News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 17)|Grayscale XRP Spot ETF Ruling Imminent; SEC to Rule on 16 Major Crypto ETFs;2Massive $536M Outflow Hits Spot Bitcoin ETFs3Research Report|In-Depth Analysis and Market Cap of Meteora(MET)

Estimates show U.S. jobless claims fell to around 215,000 last week

Cointime·2025/10/17 14:48

Ethereum Price Slides Below $4,000 Support As Sellers Tighten Their Grip

Newsbtc·2025/10/17 14:27

Bitcoin falls below $110,000, whose wallet is losing money again?

Market sentiment has fallen into extreme fear.

ForesightNews 速递·2025/10/17 14:23

21Shares Files with SEC for 2x Leveraged HYPE ETF Tracking Hyperliquid Index Performance

Cryptonewsland·2025/10/17 14:06

Ghana Targets December 2025 for Crypto Rules as Enforcement Team Remains Unfilled

Cryptonewsland·2025/10/17 14:06

ACI Worldwide and BitPay Partner to Enable Merchants to Accept Crypto and Stablecoin Payments Globally

Cryptonewsland·2025/10/17 14:06

SEC’s Hester Peirce Calls for Financial Privacy as Tokenization Gains Momentum

Cryptonewsland·2025/10/17 14:06

France Boosts AML Checks on Crypto Exchanges

France’s ACPR tightens AML rules on crypto firms like Binance amid MiCA compliance efforts.Major Exchanges Face Regulatory ReviewMiCA Brings a New Compliance Era

Coinomedia·2025/10/17 14:06

Japanese banks to launch yen and dollar stablecoins

Portalcripto·2025/10/17 14:00

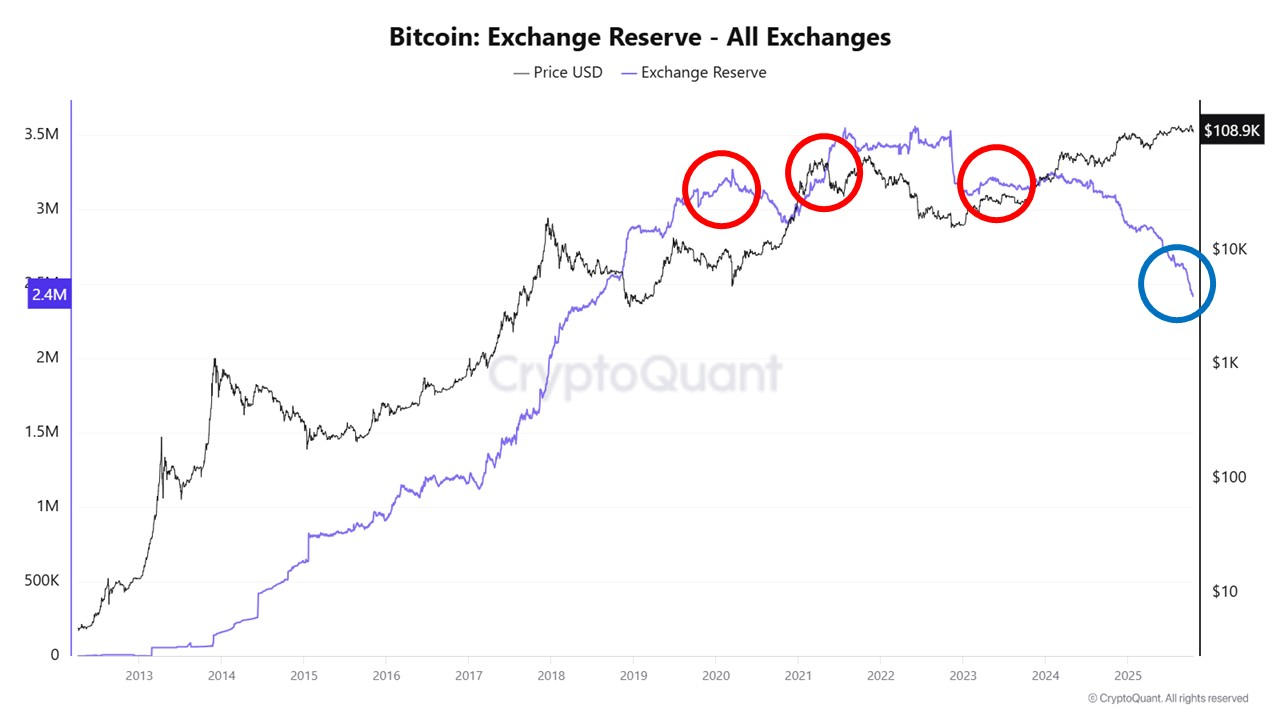

October Crypto Crash Shows Stark Contrast to 2021 Selloffs, Analyst Finds

CryptoNewsNet·2025/10/17 13:57

Flash

- 16:29Payment-focused blockchain Tempo completes $500 million Series A financingJinse Finance reported that Tempo, a blockchain project focused on payments and backed by fintech giant Stripe and blockchain venture capital firm Paradigm, announced the completion of a $500 million Series A funding round. Venture capital giants Greenoaks and Joshua Kushner's Thrive Capital led the round, which values Tempo at $5 billion. Sequoia Capital, Ribbit Capital, and Ron Conway's SV Angel also participated.

- 16:21Jupiter announces the launch of end-to-end trading engine Ultra V3ChainCatcher news, Solana ecosystem DEX Jupiter has announced the launch of Ultra V3, which Jupiter describes as its most advanced end-to-end trading engine to date. It offers a brand new router, Iris, enabling optimal private trading through ShadowLane, providing MEV protection and advanced slippage estimation. Ultra V3 integrates seamlessly with all Jupiter products, including mobile, web, desktop, API, and Pro Tools.

- 16:15Bitcoin market sentiment turns defensive as options market reflects rising demand for hedgingForesight News reported, citing glassnode analysis, that ongoing macro uncertainty continues to weigh on Bitcoin (BTC) performance. Data shows that over the past week, gold has outperformed Bitcoin by more than 20%, with some "store of value" funds flowing into the gold market. Options market data reflects a clear shift in market sentiment: overnight volatility triggered a sharp surge in short-term volatility, with BTC front-end options volatility around 50, indicating that traders are paying a premium for immediate protection; BTC option skew continues to exhibit macro asset characteristics, with a clear preference for put options, and the cost of downside protection is higher than upside risk exposure; capital flows are relatively balanced, with some accounts reducing protective positions, some accounts selling volatility on the decline, and others selectively buying call options; overall volatility structure remains defensive, showing a preference for put options, marginally rising volatility, and high demand for tail hedging. Analysis shows that although many accounts hold year-end upside risk exposure, the resilience of downside volatility has weakened this momentum. In the current market environment, selling put options or put spreads to fund potential upside in November remains attractive, provided traders can tolerate the associated risks.