News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 14)|Czech Central Bank Becomes First to Buy Bitcoin; White House Warns of 1.5% Q4 GDP Hit; Monad Mainnet and MON Token Launch Set for Nov 242The most important crypto moments of the year3Bitcoin falls to $98K as futures liquidations soar: Should bulls expect a bounce?

Saylor Dismisses Sell-Off Rumors as Strategy Increases Bitcoin Holdings Amid Market Drop

Cointribune·2025/11/15 23:33

Coinpedia Digest: This Week’s Crypto News Highlights | 15th November, 2025

Coinpedia·2025/11/15 23:24

Cathie Wood’s ARK Invest Buys Circle, BitMine, and Bullish Shares Amid Market Dip

Coinpedia·2025/11/15 23:24

Bitcoin Heads Into Weekend Under Pressure as Price Tests Key Support Levels

Coinpedia·2025/11/15 23:24

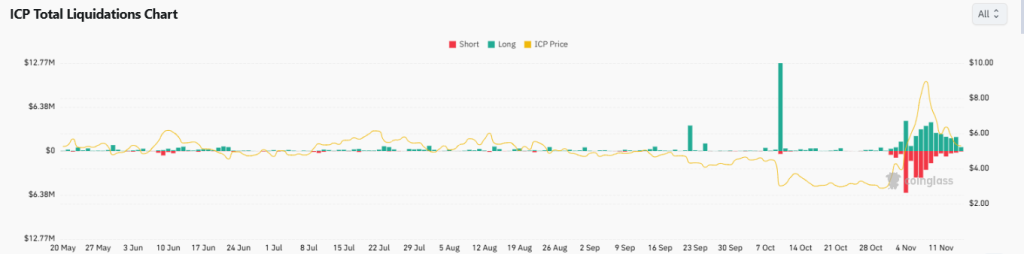

Internet Computer Price Prediction 2025: Is ICP Aimed for $1 Fall Before a Reversal Ahead?

Coinpedia·2025/11/15 23:24

Why XRP Price Didn’t Surge After the ETF Launch?

Coinpedia·2025/11/15 23:24

Bitcoin’s “Silent IPO”: A Sign of Market Maturity and Future Implications

AICoin·2025/11/15 22:06

AiCoin Daily Report (November 15)

AICoin·2025/11/15 22:05

Surviving Three Bull and Bear Cycles, Dramatic Revival, and Continuous Profits: The Real Reason Curve Became the “Liquidity Hub” of DeFi

Curve Finance has evolved from a stablecoin trading platform into a cornerstone of DeFi liquidity through its StableSwap AMM model, veTokenomics, and strong community resilience, demonstrating a sustainable development path. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still in the process of iterative improvement.

MarsBit·2025/11/15 21:59

Flash

- 03:44STRK surpasses $0.23, up 29.3% in 24 hoursJinse Finance reported that according to market data, Starknet (STRK) has surpassed $0.23 and is now trading at $0.232, with a 24-hour increase of 29.3%. The market is experiencing significant volatility, so please manage your risks accordingly.

- 03:34Tom Lee: The crypto market downturn may be due to a market maker asset gap and is a short-term market fluctuation.Jinse Finance reported that BitMine Chairman Thomas (Tom) Lee stated in a post that the recent signs of weakness in the crypto market indicate that one or more market makers may have significant gaps in their balance sheets, and the market is attempting to trigger their forced liquidation. He believes this is a short-term fluctuation and will not change Ethereum's long-term supercycle trend. He also reminds investors not to use leverage at this time to avoid liquidation risks.

- 03:28Today's Fear and Greed Index remains at 10, still in a state of extreme fear.Jinse Finance reported that today's Fear and Greed Index remains at 10 (the same as yesterday), still at the level of Extreme Fear. Note: The Fear and Greed Index ranges from 0 to 100 and includes the following indicators: volatility (25%) + market trading volume (25%) + social media popularity (15%) + market surveys (15%) + bitcoin's dominance in the overall market (10%) + Google trend analysis (10%).