Date: Tue, Dec 23, 2025 | 07:30 AM GMT

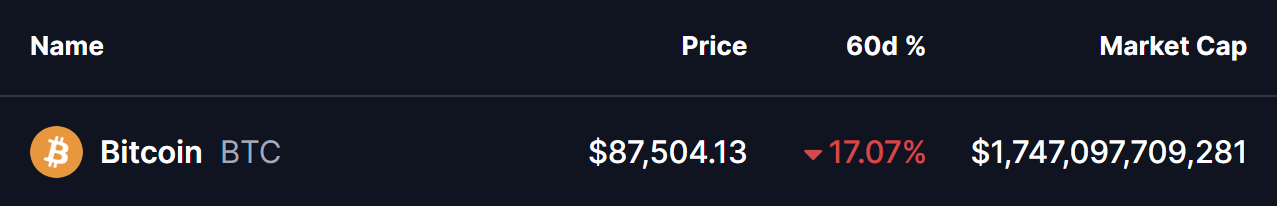

Bitcoin (BTC) has spent the past several weeks moving through a corrective and largely sideways phase after its sharp pullback from record highs near $126,000. The correction pushed BTC into the $87,000 region, cooling momentum with 17% 60 days drop and keeping traders cautious as 2025 approaches its final days.

Source: Coinmarketcap

Source: Coinmarketcap

While short-term price action remains uncertain, a powerful long-term signal is flashing from the traditional markets—one that has historically preceded major Bitcoin bull runs heading into the following year.

That signal is coming from the Russell 2000.

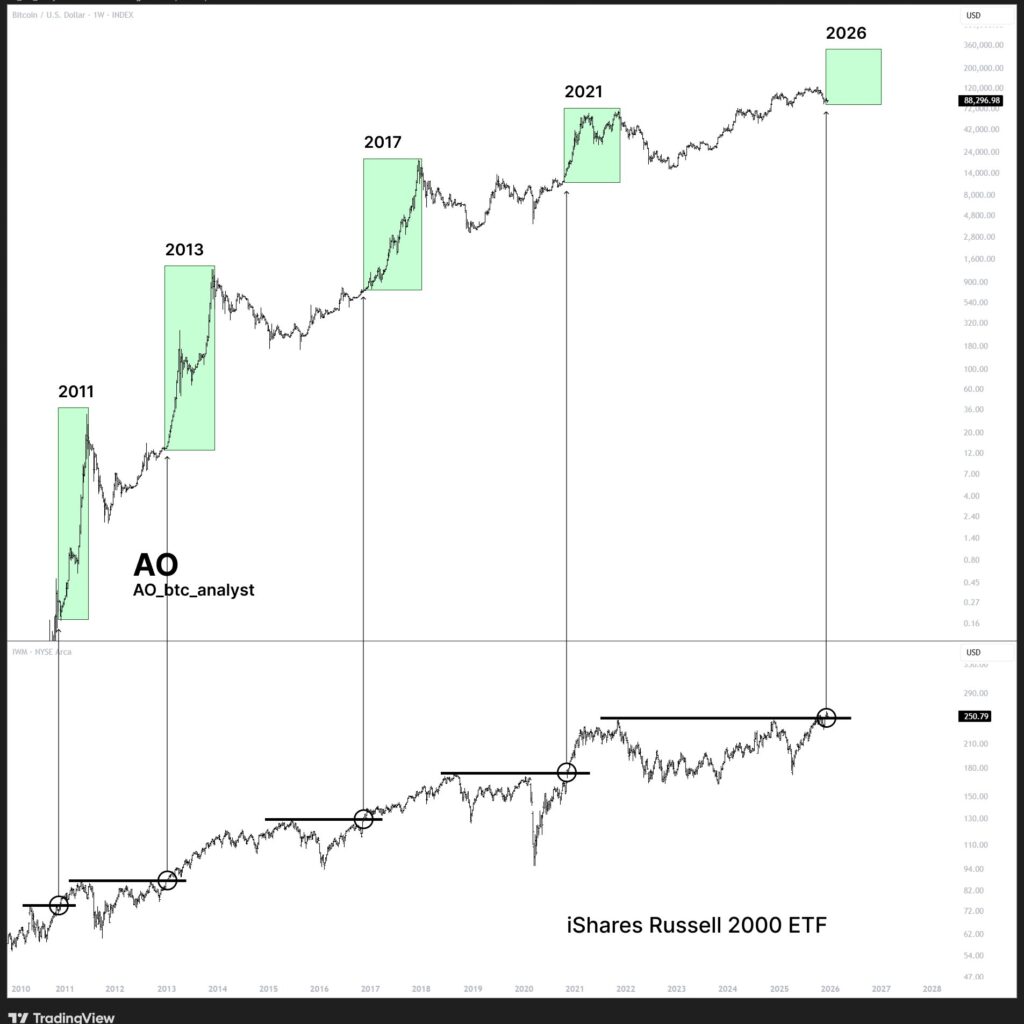

A Pattern That Has Repeated Before Every Major BTC Bull Run

A long-term comparative chart shared by crypto analyst highlights a recurring pattern between Bitcoin and the Russell 2000 Index. Each time the Russell 2000 has successfully broken above a major horizontal resistance level, Bitcoin has gone on to deliver a sustained bullish expansion in the months that followed.

This relationship has played out consistently across multiple market cycles. During previous breakouts in 2013, 2017, and 2021, the Russell 2000’s move higher signaled a shift toward risk-on conditions—an environment that historically benefits Bitcoin.

BTC and RUSSELL Fractal Chart/Credits: @AO_btc_analyst (X)

BTC and RUSSELL Fractal Chart/Credits: @AO_btc_analyst (X)

In each of those cycles, Bitcoin lagged initially before accelerating sharply once liquidity and investor confidence expanded.

Russell 2000 Breakout Strengthens the 2026 BTC Case

What makes the current setup especially notable is that the Russell 2000 has now decisively broken above its long-term horizontal resistance. This breakout confirms bullish momentum in small-cap equities and signals improving risk appetite across global markets.

Bitcoin’s current structure closely mirrors earlier cycle setups. Despite the recent correction, BTC continues to hold its broader range, suggesting the market may be building a base rather than transitioning into a prolonged bearish phase.

If this long-term pattern continues to hold, the Russell 2000 breakout could act as an early confirmation that Bitcoin is positioning for another expansion phase in 2026.

What’s Next for Bitcoin?

From a higher-timeframe perspective, Bitcoin’s outlook remains constructive as long as key support zones around the $80,000–$85,000 region remain intact. A sustained recovery and acceptance above major resistance levels would further validate the bullish thesis.

While historical patterns are never guarantees, the consistency of this signal across multiple market cycles makes it difficult to ignore. As 2026 approaches, the Russell 2000 breakout could emerge as one of the most important macro clues pointing toward renewed upside for Bitcoin, potentially setting the stage for a move toward significantly higher—though still debatable—price targets ahead.