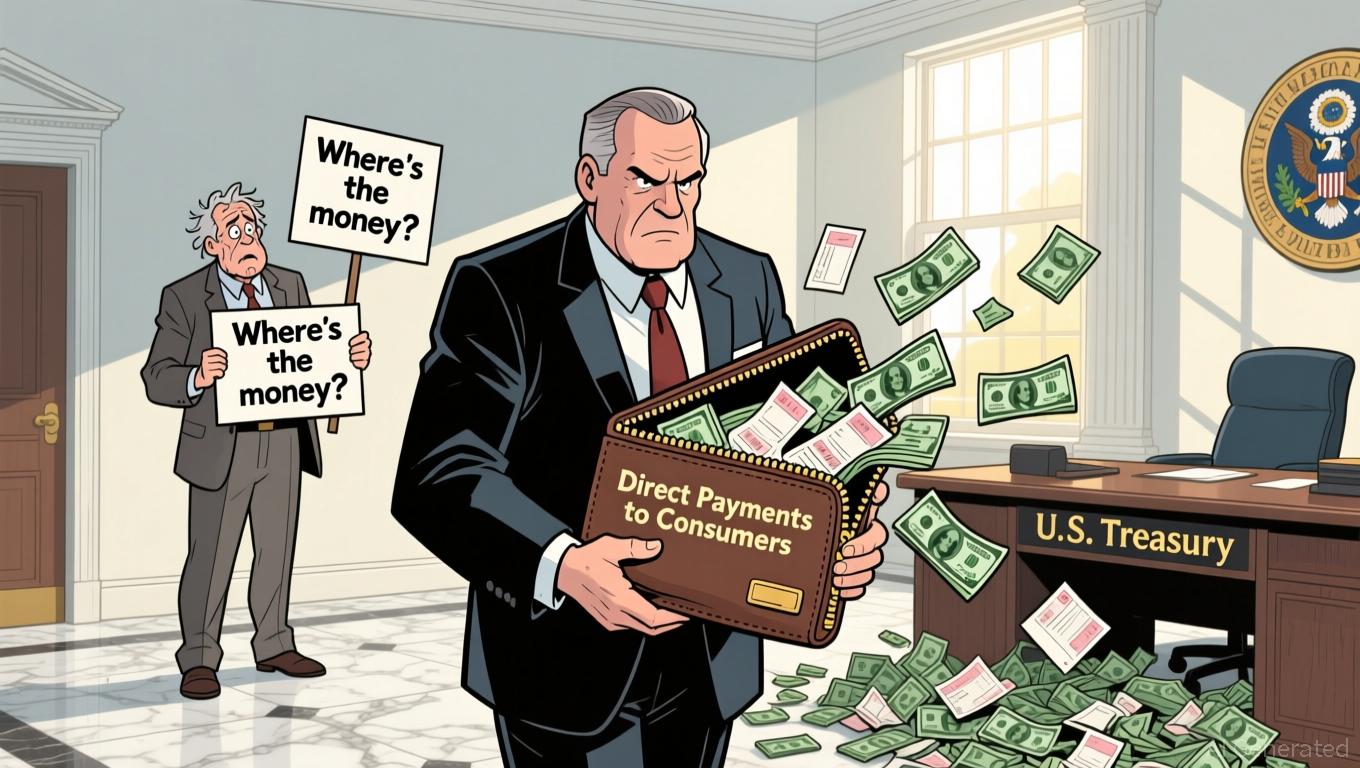

Trump’s Proposal for Direct Payments Threatens ACA Subsidy Stability Amid Ongoing Dispute

- Trump administration proposes direct consumer payments to replace ACA subsidies, aiming to cut healthcare costs by bypassing insurers . - Plan faces criticism for risking ACA marketplace stability and premium hikes, as GOP lawmakers balance Trump's stance with public affordability concerns. - Treasury Secretary Bessent defends "noninflationary growth" via tax cuts, while healthcare stocks show mixed performance amid sector-specific challenges. - Political standoff intensifies with Jan. 30 deadline loomin

Treasury Secretary Scott Bessent revealed on November 23 that the Trump administration is developing a strategy to lower health-care expenses in the U.S., with further information anticipated this week. This initiative arises as political tensions mount over the looming expiration of enhanced Affordable Care Act (ACA) subsidies at the end of the year, a change that could result in higher premiums for millions. "There will be an announcement about this in the coming week," Bessent stated during NBC's Meet the Press,

President Trump has repeatedly rejected legislative attempts to extend ACA subsidies, which Democrats maintain are essential for keeping coverage affordable.

Bessent also discussed broader economic challenges,

The current political and economic environment remains tense.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: The Ongoing Competition Between Ethereum and Solana to Transform Blockchain Value Acquisition

- Ethereum's Fusaka upgrade (Dec 3) aims to boost scalability and economic incentives, positioning ETH as a cash-flowing asset per Fidelity and Bitwise analyses. - The upgrade harmonizes consensus and execution layers, prioritizing monetization while balancing adoption risks as noted by Max Wadington and Fidelity reports. - Solana's Sunrise initiative streamlines token imports, competing with Ethereum to redefine decentralized value capture through seamless integration strategies. - Analysts warn of trade-

Fed Faces Conflicting Data and Political Tensions as December Verdict Approaches

- The Fed faces internal divisions over rate cuts amid conflicting signals on inflation and a weakening labor market. - A 10–2 vote to lower rates to 3.75%–4% masked broader disagreements, with markets now pricing <35% chance of further cuts in December. - Political pressures intensify as Trump criticizes Powell and pushes for Bessent to lead the Fed, despite Bessent's refusals. - Upcoming November 20 data on payrolls and manufacturing will be critical in resolving the Fed's policy uncertainty.

Bitcoin News Today: Bitcoin Surges to $87k—Is This a Panic-Fueled Bounce or a Sign of Lasting Market Change?

- Bitcoin surged past $87,000 in late November 2025, driven by technical support, shifting institutional sentiment, and historical rebound parallels. - Retail fear and ETF inflows signal potential recovery, while macro factors like Nvidia's earnings and Fed rate cut expectations add uncertainty. - Institutional divergence and macroeconomic headwinds pose risks, with Bitcoin's $87k and Ethereum's $2,800 support levels critical for a sustained rebound.

DASH Aster DEX Integration: Paving the Way for Advanced DeFi Infrastructure and Institutional Embrace in 2026

- DASH Aster DEX listing accelerates DeFi's 2026 growth, targeting $3T+ transaction volume via real-world asset tokenization and cross-chain liquidity. - Aster's on-chain order book architecture bridges CEX speed with DEX transparency, achieving $27.7B daily volume through strategic BNB Chain-Ethereum integration. - Institutional adoption gains momentum as Aster introduces gold/stock trading, privacy-focused ZKP features, and 5-7% annual token burns to enhance $ASTER utility. - Investors gain exposure to n