News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 14)|Czech Central Bank Becomes First to Buy Bitcoin; White House Warns of 1.5% Q4 GDP Hit; Monad Mainnet and MON Token Launch Set for Nov 242The most important crypto moments of the year3Bitcoin falls to $98K as futures liquidations soar: Should bulls expect a bounce?

Saylor Dismisses Sell-Off Rumors as Strategy Increases Bitcoin Holdings Amid Market Drop

Cointribune·2025/11/15 23:33

Coinpedia Digest: This Week’s Crypto News Highlights | 15th November, 2025

Coinpedia·2025/11/15 23:24

Cathie Wood’s ARK Invest Buys Circle, BitMine, and Bullish Shares Amid Market Dip

Coinpedia·2025/11/15 23:24

Bitcoin Heads Into Weekend Under Pressure as Price Tests Key Support Levels

Coinpedia·2025/11/15 23:24

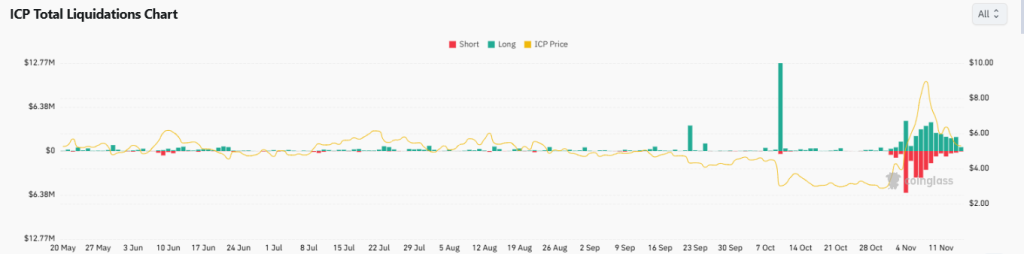

Internet Computer Price Prediction 2025: Is ICP Aimed for $1 Fall Before a Reversal Ahead?

Coinpedia·2025/11/15 23:24

Why XRP Price Didn’t Surge After the ETF Launch?

Coinpedia·2025/11/15 23:24

Bitcoin’s “Silent IPO”: A Sign of Market Maturity and Future Implications

AICoin·2025/11/15 22:06

AiCoin Daily Report (November 15)

AICoin·2025/11/15 22:05

Surviving Three Bull and Bear Cycles, Dramatic Revival, and Continuous Profits: The Real Reason Curve Became the “Liquidity Hub” of DeFi

Curve Finance has evolved from a stablecoin trading platform into a cornerstone of DeFi liquidity through its StableSwap AMM model, veTokenomics, and strong community resilience, demonstrating a sustainable development path. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still in the process of iterative improvement.

MarsBit·2025/11/15 21:59

Flash

- 01:04A certain whale deposited 44,000 ETH worth $140.2 millions into an exchange.Jinse Finance reported, according to monitoring by Lookonchain, that the whale "66kETHBorrow," who recently purchased 444,895 ETH (worth $1.39 billion), appears to have started selling. Eight hours ago, the whale withdrew 177,000 ETH (worth $561.3 million) from Aave and deposited 44,000 ETH (worth $140.2 million) to an exchange. The whale's purchase cost was approximately $3,437 per ETH, and is currently at a loss of about $125 million.

- 00:57Brown University and Emory University hold over $65 million in bitcoin-related assets combinedAccording to ChainCatcher, the latest 13F filings submitted by U.S. universities to the SEC show that as of September 30, Brown University held approximately $13.8 million worth of IBIT shares. Meanwhile, Emory University held 1,023,417 shares of Grayscale Bitcoin Mini Trust, valued at approximately $51.82 million, representing a significant increase from the previous quarter. Emory also disclosed holdings of 4,450 shares of iShares Bitcoin Trust, valued at approximately $289,000.

- 00:32Lookonchain: Arthur Hayes suspected of selling ETH, ENA, and ETHFI tokens worth approximately $2.52 millionAccording to a report by Jinse Finance, on-chain analytics platform Lookonchain has monitored that a certain exchange co-founder, Arthur Hayes, allegedly sold 520 ETH (worth $1.66 million), 2.62 million ENA (worth $733,000), and 132,730 ETHFI (worth $124,000) about 4 hours ago, with a total value of approximately $2.52 million.

![[Bitpush Daily News Selection] Financial Times: Tether is considering leading a funding round of approximately $1.16 billion for German tech startup Neura Robotics; the US SEC has issued post-shutdown document processing guidance, and multiple crypto ETFs may be expedited; US Bureau of Labor Statistics: September 2025 employment data will be released on November 20, and October state employment and unemployment data will be released on November 21.](https://img.bgstatic.com/multiLang/image/social/06829a455cc5ced5cafaf4b9bf53d5281763243641786.png)