iPower (IPW) Launches $30 Million Convertible Note Financing to Build a Digital Asset Treasury, With $4.4 Million Allocated for Bitcoin and Ethereum Purchases

COINOTAG News, reporting on December 23 via Globenewswire, confirms that U.S. publicly traded iPower (IPW) has entered into a $30 million convertible note financing agreement to advance its Digital Asset Treasury (DAT) program. The funding is structured to provide optionality and liquidity as the firm positions its balance sheet for strategic exposure to select crypto assets, with governance measures aligned to preserve capital in a volatile market.

An initial $9 million tranche is committed, with about $4.4 million earmarked for acquiring Bitcoin and Ethereum. The deployment plan signals a disciplined approach to crypto exposure, prioritizing leading assets while maintaining prudent risk controls. Investors should monitor the DAT program’s deployment cadence and potential implications for iPower’s capital structure as the facility scales.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana (SOL) Under Pressure Despite ETF Inflows as Traders Watch $110 Support Zone

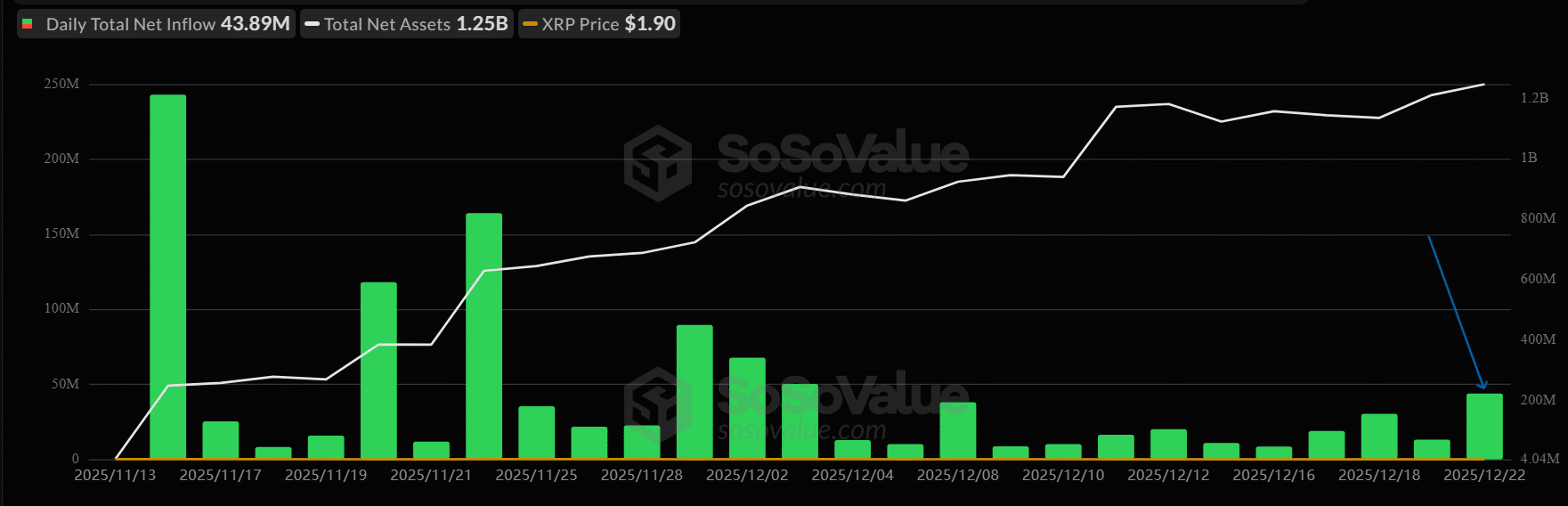

$43.89M flows into XRP ETFs despite falling sentiment – Here’s why

PlayAstroon Taps Cache Wallet to Advance Web3 Onboarding and Security

ZOOZ Strategy Receives Nasdaq Delisting Warning As Bitcoin Treasury Stock Falls Below $1