News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 17)|Grayscale XRP Spot ETF Ruling Imminent; SEC to Rule on 16 Major Crypto ETFs;2Massive $536M Outflow Hits Spot Bitcoin ETFs3Research Report|In-Depth Analysis and Market Cap of Meteora(MET)

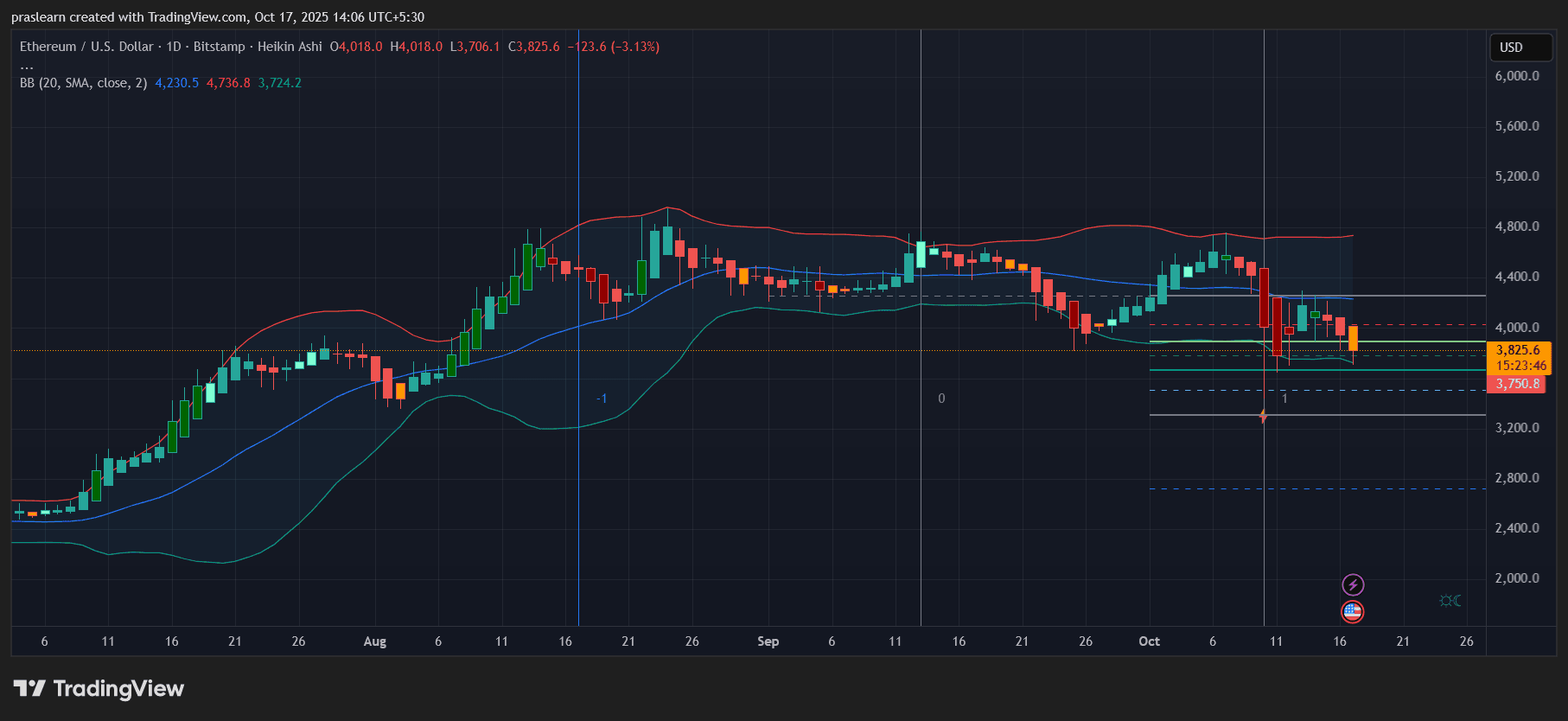

Crypto market update: Bitcoin dips below $106k, ETH, XRP, SOL risk key levels

Coinjournal·2025/10/17 13:39

Will Ethereum’s Slide Deepen as Banking Stress Spreads?

Cryptoticker·2025/10/17 13:33

Kalshi's On-Chain Ambitions: From Compliant Prediction Markets to Web3 Infrastructure

Advantages include broader coverage, legitimacy, mainstream adoption, and a hybrid model.

深潮·2025/10/17 13:03

ETH Price Experiences Volatility: In-Depth Analysis and Outlook

AICoin·2025/10/17 11:54

The Truth Behind Dogecoin's Plunge: Why Are Meme Coins the First to Fall in the Storm?

AICoin·2025/10/17 11:54

Bitcoin's "Breathing Crisis": Whales Flee, $100,000 Mark Hangs by a Thread

AICoin·2025/10/17 11:54

Credit "cockroaches" appear! Is the US regional banking crisis resurfacing?

As two regional banks disclosed significant credit losses, Wall Street's "sell first, ask questions later" pattern has reemerged, and a new wave of panic is sweeping through U.S. regional banks.

Jin10·2025/10/17 11:34

How to achieve ultra-high win rates on Polymarket through insiders?

The more insiders there are, the more accurate the price is, and the more reliable the information provided by the market becomes.

BlockBeats·2025/10/17 10:42

Singapore Implicated in Cambodia Pig-Butchering Scam, "Tax Haven" Status Questioned Again

The charges have once again drawn attention to Singapore's role in criminal activities in the Southeast Asian region.

ForesightNews 速递·2025/10/17 10:41

Flash

- 13:37Arthur Hayes: If the U.S. regional banking crisis worsens, a "2023-style bailout" will arrive, and Bitcoin is currently in a bottom-buying rangeChainCatcher reported that Arthur Hayes, co-founder of an exchange, posted on X stating that bitcoin is currently "on sale," and warned that if the turmoil among US regional banks escalates into a systemic crisis, the government may once again implement financial bailout measures similar to those in 2023. He said he is ready to "buy the dip" after such bailouts and encouraged investors to consider opportunities in the crypto market when they have idle funds.

- 13:29MrBeast files trademark application for "MrBeast Financial," plans to offer cryptocurrency trading and related servicesAccording to ChainCatcher, information disclosed by the USPTO shows that YouTube blogger MrBeast has submitted a trademark application for "MrBeast Financial" to the United States Patent and Trademark Office, planning to register a company to provide cryptocurrency trading, crypto payment processing, and other related services.

- 13:26MegaETH: Has completed buyback of 4.75% shares from early investorsJinse Finance reported, according to market sources: MegaETH announced today that it has completed a cash repurchase of 4.75% of the company's equity from its seed round investors.