News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 14)|Czech Central Bank Becomes First to Buy Bitcoin; White House Warns of 1.5% Q4 GDP Hit; Monad Mainnet and MON Token Launch Set for Nov 242The most important crypto moments of the year3Bitcoin falls to $98K as futures liquidations soar: Should bulls expect a bounce?

Saylor Dismisses Sell-Off Rumors as Strategy Increases Bitcoin Holdings Amid Market Drop

Cointribune·2025/11/15 23:33

Coinpedia Digest: This Week’s Crypto News Highlights | 15th November, 2025

Coinpedia·2025/11/15 23:24

Cathie Wood’s ARK Invest Buys Circle, BitMine, and Bullish Shares Amid Market Dip

Coinpedia·2025/11/15 23:24

Bitcoin Heads Into Weekend Under Pressure as Price Tests Key Support Levels

Coinpedia·2025/11/15 23:24

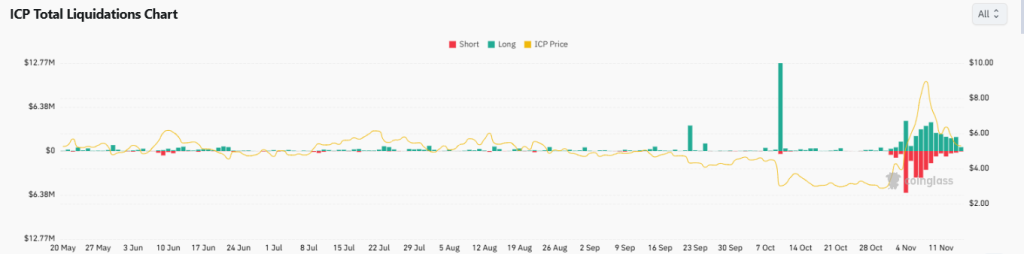

Internet Computer Price Prediction 2025: Is ICP Aimed for $1 Fall Before a Reversal Ahead?

Coinpedia·2025/11/15 23:24

Why XRP Price Didn’t Surge After the ETF Launch?

Coinpedia·2025/11/15 23:24

Bitcoin’s “Silent IPO”: A Sign of Market Maturity and Future Implications

AICoin·2025/11/15 22:06

AiCoin Daily Report (November 15)

AICoin·2025/11/15 22:05

Surviving Three Bull and Bear Cycles, Dramatic Revival, and Continuous Profits: The Real Reason Curve Became the “Liquidity Hub” of DeFi

Curve Finance has evolved from a stablecoin trading platform into a cornerstone of DeFi liquidity through its StableSwap AMM model, veTokenomics, and strong community resilience, demonstrating a sustainable development path. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still in the process of iterative improvement.

MarsBit·2025/11/15 21:59

Flash

- 00:32Arthur Hayes suspected of selling $1.66 million worth of ETH, $733,000 worth of ENA, and $124,000 worth of ETHFIAccording to ChainCatcher, Onchain Lens monitoring shows that Arthur Hayes appears to have sold ETH, ENA, and ETHFI about 4 hours ago. 520 ETH (worth $1.66 million) was sent to an exchange and FalconX; 2.62 million ENA (worth $733,000) was sent to an exchange, Wintermute, and FalconX; 132,730 ETHFI (worth $124,000) was sent to Wintermute. In addition, Arthur also received USDC worth $3.56 million from FlowDesk.

- 00:0510x Research: ETH falls below short- and medium-term moving averages, ETF sees net outflow of over $1.4 billion in a single weekAccording to ChainCatcher, analysis by 10x Research shows that ETH has now fallen below its 7-day and 30-day moving averages, with a bearish technical pattern and a decline of 6.6% over the past week. Meanwhile, ETH ETF has seen net outflows exceeding 1.4 billions USD, and long-term holders of 3-10 years on-chain are selling at the fastest pace since 2021, creating additional supply pressure. Despite the intensified selling pressure, large addresses have been accumulating ETH during the decline, with several whales collectively purchasing ETH worth over 1 billion USD.

- 2025/11/15 23:02U.S. Department of Justice: American citizens helped North Korean IT workers infiltrate 136 companiesJinse Finance reported that the U.S. Department of Justice announced on Friday that it has filed an application to forfeit Tether USDT stablecoins worth $15.1 million, which were seized from North Korean hackers associated with the APT38 group. The Department of Justice also secured guilty pleas from four U.S. citizens and one Ukrainian national, who admitted to assisting North Korean IT workers in fraudulently obtaining jobs at U.S. companies by providing stolen identities and custodial company laptops.

![[Bitpush Daily News Selection] Financial Times: Tether is considering leading a funding round of approximately $1.16 billion for German tech startup Neura Robotics; the US SEC has issued post-shutdown document processing guidance, and multiple crypto ETFs may be expedited; US Bureau of Labor Statistics: September 2025 employment data will be released on November 20, and October state employment and unemployment data will be released on November 21.](https://img.bgstatic.com/multiLang/image/social/06829a455cc5ced5cafaf4b9bf53d5281763243641786.png)