News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 14)|Czech Central Bank Becomes First to Buy Bitcoin; White House Warns of 1.5% Q4 GDP Hit; Monad Mainnet and MON Token Launch Set for Nov 242The most important crypto moments of the year3Bitcoin falls to $98K as futures liquidations soar: Should bulls expect a bounce?

Ethereum Interop Roadmap: How to Unlock the “Last Mile” for Mass Adoption

From cross-chain to "interoperability," many of Ethereum's fundamental infrastructures are accelerating towards system integration for large-scale adoption.

Chaincatcher·2025/11/16 04:53

A $170 million buyback and AI features still fail to hide the decline; Pump.fun is trapped in the Meme cycle

Facing a complex market environment and internal challenges, can this Meme flagship really make a comeback?

Chaincatcher·2025/11/16 04:53

Saylor Dismisses Sell-Off Rumors as Strategy Increases Bitcoin Holdings Amid Market Drop

Cointribune·2025/11/15 23:33

Coinpedia Digest: This Week’s Crypto News Highlights | 15th November, 2025

Coinpedia·2025/11/15 23:24

Cathie Wood’s ARK Invest Buys Circle, BitMine, and Bullish Shares Amid Market Dip

Coinpedia·2025/11/15 23:24

Bitcoin Heads Into Weekend Under Pressure as Price Tests Key Support Levels

Coinpedia·2025/11/15 23:24

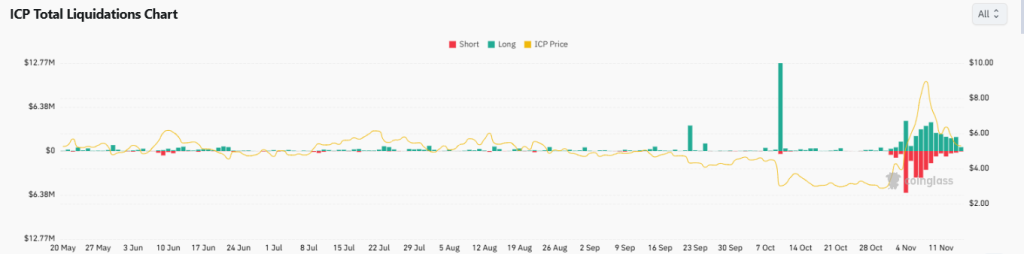

Internet Computer Price Prediction 2025: Is ICP Aimed for $1 Fall Before a Reversal Ahead?

Coinpedia·2025/11/15 23:24

Why XRP Price Didn’t Surge After the ETF Launch?

Coinpedia·2025/11/15 23:24

Bitcoin’s “Silent IPO”: A Sign of Market Maturity and Future Implications

AICoin·2025/11/15 22:06

Flash

- 05:17SOL spot ETF records net inflows for 14 consecutive trading days, with total inflows reaching $382 millionAccording to ChainCatcher, citing monitoring by Farside Investors, the US SOL spot ETF has recorded net inflows for 14 consecutive trading days since its launch on October 18, with total inflows reaching $382 million. Among them, Bitwise's BSOL saw net inflows of $357.8 million, while Grayscale's GSOL recorded net inflows of $24.4 million.

- 04:38Data: The current Crypto Fear & Greed Index is 9, indicating an extreme fear state.ChainCatcher news, according to Coinglass data, the current cryptocurrency Fear and Greed Index is 9, down 2 points from yesterday. The 7-day average is 18, and the 30-day average is 28.

- 04:06Multiple U.S. hedge funds reduced holdings in the "Tech Magnificent Seven" in Q3According to Jinse Finance, the latest quarterly disclosure documents show that Wall Street's largest hedge funds shifted their stance on tech giants in the third quarter, reducing their holdings in some of the "Tech Magnificent Seven" stocks, including Nvidia, Amazon, Alphabet, and Meta, while placing new bets in areas such as application software, e-commerce, and payments. During the quarter ending September 30, several funds also cut their positions in well-known companies in the healthcare and energy sectors. The overall market rose in the third quarter, with the S&P 500 index up nearly 8%, and the tech-heavy Nasdaq 100 index gaining about 9% for the season.