prove its unique advantage as a stablecoin-focused chain.

In the long term, this exploration aligns with the evolution of blockchain: from general-purpose platforms to vertical ecosystems. Circle’s Q3 profit growth proves its business model is sustainable, and a native token will be a catalyst.

Currently, participants can receive test tokens on the testnet and participate by deploying contracts on the testnet. The official team has released detailed tutorial documentation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The 12 trillion financing market is in crisis! Institutions urge the Federal Reserve to step up rescue efforts

Wall Street financing costs are rising, highlighting signs of liquidity tightening. Although the Federal Reserve will stop quantitative tightening in December, institutions believe this is not enough and are calling on the Fed to resume bond purchases or increase short-term lending to ease the pressure.

Another Trump 2.0 era tragedy! The largest yen long position in nearly 40 years collapses

As the yen exchange rate hits a nine-month low, investors are pulling back from long positions. With a 300 basis point interest rate differential between the US and Japan, carry trades are dominating the market, putting the yen at further risk of depreciation.

Is a "cliff" in Russian oil production coming? IEA warns: US sanctions on Russia may have "far-reaching consequences"!

U.S. sanctions have dealt a heavy blow to Russia’s oil giants, and the IEA says this could have the most profound impact on the global oil market so far. Although Russian oil exports have not yet seen a significant decline, supply chain risks are spreading across borders.