Bitcoin Updates: Abu Dhabi Invests $518 Million in Bitcoin Despite Bearish Death Cross Warnings

- Bitcoin's 2025 "death cross" signals bearish concerns as price nears $90,000, contrasting Abu Dhabi's $518M IBIT investment boost. - Historical death cross patterns show mixed outcomes, with 2022's 64% drop contrasting recent local bottom recoveries amid rising selling pressure. - Institutional confidence grows (Harvard, KindlyMD) despite $3.1B ETF outflows, as technical indicators suggest short-term bounce but $100,000 resistance remains key.

The cryptocurrency sector is currently facing a crucial technical event as Bitcoin's price chart displayed a "death cross" at the end of 2025, igniting discussions about whether this signals the beginning of a prolonged downturn or simply a short-term bottom. Experts and major investors are split in their assessments: some reference past trends that hint at a possible rebound, while others caution that further losses could be ahead

ADIC's actions reflect a wider trend of institutional involvement in crypto, such as Harvard University's own IBIT acquisitions. The fund's approach focuses on diversification, with a spokesperson likening Bitcoin's function in a portfolio to that of gold. Despite recent declines, ADIC is holding its position, confident in Bitcoin's future value. This stands in contrast to the broader market's caution: since October, U.S. spot Bitcoin ETFs have experienced $3.1 billion in withdrawals,

Opinions among market experts remain split. Some believe the death cross presents a buying opportunity, noting its historical tendency to signal market bottoms. For instance, after the 2022 death cross, Bitcoin rebounded, and the 2025 event aligns with Abu Dhabi's significant buying. Others argue that the current environment—characterized by low liquidity and limited large-scale inflows—could extend the downturn.

At the same time, other major players are also increasing their crypto allocations.

The next few weeks are expected to be decisive. Should Bitcoin slip below $88,000, the next levels to watch are $81,000 and $75,000. Conversely, a move above $100,000 could redefine the death cross as a local low. For now, the market remains in a state of uncertainty, with institutional optimism and technical signals pointing in different directions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AI is considered uninsurable by those whose profession is to assess and cover risks

X’s recently launched About This Account function is performing exceptionally well

Ethereum Updates Today: Digital Asset Holdings Divided by Discount Challenges and Premium Opportunities

- Digital asset treasuries (DATs) trade at 5-10% discounts to mNAV due to crypto illiquidity, operational costs, and market volatility, per Bitwise analysis. - Firms like BitMine (0.73x mNAV) and SharpLink (0.82x) face $5.8B in unrealized losses, forcing liquidity measures like equity dilution. - FG Nexus sold 10,922 ETH to repurchase shares at $3.94 NAV, reflecting sector-wide struggles to balance liquidity and investor confidence. - Premium DATs may leverage debt, crypto lending, and derivatives to boost

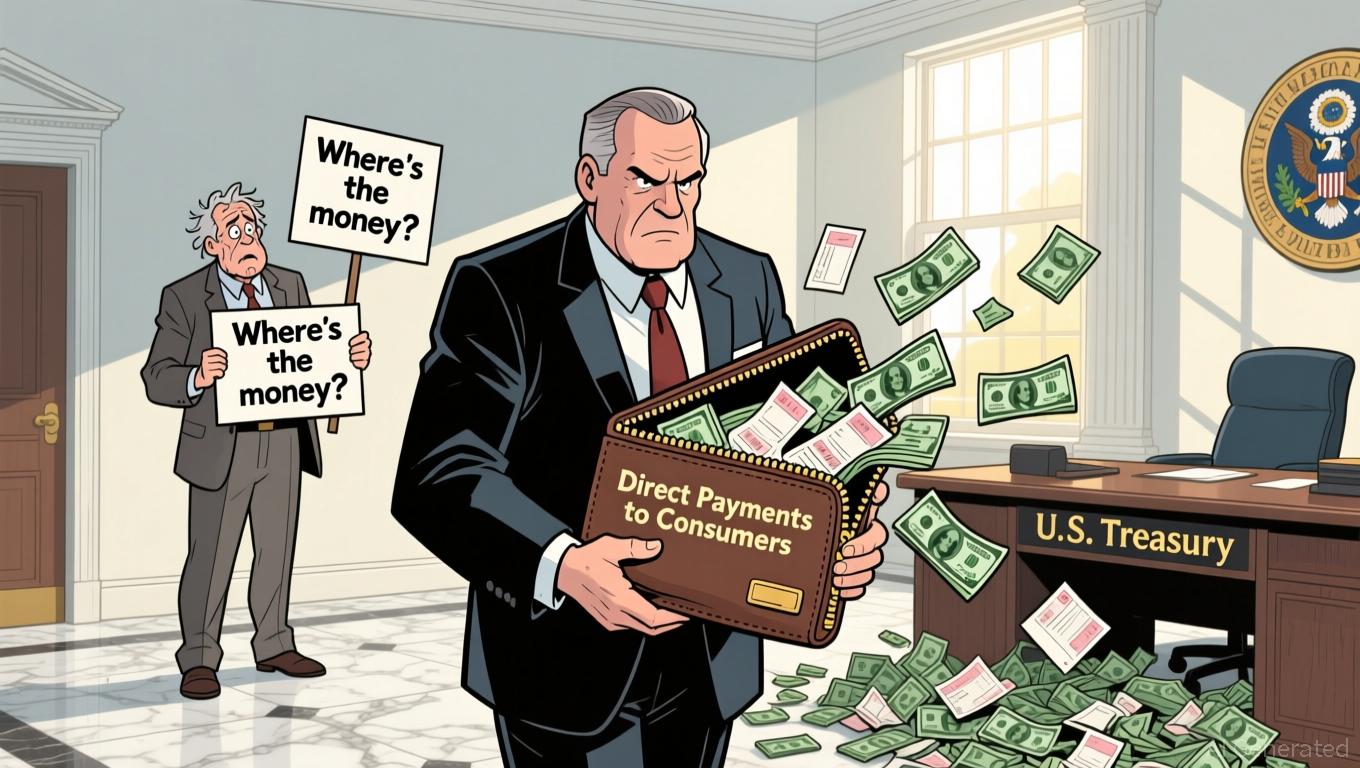

Trump’s Proposal for Direct Payments Threatens ACA Subsidy Stability Amid Ongoing Dispute

- Trump administration proposes direct consumer payments to replace ACA subsidies, aiming to cut healthcare costs by bypassing insurers . - Plan faces criticism for risking ACA marketplace stability and premium hikes, as GOP lawmakers balance Trump's stance with public affordability concerns. - Treasury Secretary Bessent defends "noninflationary growth" via tax cuts, while healthcare stocks show mixed performance amid sector-specific challenges. - Political standoff intensifies with Jan. 30 deadline loomin