Robinhood CEO Vlad Tenev: Prediction Markets Enter Early Supercycle with Potential Trillion-Dollar Annual Trading Volumes

In a recent market-structure briefing, Robinhood CEO Vlad Tenev described the current moment as the early phase of a supercycle for prediction markets. He cautioned that, as the cycle unfolds, the platform could see sustained gains in user adoption and trading velocity, supported by deeper liquidity and broader market participation. While hedging against uncertainty, Tenev noted the trajectory may push annual trading volumes toward the trillions of dollars range, aligning with a broader shift in crypto and digital asset trading. The commentary underscores how forecasted volatility and new product rails in decentralized finance and prediction markets could bolster investor interest, while risk controls and compliance frameworks remain paramount as adoption accelerates across digital asset ecosystems.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

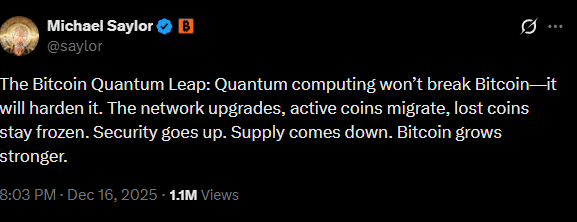

Bitcoin’s quantum future – Saylor plays down risks as experts raise red flags

Japan Rate Hike Looms: What Historical Trends Suggest for Bitcoin and the Broader Crypto Market

Unlock Your Sound: The ARIA Nana Remix Contest Closes for Submissions on January 9