News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

After several weeks of decline, XRP is finally showing signs of recovery as US inflation slightly cools.

In-depth analysis of the technical barriers and EVM challenges faced by Prop AMM (Professional Automated Market Makers).

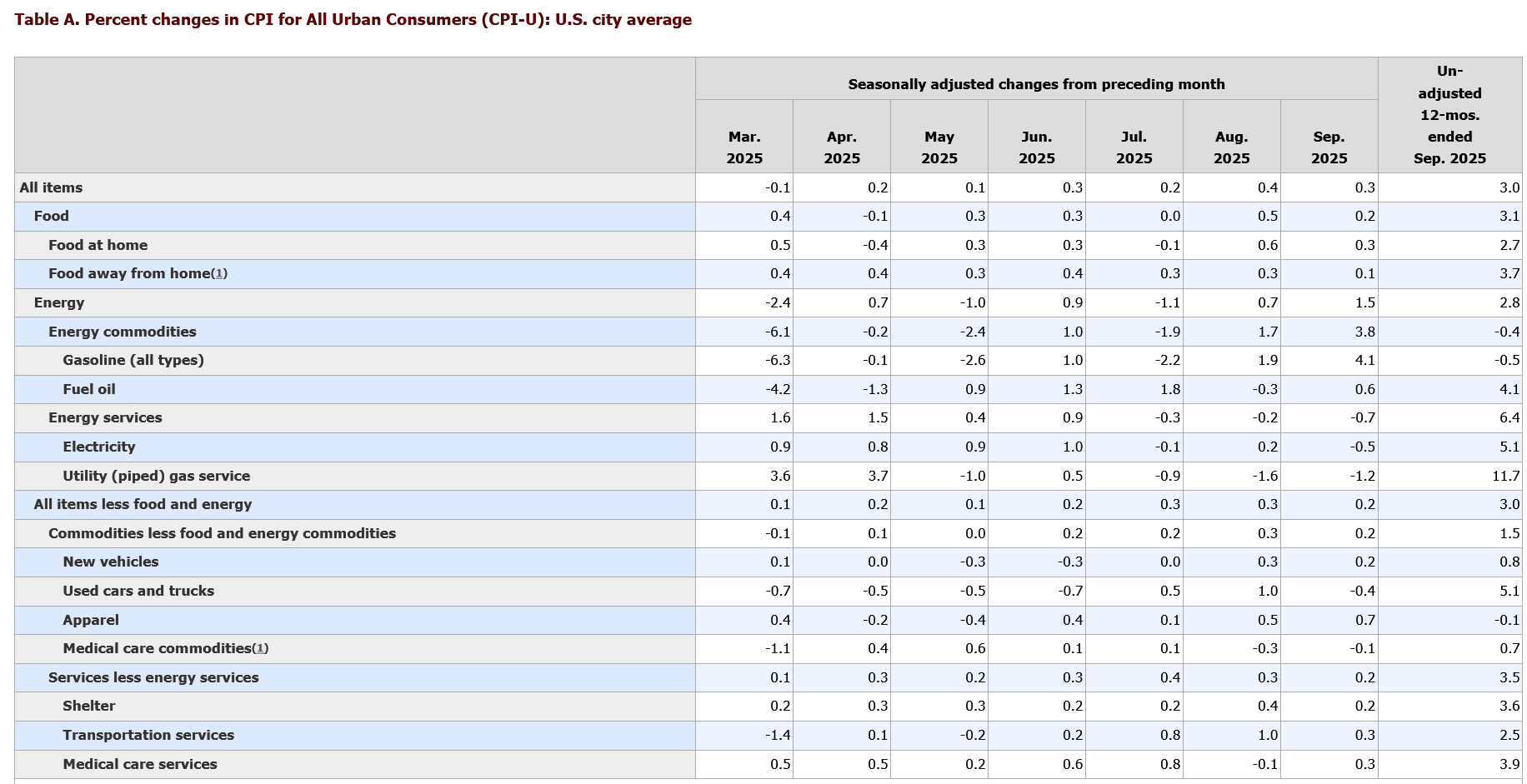

Crypto Market Sees Green: Bitcoin Soars to $111,500 and Altcoins ETH, XRP, BNB Enjoy 3-5% Gains Amid Lower US Inflation

The Uniswap Foundation has granted funding to Brevis to develop and implement a "Trustless Routing Rebate Program," offering up to $9 million in gas fee rebates to routers integrating v4 Hook pools. This system will utilize Brevis' ZK Data Coprocessor and Pico zkVM to compute and verify all rebate amounts in a trustless manner, without relying on centralized databases or hidden computation. By providing economic incentives to aggregators, this initiative encourages them to prioritize Hook integration, thereby accelerating the adoption of v4.

- 00:24Biodefense startup Valthos raises $30 million in funding, with participation from OpenAIChainCatcher news, biotechnology defense startup Valthos has raised $30 million in funding from the OpenAI Startup Fund, Lux Capital, and Founders Fund. The company's AI system can update medical countermeasures according to the changing speed of biological threats, enabling researchers and government agencies to identify and respond to pathogens as quickly as possible. Valthos was founded in New York last November, and its leadership includes: former Palantir Technologies Head of Life Sciences Kathleen McMahon, former Oxford University computational neuroscience researcher Tess van Stekelenburg, and founding AI engineer Victor Mao (who previously served as a research engineer at Google DeepMind).

- 00:23Today's Fear and Greed Index rises to 40, still in a state of fearAccording to Jinse Finance, data from Alternative shows that today the Crypto Fear & Greed Index has risen to 40 (yesterday the index was 37), indicating that the market is still in a state of fear.

- 00:22The "100% Win Rate Mysterious Whale" increased their long position by 173.6 BTC early this morning, bringing the total long position to nearly $300 million.According to Jinse Finance, on-chain analyst Ai Yi (@ai_9684xtpa) has monitored that the "100% Win Rate Mysterious Whale" increased their position by another 173.6 BTC in the early hours today. The current BTC long position has surpassed 165 million USD, with a total position exceeding 296 million USD and an unrealized profit of 2.97 million USD. The current positions are as follows: BTC long: holding 1,482.9 BTC, valued at 165 million USD, with an entry price of 110,680.1 USD; ETH long: holding 33,270.78 ETH, valued at 132 million USD, with an entry price of 3,897.59 USD.